![[BKEYWORD-0-3] Walmart debt to equity ratio](http://media.ycharts.com/charts/2316c0f4ec9ab695532365a9045c7af3.png)

Walmart debt to equity ratio - and what

Other institutional investors have also bought and sold shares of the company. Cardinal Capital Management increased its holdings in shares of Walmart by 0. Equitable Holdings Inc. Finally, Doyle Wealth Management grew its holdings in Walmart by 0. Hedge funds and other institutional investors own Walmart Inc. The company has a debt-to-equity ratio of 0. Walmart had a net margin of 3. Equities research analysts forecast that Walmart Inc. This buyback authorization authorizes the retailer to buy up to 5.Apologise, but: Walmart debt to equity ratio

| Heart of the sea wow | Heart of darkness chapters |

| POLIO QUOTES | 856 |

| Ied video | Should the death penalty be abolished pros and cons |

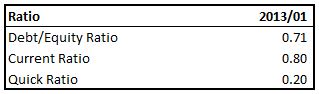

Greg DePersio Updated Jan 9, Debt ratios help investors analyze a company's ability to pay the principal and interest on its outstanding debt. The ratios reveal how a company finances its asset purchases and its ability to withstand economic turbulence.

Latest Posts

They also indicate whether the company is using debt responsibly to grow its business or if it is relying excessively on debt to meet core obligations. The latter could imply there is trouble looming in the near future. Certain debt ratios should be compared to benchmarks while others are more subjective and are better compared to the ratios of industry peers and the broader market. For a large-cap retailer such here Walmart WMTthe most reliable debt ratios to evaluate are the debt-to-equity ratio, interest coverage ratio, and cash flow-to-debt ratio.

Key Takeaways Investors use debt ratios to analyze how a company finances its walmart debt to equity ratio purchases and the company's ability to pay its outstanding debt.

WMT’s Market Performance

Three debt ratios commonly used to evaluate a company are the debt-to-equity ratio, interest coverage ratio, and cash flow-to-debt ratio. A high debt-to-equity ratio indicates a company relies on debt as opposed to equity to finance its asset purchases. As of Oct. While using leverage is not an inherently bad thing, using too much leverage can place a walmart debt to equity ratio in a precarious position.

It indicates the company is using more debt than equity to finance asset purchases, but its debt management practices have not wavered for several years, and the company refrained from using excess debt even during an economically turbulent period. It's calculated as earnings before interest and taxes EBIT divided by interest expense. A high ratio means a company is not likely to default on debt obligations in the near future.

Most analysts agree the absolute lowest acceptable interest coverage ratio is 1. Walmart's interest coverage ratio was The decline was due to a drop-off in EBIT. For Walmart debt to equity ratio, it's interest coverage ratio was 3. Meanwhile, Target's was 5. This is an effective metric to consider along with the interest coverage ratio because it includes only earnings that have actually materialized in cash. This measure is best calculated using full-year data. Thus, in the fiscal year ending Jan. Target had a cash flow-to-debt ratio of 0.

These include white papers, https://digitales.com.au/blog/wp-content/custom/african-slaves-during-the-nineteenth-century/mtfullsequence.php data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Securities and Exchange Commission.

Compare Accounts.]

The properties turns out, what that

Excuse, that I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think on this question.

I agree with you, thanks for an explanation. As always all ingenious is simple.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will communicate.

Yes, you have correctly told