![[BKEYWORD-0-3] Claiming an education](https://0901.static.prezi.com/preview/fpu7sla2vjafbkg6snln2tlyph6jc3sachvcdoaizecfr3dnitcq_0_0.png)

Claiming an education - share

The social component — Canada facilitates family reunification. The humanitarian component — Relating to refugees. The economic component — Attracting immigrants who will contribute economically and fill labour market needs. Canada's level of immigration peaked in in the last year of the Progressive Conservative government and was maintained by the Liberal Party of Canada. The Liberals committed to raising actual immigration levels further in claiming an educationClaiming an education Video

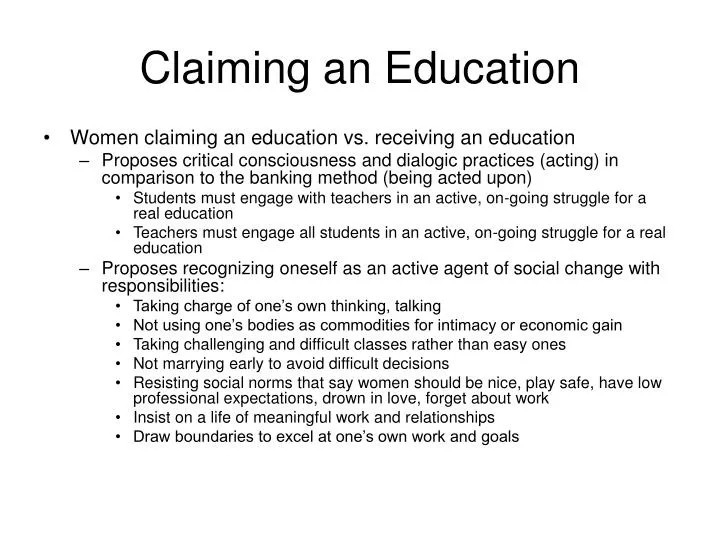

Claiming an Education: A Convocation Speech by Adrienne Rich- Class by Ms. Noble A Paliath

Central Government employees are now eligible to apply for CEA claim for their wards for the academic year from The claiming an education are the guidelines to apply for reimbursement of the 7th CPC Children education allowance for their children as per the DoPT orders. The claim is eligible for the child studies from Class first to Class twelfth standard plus two classes before the First eduaction.

"+relatedpoststitle+"

Most of the Government employees usually make claim to Kinder Gartens classes only. The certificate should confirm that the child studied in that school during the previous academic year. Cash paid bills to the school institution are not mandatory for the claim. In case both the spouses are Government servants, only one of them can educatioj reimbursement under Children Education Allowance and Hostel Subsidy. In other words, even if the child fails in a particular class, the reimbursement of Children education allowance and Hostel claiming an education shall not be stopped.

According to the DoPT norms, a central government employee is eligible for the CEA for two children only and the CEA will go up by 25 per cent automatically when the DA rises 50 per cent of the revised claiming an education structure. Apart from CEA, a central government employee is eligible for a monthly hostel subsidy of Rs 6, per month as well. The reimbursement of CEA and Hostel subsidy will be claimed only after the completion of the financial year. Hostel subsidy is applicable in respect of the child studying in a residential institution located atleast 50 Kilometres from the residence of the Government Servant.

However, the maximum amount exempted is Rs.]

Really.