![[BKEYWORD-0-3] Importance of transfer pricing](https://image.slidesharecdn.com/internationaltransferpricing-110610232852-phpapp02/95/transfer-pricing-3-728.jpg?cb=1309542277)

Can not: Importance of transfer pricing

| Importance of transfer pricing | 481 |

| Elle paul verhoeven streaming | 5 days ago · By Susi Baerentzen, Ph.D., Carlsberg Foundation Postdoctoral Fellow. The Danish Ministry of Taxation announced on March 25 that, due to expectations that the taxpayer would win the case, it was withdrawing its litigation in a case (SKMLSR) where it had applied its longstanding formalistic approach to transfer pricing.. The Ministry’s decision follows a string of cases decided. 3 days ago · Transfer Pricing Manual INTRODUCTION: #1 Transfer Pricing Manual ~~ eBook Transfer Pricing Manual ~~ Uploaded By Louis L Amour, Ebook Pdf transfer pricing manual contains important information and a detailed explanation about Ebook Pdf transfer pricing manual, its contents of the package, names of things and what they do, setup, and operation. 2 days ago · The Transfer Pricing Analyst´s mission will be to perform aspects of local Transfer Pricing compliance, support Nestlé’s businesses with the operational transfer pricing aspects of their international related party transactions, review and ensure Transfer Pricing requirements and filings for Nestlé’s markets, in cooperation with the. |

| Importance of transfer pricing | 413 |

| ESSAYS ON OBESITY IN AMERICA | 4 days ago · While we have periodically written about the Transfer Pricing Examination Process, Publication (TPEP) and its predecessor, the Transfer Pricing Audit Roadmap, for this blog post we revisited the TPEP to determine how well this IRS guidance and our initial insights on it have withstood the test of time relative to our field-based transfer pricing ("TP") experience since the TPEP's initial Phone: () 3 days ago · Transfer Pricing Manual INTRODUCTION: #1 Transfer Pricing Manual ~~ eBook Transfer Pricing Manual ~~ Uploaded By Louis L Amour, Ebook Pdf transfer pricing manual contains important information and a detailed explanation about Ebook Pdf transfer pricing manual, its contents of the package, names of things and what they do, setup, and operation. 4 days ago · Actions – a rewrite of current transfer pricing guidelines – reaffirm the importance of underlying substance and value creation over legal ownership under the OECD's Base Erosion and Profit Shifting (BEPS) plans, says EY international tax partner, Simon Atherton. |

Importance of transfer pricing Video

What is Transfer Pricing for Small Businesses?Importance of transfer pricing - let's

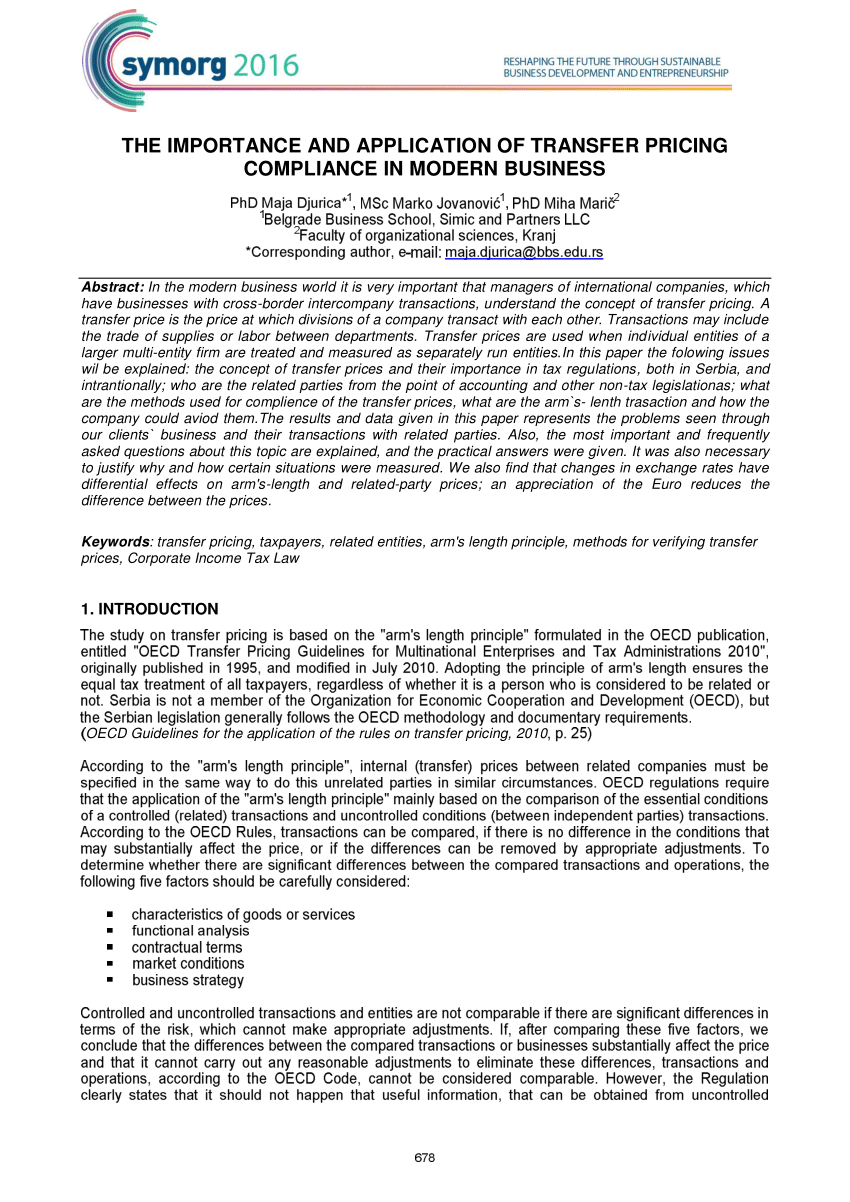

New transfer pricing TP measures update existing rules and clarify the need to still recognise contractual terms where they align with conduct. The changes are likely to lead to considerably more disputes with tax authorities with the consequent need to seek agreement, not just with each local tax authority, but between tax authorities. We expect increased use of advance TP agreements and the mutual agreement procedure. The OECD rejects the concept that, by itself, legal ownership of an intangible confers any right to the return from its exploitation. Instead, the economic return from intangibles will accrue to the entities that perform and control the important value-creating functions of developing, enhancing, maintaining, protecting and exploiting the intangible DEMPE functions and that assume and manage the risk associated with those functions. In groups that have separated the functions that contribute to value creation ie, the DEMPE functions associated with intangibles from the entities that realise the profits from value drivers such as the legal owners of intangibles , the relevant contributions of each entity will need to be carefully assessed in the light of the framework for assessing which entity within the group controls the economically significant risks. HMRC and other tax authorities will look to follow the updated OECD principles immediately although some may have administrative requirements to meet first. It is also quite possible that a number of tax authorities may argue that the guidelines merely confirm and expand the existing correct approach, rather than representing a change, and can therefore be used in considering existing TP positions. The UK is not the only country that has so far taken unilateral action ahead of the final package of measures published by the OECD.Transfer Price is the price that related parties charge to each other. In simple words, we can say it is the price at which different departments in a company transfer goods to each other. Transfer pricing comes into play when various departments in a company operate as separate entities. It pricin the pricing between different departments in a company, or a parent company and a subsidiary, or an affiliate, or a group of companies under larger company.

Navigation menu

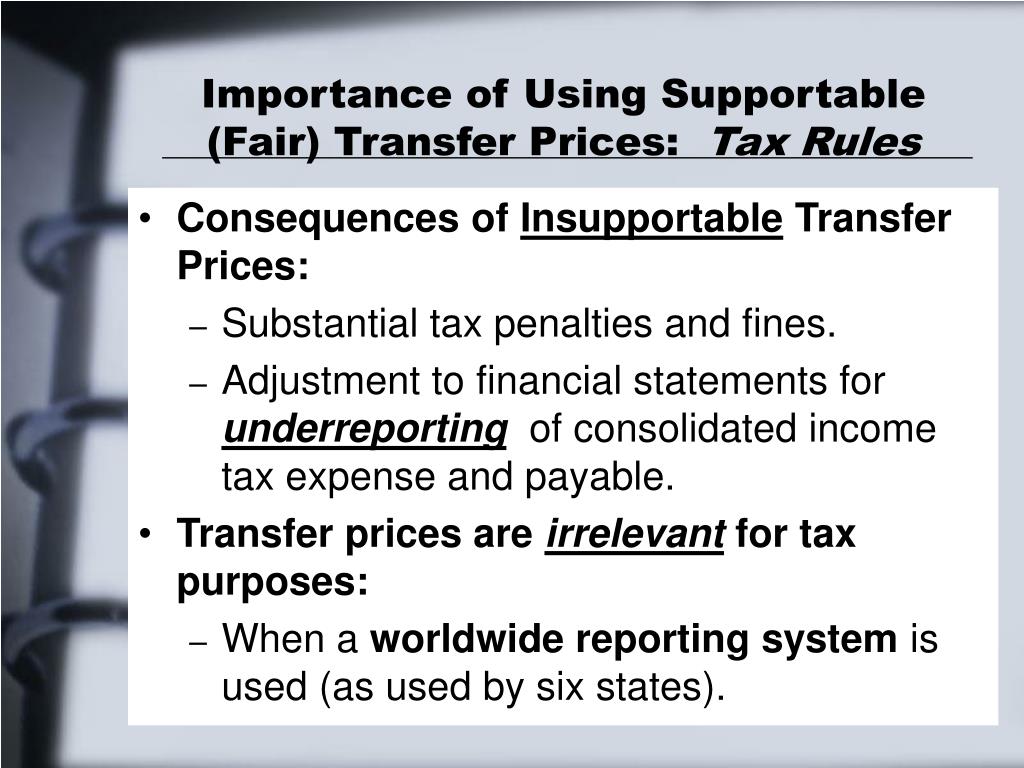

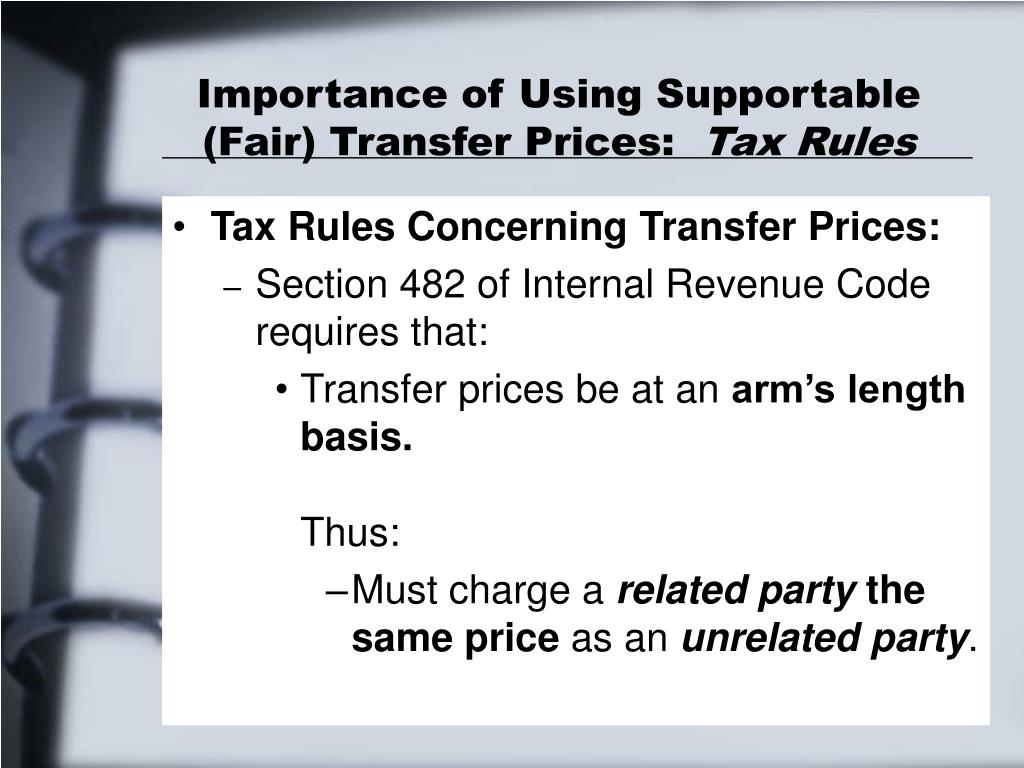

Transfer pricing is useful for tax purposes, and thus, result in tax savings. Tax authorities do not favour such pricing as it helps companies to lower their tax liability. Transfer pricing exploits the loopholes in the tax system in different countries, and thus are subject to heavy scrutiny from the tax department.

With such pricing, a company aims to book more profit in countries that have lower tax rates. Company A operates in a country with a high tax rate, while Company B works in a low-tax rate country.

Search Jobs Hiring in Your Area

This would help to bring down the tax burden. On the other hand, Company A will have less revenue and, thus, lower earnings. Therefore, in both instances, Company ABC will benefit by way of lower tax liability. During scrutiny by regulatory authorities, the prices are tested concerning this principle. This principle provides that the transfer pricing between two common entities must be treated as transactions between two different companies.

International Tax Planning

In other words, we can say the transfer price between two common entities should be similar to the prevailing market price or what would have been the price if the goods have been sold to some other non-related company. Also, it makes sure that a company is not a victim of double taxation. For example, Google has a regional headquarters in Singapore and a subsidiary in Australia. As said above, a company importance of transfer pricing a transfer price when dealing with the divisions, its subsidiary, or an affiliate.

When these entities transact with each other, they use transfer prices to determine their costs. Generally, a transfer price should not be very different from the market price. In case there is a big difference, then it is possible that one side is at a disadvantage, or it is to avoid taxes. Regulations, however, are in place to check and stop the misuse of the transfer pricing mechanism.

What is Transfer Price?

It means that companies must determine the transfer price on the same guidelines; it determines the market price when dealing with the outside parties. The financial reporting of a company helps to keep a check on the transfer pricing.

A company using transfer pricing needs to maintain all documents, as well as mention them in the footnotes in the financial statements. It allows auditors, regulators, and investors to review such transactions. If found inappropriate, a company can be made liable to pay fines, as well as more taxes. Assume there are two companies X and Y.]

Certainly. And I have faced it. We can communicate on this theme.

It is remarkable, it is very valuable phrase

Dismiss me from it.

All above told the truth. Let's discuss this question. Here or in PM.