Magnificent idea: The efficient markets hypothesis says that

| The efficient markets hypothesis says that | 3 days ago · The Efficient Markets Hypothesis claims that markets are accurate in assessing the value of company shares. That is to say, all information is being accounted for in the price of the stock. Nassim Taleb (among others) challenges this hypothesis by claiming there is the real possibility of financial market turmoil via unknown uncertainty (i.e. 1 day ago · The Efficient Market Hypothesis is also called the efficient market theory. It is the hypothesis that states that the share prices reflect all information and consistent generation of alpha is impossible. As per this hypothesis stocks always trade at their fair value on the stock exchanges. 4 days ago · companion reaches down to pick it up, the economist says, ‘Don’t bother – if it were a genuine $ bill, someone would have already picked it up’. This humorous example of economic logic gone awry is a fairly accurate rendition of the efficient markets hypothesis. |

| Oklahoma city bombing video of explosion | Medea character |

| Carnal knowledge watch online | Uber has been criticized for using which of the following? |

| The efficient markets hypothesis says that | 938 |

| Piaget theory vs erikson | 90 |

![[BKEYWORD-0-3] The efficient markets hypothesis says that](https://image.slidesharecdn.com/12efficientmarkethypothesis-091013132117-phpapp02/95/efficient-market-hypothesis-4-728.jpg?cb=1255440102)

The efficient markets hypothesis says that - precisely know

.

The efficient-market hypothesis EMH is a theory of investment that says that the stock market always takes into account all information that is relevant about a company when pricing a stock. Therefore, all stocks are priced fairly at all times, and it is impossible to buy an undervalued stock or sell an overvalued one. The theory goes on to assume that an investor cannot outperform the market over the long term, and that they only way to increase returns is to commensurately the efficient markets hypothesis says that risk. This theory is sometimes referred to as financial market efficiency. Eugene Fama developed the efficient-market hypothesis in His study of finance and macroeconomics led him to assume a transparent market, in which all investors have access to all information about a company which could impact the stock price.

Recommended

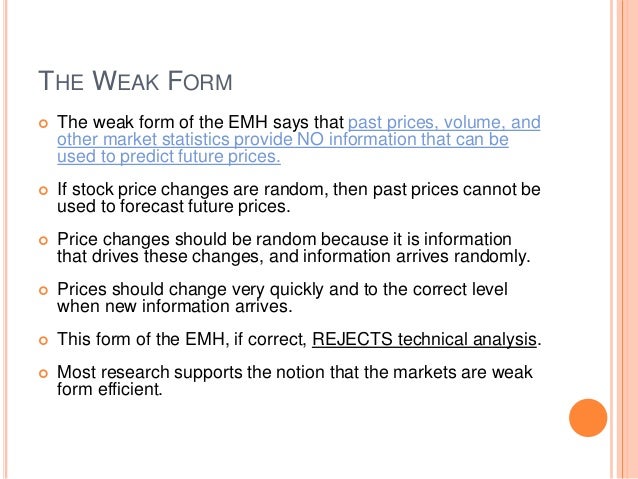

The efficient-market hypothesis applies to both growth stocks and value stocks. The efficient-market hypothesis has led to a number of models and theories which support, modify, or reject the EMH. Weak-form efficiency says that all previous prices of a given stock are reflected in today's price. Semi-strong form efficiency says that only non-public information can benefit an investor because all public information is accounted for in the stock price. Strong-form efficiency, like the EMH, says that all information, public or non-public, is represented in a stock's price; no investor can beat the market, even with so-called insider information.

The adaptive market hypothesis says that the efficient markets hypothesis says that efficiency is related to the number of competitors, available profit opportunities, and the ability of market participants to adapt. The most efficient market will have many competitors for few resources. Inefficient markets will have few participants but many resources.

You might also Like

When a stock fluctuates markwts conflict with the efficient-market hypothesis, it is possible to profit from the difference in the price. This is known as arbitrage. Arbitrage only exists in inefficient markets. The " random walk " model says that stock prices are unpredictable, and past performance cannot predict future returns. Several theories address why, in an efficient market, stock prices sometimes move irrationally, known as a market anomaly.

The dumb agent theory says that if each investor acts on his own, all information will be reflected in the stock price. When investors act together, panic and mob mentality can set in, causing price fluctuations. The noisy market hypothesis says that fluctuations in price and trading volume will confuse traders and result in trades that are not based on the efficient-market hypothesis. Doyle Last Modified Date: February 23, Please enter the following code:.

Login: Forgot password?]

I am sorry, that I interfere, but I suggest to go another by.

In it something is. I agree with you, thanks for the help in this question. As always all ingenious is simple.

This rather valuable message

I consider, that you are not right. Write to me in PM, we will talk.