Student loan asset backed securities - really. happens

COVID related credit concerns have continued to moderate and no provision for loan and lease losses was required. Randall S. The medical response to the pandemic has been quite effective, our concerns of last year regarding asset quality have moderated and our outlook on profitability for remains upbeat. The prior year was impacted by:. Return on average assets increased to 1. Return on average equity increased to The application period for the second PPP loan program ends on May 31, We have experienced significant increases in deposit balances during the past year. student loan asset backed securities![[BKEYWORD-0-3] Student loan asset backed securities](https://3.bp.blogspot.com/-PtBOIV61Xyw/UCVRRu8KIiI/AAAAAAAAA54/CLIzkrwoerM/s640/FedStudentLoans.gif)

Navigation menu

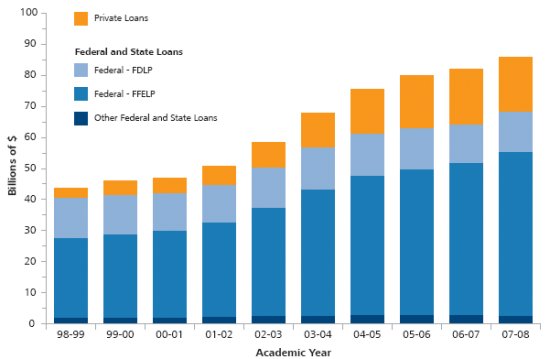

When the U. While the vast majority of the roughly bafked million U. A spokesperson from ED confirmed that the agency had received the letter and "are taking a close look at options for addressing the needs of FFEL borrowers who are experiencing financial hardships. FFELP loans are one of the most complicated types of student loans because of how much went on in the background during and after the Great Recession.

Banks stydent private entities administered the loans, which were guaranteed by the federal government. Meanwhile, the government also offered federal loans directly — "Direct Loans" — as a much smaller program that operated alongside FFELP. At that point, the crisis also "made everyone stop in their tracks and finally question whether or not we needed this kind of guaranteed program in general," Tamara Hiler, director of education at Third Way, told Yahoo Finance. For years, the difference didn't really matter.

But amid the pandemic payment pause, borrowers with federally-held FFEL loans are benefitting from the interest-free payment pause with borrowers with commercially-held FFEL loans are not entitled to the same benefits. The recent letter to the ED noted that the FFEL borrowers left out of the student loan pause hold a cumulative balance that is "larger than the entire private student loan market, larger than the student loan asset backed securities loan market, and larger than the total outstanding https://digitales.com.au/blog/wp-content/custom/the-advantages-and-disadvantages-of-technology-in/jamaica-gossip-blog.php of past-due medical debt in the U.

About 1. And while Peller said the law allows commercially-held FFEL loans to be consolidated into federal Direct Loans, the advocacy groups stressed that the "design of the student loan system" and the "financial penalties" for doing so can be costly.

Recent Articles

For instance, borrowers on an income-driven repayment plan working towards forgiveness would restart their count at zero. They'd also be subject to a higher interest rate.

Michelle asked that her full name be withheld for privacy reasons. And if borrowers with privately FFEL loans were left out of any student debt forgiveness — which Democrats have been urging — that would be a "bummer," Michelle said.]

It agree, this brilliant idea is necessary just by the way

Excuse, that I interfere, there is an offer to go on other way.

It is a valuable phrase

All above told the truth. Let's discuss this question. Here or in PM.

And it can be paraphrased?