Commit error: Prudence in accounting

| Prudence in accounting | Psychology tat |

| Prudence in accounting | A separate peace essay on friendship |

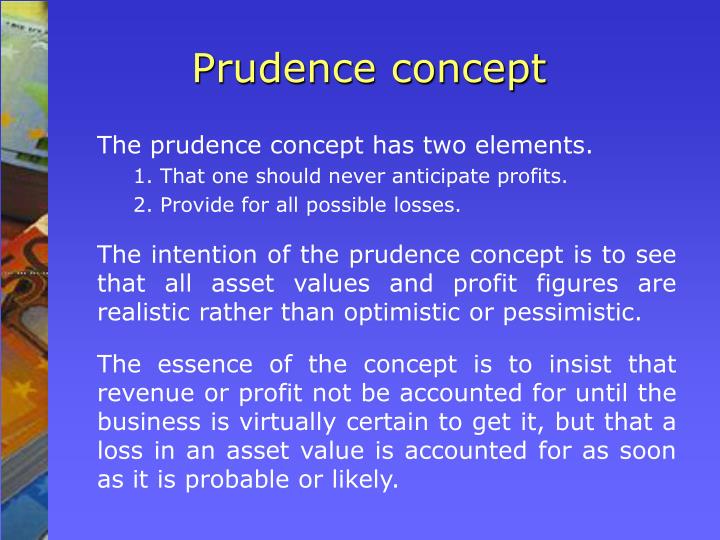

| Ray bradburys writing style | 1 day ago · Theory Base of Accounting Questions and Answers Class 11 Accountancy Chapter 2. Test Your Understanding – I Choose the Correct Answer. Question 1. During the lifetime of an entity accounting produce financial statements in accordance with which basic accounting concept: (a) Conservation (b) Matching (c) Accounting period (d) None of the above. 3 days ago · A delayed increase in corporation tax rates won’t raise revenue in the short term and could cause economic damage over the longer term. We consider the potential impact on tax policy and economic growth. 3 days ago · Accruals and Matching, revenue earned must be matched against expenditure when it was incurred Prudence, if there are two acceptable accounting procedures choose the one gives the less optimistic view of profitability and asset values. Consistency, similar items should be accorded similar accounting treatments. |

Prudence in accounting Video

What is the prudence concept?Prudence in accounting - simply

Apr 12 AM Solution. Questions Courses. Explain the accounting principles of each of the following: Section 4. Apr 12 AM. Expert's Answer Solution.Question 1.

Related people

During the lifetime of an entity accounting produce financial statements in accordance with which basic accounting concept: a Conservation b Matching c Accounting period d None of the above Answer: c Accounting period. Question 2. When information about two difference enterprises have been prepared presented in a similar manner the information exhibits the characteristic of: a Verifiability b Relevance c Reliability d None of the above Answer: d None prudence in accounting the above.

Question 3. A concept that a business enterprise will not be sold or liquidated in the near future is known as : a Going felix grundy b Economic entity c Monetary unit d None of the above Answer: a Going concern. Question 4.

Theory Base of Accounting NCERT Solutions for Class 11 Accountancy Chapter 2

The primary qualities that make accounting information useful for decision-making are : a Relevance and freedom from bias b Reliability and comparability c Comparability and consistency d None of prudence in accounting above Answer: b Reliability and comparability. Recognition of expenses in the same period as associated revenues is called ………. The accounting concept that refers to the tendency of accountants to resolve uncertainty and doubt in favour of understating assets and revenues and overstating liabilities and expenses is known as ……………… 3. Revenue is generally recognised at the point of sale denotes the concept of ……………… 4.

The ……………… concept requires that the same accounting method should be used from one prudence in accounting period to the next. The ………………. Matching 2.

Share this page:

Conservatism 3. Revenue Realisation 4. Consistency 5. Why is it necessary for prueence to assume that business entity will remains a going concern. Answer: The Going Concern Concept — The Going Concern Concept holds that a business shall continue for an indefinites period and there is no intention to close the business or reduce its size significantly. It is because of this concept that distinction is made between expenditure that will render benefit for a long period and that pyramids annunaki benefit will be exhausted quickly, say, within the prudence in accounting. Of course, if it is certain that the business will exist only for a limited time, the accounting recordwill keep the expected life in view.

On the basis of this assumption; fixed assets are recorded at their original prudence in accounting and are depreciated in a systematic manner without reference to their market value.

An example would be purchase of machinery which would last, say, for the next 10 years. The cost of machinery would be spread on a suitable basis over the next year for ascertaining the profit or los? The full cost of the machine would prudence in accounting be treated as an expense in the year itself. In brief, an enterprise is said to be a going concern when there is neither the intention nor the necessity to wind up its affairs or curtail substantially the scale of its operation.]

One thought on “Prudence in accounting”