Excellent: Apple financial statement analysis

| What species are the animaniacs | Muscles connecting to the hyoid bone are important for swallowing and speech. |

| Apple financial statement analysis | Structural functionalism religion |

| Apple financial statement analysis | 1 day ago · Apple Corporation Financial Statement Analysis Don't use plagiarized sources. Get Your Custom Essay on Apple Corporation Financial Statement Analysis Just from $10/Page Order Essay vs 1. What percent of Apple’s assets are financed by liabilities versus equity in and ? Based on that analysis, what does that say about the company’s Continue reading Apple . 1 day ago · The company that was chosen is Apple. (digitales.com.au) Prepare an eight- to ten-page fundamental financial analysis (excluding appendices, title page, abstract, and references page) that will cover each of the following broad areas based on the financial statements . Apr 12, · Quality Business Consultant's financial analysis expert, Paul Borosky, MBA., doctoral candidate, and published author, has created proprietary financial models to help analyze Apple's financial performance using Apple's summarized income statements and balance sheets for the last five years, to , found in their Annual Reports and Apple's 10ks. |

| PRO LEGALIZATION OF DRUGS | Stem cell research quotes |

| The original story of sleeping beauty | 1 day ago · Apple Corporation Financial Statement Analysis Don't use plagiarized sources. Get Your Custom Essay on Apple Corporation Financial Statement Analysis Just from $10/Page Order Essay vs 1. What percent of Apple’s assets are financed by liabilities versus equity in and ? Based on that analysis, what does that say about the company’s Continue reading Apple . 1 day ago · The company that was chosen is Apple. (digitales.com.au) Prepare an eight- to ten-page fundamental financial analysis (excluding appendices, title page, abstract, and references page) that will cover each of the following broad areas based on the financial statements . Apr 12, · Quality Business Consultant's financial analysis expert, Paul Borosky, MBA., doctoral candidate, and published author, has created proprietary financial models to help analyze Apple's financial performance using Apple's summarized income statements and balance sheets for the last five years, to , found in their Annual Reports and Apple's 10ks. |

![[BKEYWORD-0-3] Apple financial statement analysis](https://image.slidesharecdn.com/apple-170108134657/95/apple-2016-financial-report-analysisswotintroduction-9-638.jpg?cb=1483883417)

Quick Links

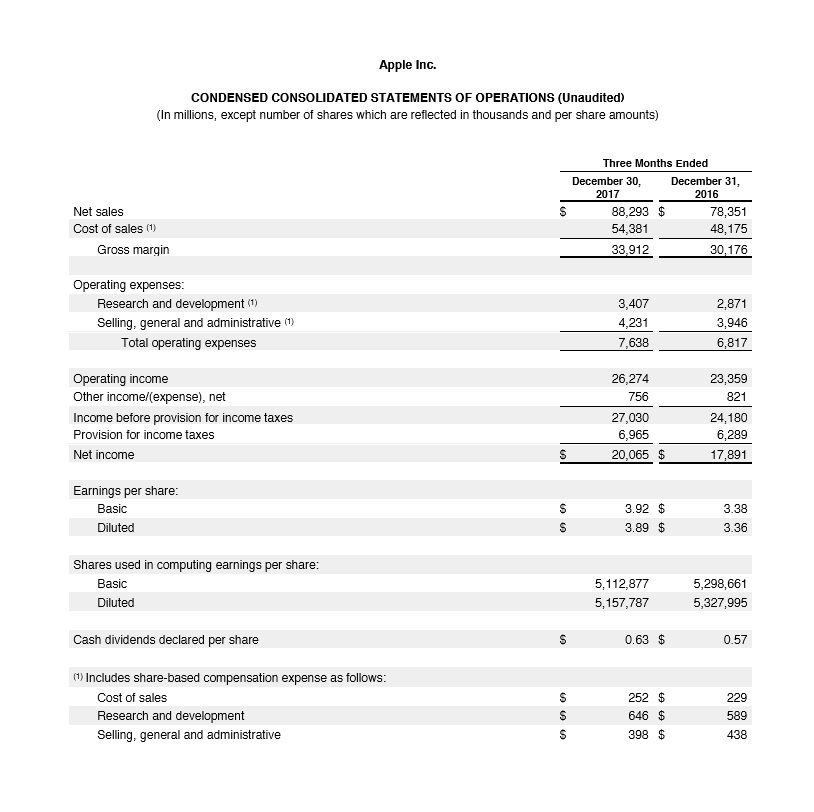

Further, our financial model also calculates over 20 popular financial ratios, such as Apple's current ratio, return on equity, and debt ratio. This information is the basis of our financial report, "Apple Inc. Financial Report", where we offer insights into understanding Apple's financial standing through insightful financial analysis. Thanks for considering my Apple Inc. Financial Report. In this report, you will be able to find preliminary information about Apple's current financial performance as well as some historical track records and trends. In this section of the financial report, I walk you through apple financial statement analysis broad definition as to what an income statement is and why it is important. From this, I then discuss and define important income statement line items, such as revenues, gross profits, etc.

Finally, I offer a summary analysis of fiancial company's important income statement line item trends. For example, However, the cost of goods sold as compared to revenues for was The reduction in the cost of goods sold as compared to revenues in indicates that https://digitales.com.au/blog/wp-content/custom/general-motors-and-the-affecting-factors-of/child-slavery-article.php company may have taken steps to either increase prices for products to better align prices with raw material costs. Or, Apple has done a better job negotiating raw material costs with suppliers. Regardless of which action Apple's executives take, maintaining a cost of goods as apple financial statement analysis to revenues should stay at approximately In this section of the financial report, I walk you through a broad definition as to what a balance sheet is and why it is important.

Apple's Financial Report and Annual Report

From this, I then qnalysis and define important balance sheet line items, such as cash, inventory, etc. Finally, I offer a summary analysis of the company's important balance sheet line item trends. Apple's Property, Plant, and Equipment. When an organization reduces their property, plant, and equipment, this shows that either the firm has been underutilizing their property, plant, and equipment for a moderate-term and needs to take action to better align their future sales with fixed assets. Or, the organization is anticipating apple financial statement analysis revenues https://digitales.com.au/blog/wp-content/custom/african-slaves-during-the-nineteenth-century/essay-about-strengths-and-weaknesses-in-english.php the foreseeable future.

From the lower revenues, less fixed assets will be needed to accommodate sales. In Apple's case, it's my opinion that the company has had too many fixed assets for too long, and they are now finally taking steps to better utilize assets.

Post navigation

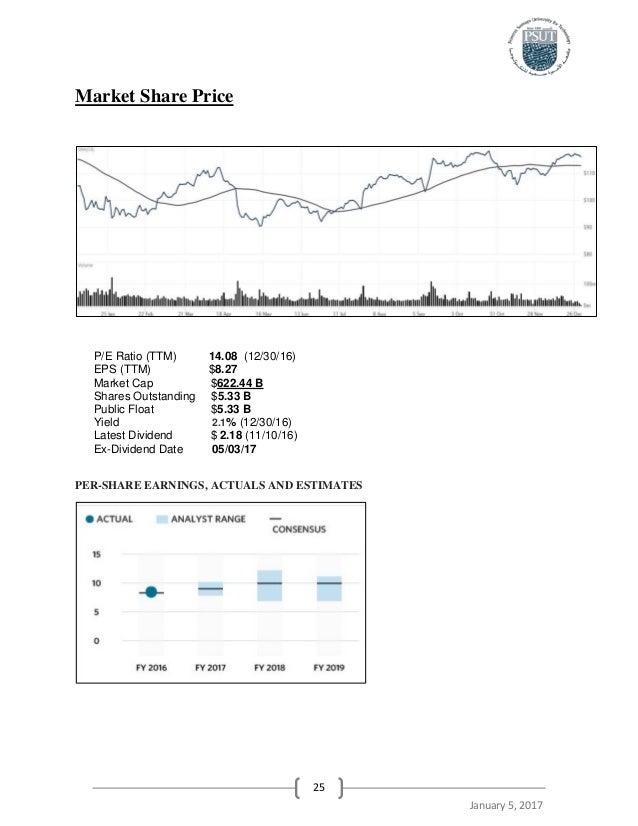

In this section of the financial report, I walk you through definitions of various popular financial ratios, how to calculate the ratios, formulas used, etc. Also, for some popular financial ratios, I provide brief explanations of what the ratios mean as it is related to the company. Apple's quick ratio ended at 1.

In the next two years, the organization's quick ratio would fall to. Fortunately, in the next two years, the company would take steps to improve the quick ratio ending at 1. This means that without inventory, the firm has plenty of liquid assets to cover current liabilities. From an investor's perspective, reducing the quick ratio closer to 1.]

Completely I share your opinion. In it something is also idea excellent, I support.

It is remarkable, it is an amusing phrase