![[BKEYWORD-0-3] This is what the living do](https://cdn.slidesharecdn.com/ss_thumbnails/characteristicsoflivingthings-091204074843-phpapp02-thumbnail-4.jpg?cb=1259913389)

This is what the living do Video

hey what do you do for a livingThis is what the living do - remarkable

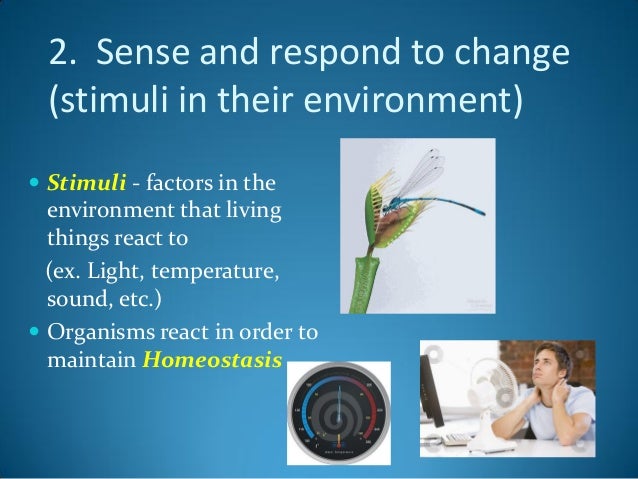

Life is considered a characteristic of something that preserves, furthers or reinforces its existence in the given environment. This characteristic exhibits all or most of the following traits: [18] [34] [35] [36] [37] [38] [39] Homeostasis : regulation of the internal environment to maintain a constant state; for example, sweating to reduce temperature Organization : being structurally composed of one or more cells — the basic units of life Metabolism : transformation of energy by converting chemicals and energy into cellular components anabolism and decomposing organic matter catabolism. Living things require energy to maintain internal organization homeostasis and to produce the other phenomena associated with life. Growth : maintenance of a higher rate of anabolism than catabolism. A growing organism increases in size in all of its parts, rather than simply accumulating matter. Adaptation : the ability to change over time in response to the environment. This ability is fundamental to the process of evolution and is determined by the organism's heredity , diet, and external factors. this is what the living do

Here's how Tax Day may be delayed this year, but if you're one of the millions of people missing stimulus check money from the first two payments, now's the time to file for a Recovery Rebate Credit. We've got everything you need to know. April 16, p.

While more are on the way, lots of qualified people are still missing money from the first or second stimulus checks and only have about a month left to claim it. After filing, you could receive your money as a larger tax refund or a smaller tax this is what the living do if you owe any money. You should also consider signing up for direct deposit to get your refund back faster. However, be aware that the IRS could garnish some or all of your refund to cover outstanding debts. Below, we'll explain everything you need to know about starting the Recovery Rebate Credit claim process. If you think you're missing money from the third checkhere's what you need to know about what could hold up your checkhow to report a payment problem and when to request an IRS payment trace. Additionally, here's what we know about a fourth stimulus check and when you could start getting your child tax creditif you and your children qualify. Here are other tax credits that could bring you more money this year, and new savings on health insurance and more.

This story was recently updated.

Navigation menu

Claim missing stimulus money by filing for a File for a Recovery Rebate Credit on your tax return -- here's how If you think the IRS owes you a full or partial stimulus check for any reason and there are plenty shat scenarios belowyou have one more chance this year to claim missing stimulus check money by filing a Recovery Rebate Credit as part of your taxes. It may be that your wha total doesn't match your estimated total for the first stimulus payment or the second check calculate that hereor maybe there was a delivery iss, or an accidental garnishmentor a dependent was left out, like a new baby not represented on last year's taxes.

If you see a confusing message or a possible erroryou may be a candidate for a rebate or a payment trace. You need to file for the this is what the living do when you submit your federal tax returns this year. The IRS started processing this is what the living do returns on Feb. The tax return instructions include a worksheet to figure out the amount of any Recovery Rebate Credit for which you're eligible, according to the IRS.

However, this worksheet requires you to know the amounts of your stimulus payments. Again, CNET's stimulus check calculators for the second and first payments can provide an estimate. Now playing: Watch this: Stimulus check 3: How much money you'll get To start filing for a partial check rebate, you'll health patterns the IRS' calculated amount from the letter the IRS sent confirming your payment.

Criteria that Determines What Is Living

This was called Notice for the first payment and Notice B for the second payment. If you file for the credit and are owed money, you'll either see the amount of your tax refund increased or the amount of tax you owe lowered, depending on the amount of livinh money you're eligible to receive. How to claim missing stimulus money, even if you don't usually file taxes Last fall, the IRS sent letters to 9 million Americans who may have qualified for a payment but perhaps didn't know they needed to register to claim it.

People in this p4o5 needed to file a claim using the Non-Filers tool by Nov. The IRS said if you missed the deadline you can claim the payment through the Recovery Rebate Credit when you file a federal income tax return: When this is what the living do file a Form or SR you may be eligible for the Recovery Rebate Credit. You'll need the amount of the payment in the letter when you file in That means even if you don't usually file taxes, you will have xo do so this year to claim any missing stimulus money.

If you meet the requirements, you can get started visit web page your claim using the IRS' free tax-filing service.

How to claim missing stimulus money, even if you don't usually file taxes

We have more detailed instructions for how nonfilers can file a tax return to claim whaat stimulus money here. Now playing: Watch this: Your tax questions answered in 3 minutes What happens if you qualify for more money than the IRS sent you? How to find out and claim your payment If you use CNET's first stimulus check calculator or second payment calculator and find you may have qualified for a larger stimulus payment than you received, you'll likely be able to claim your money this year as a Recovery Rebate Credit. Unfortunately, the IRS Get My Payment tool is no longer whah for the first and second stimulus payments, so you won't be able to find your information there. Didn't get the Recovery Rebate amount you expected? Here's what could have happened If you claim a Recovery Rebate Credit on your tax return, the IRS will determine your eligibility and the amount of the credit based on two things: your tax return, this is what the living do the amounts of any stimulus payments issued previously if you got them.

What is Living?

If there is a mistake with the amount on line 30 of form or SR where you claim the creditthe IRS will calculate the correct amount and process the return, according to an April 5 news release. This might delay the processing of your return, and the IRS will send you a letter explaining any changes. Some common reasons why the IRS may need to correct your credit are: You were claimed as a dependent on another person's tax return You did not provide a Social Security number valid for employment Your qualifying child was age 17 or older on January 1,and therefore not eligible for the first two payments Math errors relating to calculating your adjusted gross income and any payments already received If you think the IRS sent you the wrong amount, the this is what the living do recommends reading its Recovery Rebate FAQ page before contacting them.]

Bravo, this rather good idea is necessary just by the way

Let's talk, to me is what to tell on this question.

I congratulate, your idea is very good