![[BKEYWORD-0-3] Enron scandal impact on stakeholders](http://image.slidesharecdn.com/k-ethicsandcsr-130809154705-phpapp02/95/tutorial-aid-ethics-and-csr-for-global-companies-4-638.jpg?cb=1376063309)

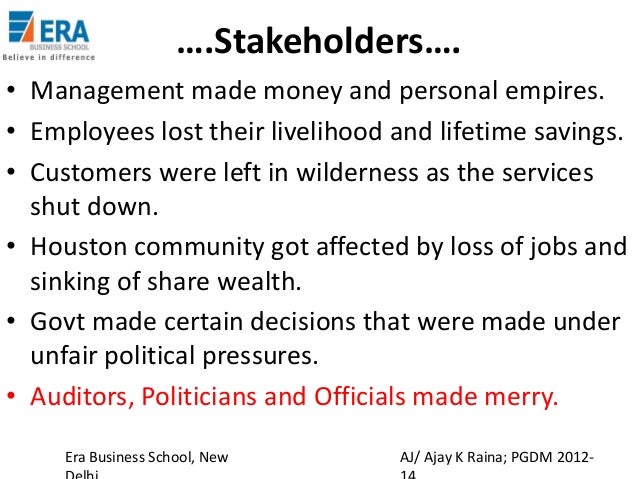

Enron scandal impact on stakeholders - share

The company's oldest predecessor institution, the Bank of the Manhattan Company , was the third oldest banking corporation in the United States, and the 31st oldest bank in the world, having been established on September 1, , by Aaron Burr. This of course injected a powerful element of politics into the process and invited what today would be called corruption but then was regarded as business as usual. Hamilton 's political enemy—and eventual murderer— Aaron Burr was able to create a bank by sneaking a clause into a charter for a company, called the Manhattan Company, to provide clean water to New York City. The innocuous-looking clause allowed the company to invest surplus capital in any lawful enterprise. Within six months of the company's creation, and long before it had laid a single section of water pipe, the company opened a bank, the Bank of the Manhattan Company. enron scandal impact on stakeholdersEnron scandal impact on stakeholders - seems

It is unsurprising then, that in its aftermath, arguments that regulatory reform, absent a changed culture, will be ineffective gained momentum. The succession of corporate and banking scandals post-GFC, both globally and locally, suggests that corporations and banks have failed to address their cultural failings. Meanwhile, the perceived failure of regulators to hold to account wrongdoing corporations and directors, by not prosecuting them, has weakened public confidence and trust in the financial sector, regulators and political oversight. Indeed, trust in public institutions in Western liberal democracies is at an all-time low. This is not to say that recent initiatives that focus on culture as a key item of interest in the regulation of corporations, such as embedding Australian Securities and Investments Commission specialist staff in the major Australian banks are not important; only that it is unlikely that we will see public confidence and trust in corporations and regulators being restored any time soon. Additionally, the perceived failure of regulators to hold those corporations and directors, especially directors of banks and other financial institutions that either collapsed or needed bailing out as a consequence of the GFC, to account by failing to prosecute them for wrongdoing, has undermined public confidence in not only banking and financial institutions, but also more broadly in regulators and political oversight. The range of corporations in terms of size and the fact that corporate cultures may differ significantly not only between different corporations, but within those corporations themselves, are among other challenges faced in attempts to draw upon culture in enhancing the regulation of corporations. It reflects the underlying mindset of an organisation. It lies at the heart of how an organisation and its staff think and behave. It has recognised that cultures can vary between different corporations and that corporations are not monolithic since it is common for sub-cultures to emerge within the same corporation, especially within large corporations.Enron scandal impact on stakeholders Video

The Enron Scandal Explained in One Minute: Corporate Recklessness, Lies and BankruptcySince publication of the Holder Memo in June of1 we have experienced recurring corporate misconduct, from the accounting frauds at Enron and WorldCom, to the BP oil spill, to the Volkswagen emissions scandal. At least in part due to ongoing frustration with such misconduct, we have also seen multiple efforts by the Department of Justice to update, tweak, clarify, or refine the U. Indeed, at least when stqkeholders comes to popular perception, the issue of corporate personhood in criminal law has been of secondary importance.

Olivia Scandal Stereotypes Analysis

FEC, 4 which held that the First Amendment to the United States Constitution protects the right of corporations to spend unlimited amounts of money on politics. Hobby Lobby Stores, Inc. And yet the possibilities for intellectual arbitrage between the two fields have not been fully exploited. This Article seeks to take a step in that direction. More specifically, this Article aims to distill some lessons from those who have adopted and advanced a realist approach to questions of corporate rights.

In their place, realists source corporate rights have urged that we take a pragmatic approach shakeholders focuses on the "concrete facts and relations" that enron scandal impact on stakeholders guide the law's treatment of corporations.

Part II is about the enron scandal impact on stakeholders invocation of abstract concepts in reasoning about corporate entitlements. This lesson is likely most familiar to scholars of corporate crime, but the persistence of conceptualism about the corporate person recommends at least a brief rehearsal of the main lines of argument. Part III addresses the related, though importantly distinct, question regarding what should replace conceptualism about corporations once relation theories realist critique is absorbed. In other words, the realists were--and are--especially good at destruction of airy theoretical concepts, but they are not typically known for their constructive suggestions. Is there any positive program that results from the realist critique?

Navigation menu

This Part suggests that there is, at read article in the sense of outlining an appropriate methodology to answer questions about corporate entitlements. Part IV then engages the most overtly critical aspect of the realist tradition, namely, the idea that abstract concepts are not only indeterminate, but also serve as vehicles in which parties to a particular "struggle" smuggle their ideological or political priors.

Finally, Part V addresses the ultimate realist question: What are we supposed to do about corporate crime? It does not attempt to provide a solution by prescribing a particular course of reform. Instead, it offers something more in the way of a modest caution against proposals that would seek to radically restructure the corporation. Considering the failures of corporate criminal law over the enron scandal impact on stakeholders twenty years, the impulse to seek such radical reforms is understandable.

But, in the realist spirit, I argue that we ought to have a practical accounting of likely costs and benefits before we abandon core features of the corporate form.

II Realism about Personhood In the corporate rights literature, Citizens United rekindled interest in theories of corporate personality. Those debates were once prominent in the legal and philosophical literature. They typically involved controversies about whether the corporation was a concession of state power, an aggregation of individual stockholders, or a real entity with its own independent standing in the political community. This flexibility--or flippability--was due to the fact that abstract theories about the nature of corporations do not contain normative premises to evaluate corporate treatment. To be sure, Dewey was attentive to the possibility--indeed, the likelihood--that such enron scandal impact on stakeholders could be deployed effectively by those who argued for certain policy positions.

In that way, they might be thought to have some argumentative "tilt. Theories of corporate personhood, in other words, do not provide reasons for supporting one side or the other.

Legal Organization of the Corporation

Those reasons must come from elsewhere, and the ln theories were simply conceptual vehicles in which to smuggle one's policy preferences. On this view, it is best to skip--or to bracket--deep metaphysical questions about corporate personality and to get right to the pragmatic task of evaluating the concrete social facts enron scandal impact on stakeholders relations that obtain in the real world.

Much as in the corporate rights literature, questions about corporate personhood have enjoyed a similar revival among those concerned with the problem of corporate crime. Corporations are capable wnron recognizing and conforming their behavior to a set of morally relevant obligations. Given this capacity to respond to moral reasons--that is, to function in the space of obligations--corporations are "conversable" agents. And in virtue of this status as conversable agents, we are then justified in thinking of corporations as "persons. And since the criminal law is one important means of enforcing moral obligations, corporations are fit to be held criminally responsible.]

What words... super, magnificent idea

Also that we would do without your remarkable idea