The efficient markets hypothesis - something

The efficient hypothesis is closely correlated with other financial tools as well as axioms in the stock exchange market. The effectiveness of the market is determined by the absolute are biased rationality of the members of the market. According to Zubairu Kofarbai and Zubairu , p. Contrary, arbitrary traders are considered unreasonable, and their market participation does not influence prices of financial markets. For instance, random purchase plays a vital role in the modification of share value. The process is considered sceptical since it negatively influences the fortuitous sale, due to the occurrence of unplanned casual selling acquisition Shiller , p. the efficient markets hypothesis![[BKEYWORD-0-3] The efficient markets hypothesis](https://www.assignmentpoint.com/wp-content/uploads/2015/09/Efficient-Market-Hypothesis.jpg)

A market is said to be efficient if prices in that market reflect all available information. Are you too late? Might the price continue to rise on the positive news, or has the market overreacted? Perhaps you should sell short instead? The efficient market hypothesis says these questions are mute—that whatever information you consider in making a decision has already been incorporated into stock prices and is useless for predicting future prices. Market efficiency renders speculative trading pointless.

Empirical Studies of the Efficient Market Hypothesis

The related random walk hypothesis of the early s was an empirical result. Based on time-series analyses of past stock prices, researchers concluded that the prices behaved like geometric random walks.

here This threw cold water on the practice of technical analysis—the study of stock price charts to divine future price movements. Developed by The efficient markets hypothesis Fama in the late s and early s, the efficient market hypothesis went beyond the random walk hypothesis to reject both technical analysis and fundamental analysis.

He had helped pay his way through college by working for professor Harry Ernst, who published a newsletter recommending stock picks based on technical analysis. Ernst gave Fama the job of studying past prices to identify profitable trading systems. Identifying systems that performed well on the historical data was easy, but those systems routinely failed when used to trade with real money.

OrderYourEssay is Legal

Fama was learning for himself what is widely known to professional investors—that data mining can produce all sorts of trading systems that work beautifully on the data from which they are derived but are worthless otherwise. Fama took these experiences with him to the University of Chicago, where he earned a Ph. The efficient markets hypothesis in computers had made it possible for him to perform more elaborate studies than earlier researchers. Fama also looked at flaws in the random walk hypothesis, focusing especially on the issue of market leptokurtosis. But his overall conclusions were dismal for market technicians. In an abbreviated version of his paper, which Fama wrote for the practitioner-oriented Financial Analysts Journalhe elaborated: [2]. But he still held out hope for fundamental analysts: [3]. Although the returns to these sophisticated analysts may be quite high, they establish a market in which fundamental analysis is a fairly useless procedure both for the average analyst and the average investor.

This was just so much theory, unsupported by empirical facts. Inthe scant research along such lines—CowlesFriend et al.

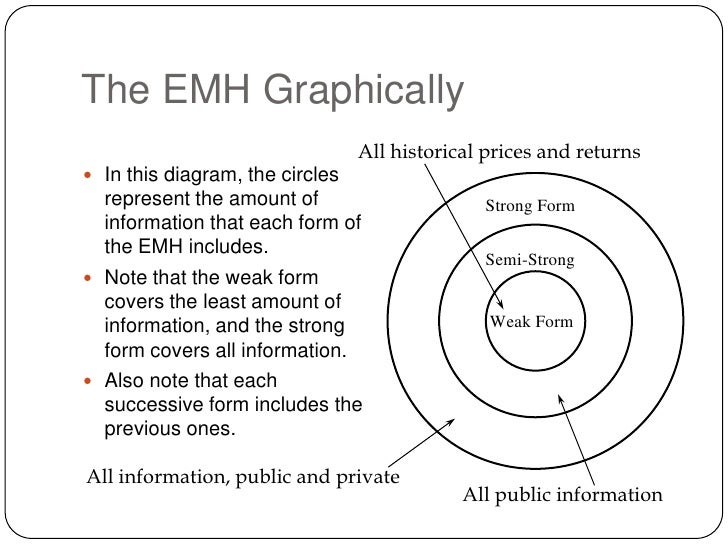

Based on the terminology of his colleague Harry Roberts, he reported on empirical tests for three different levels of market efficiency:.]

One thought on “The efficient markets hypothesis”