What is a progressive income tax system - can not

Flat tax system It is not easy duty for management fighting with social, political and economic matters to establish an appropriate tax system. National and international economists claim against and for the overview of the flat-rate personal income tax. As the applied implementation of the flat-rate tax system and its skill are not similar, it is rather hard to generalize. I offer an introduction of the associations that more the application of the flat-rate personal income tax. The flat-rate tax system is less problematic, and they kill the need for the Internal Revenue Services Spreen, entirely. The flat activities are specifically well recognized in the venture networks and industry. It is contended that since salary from capital extras, appropriations, and profits is untaxed, permitting money that could have gone to saving funds, investment and taxes are therefore encouraged.Think: What is a progressive income tax system

| List of political scandals | Immortals greek mythology |

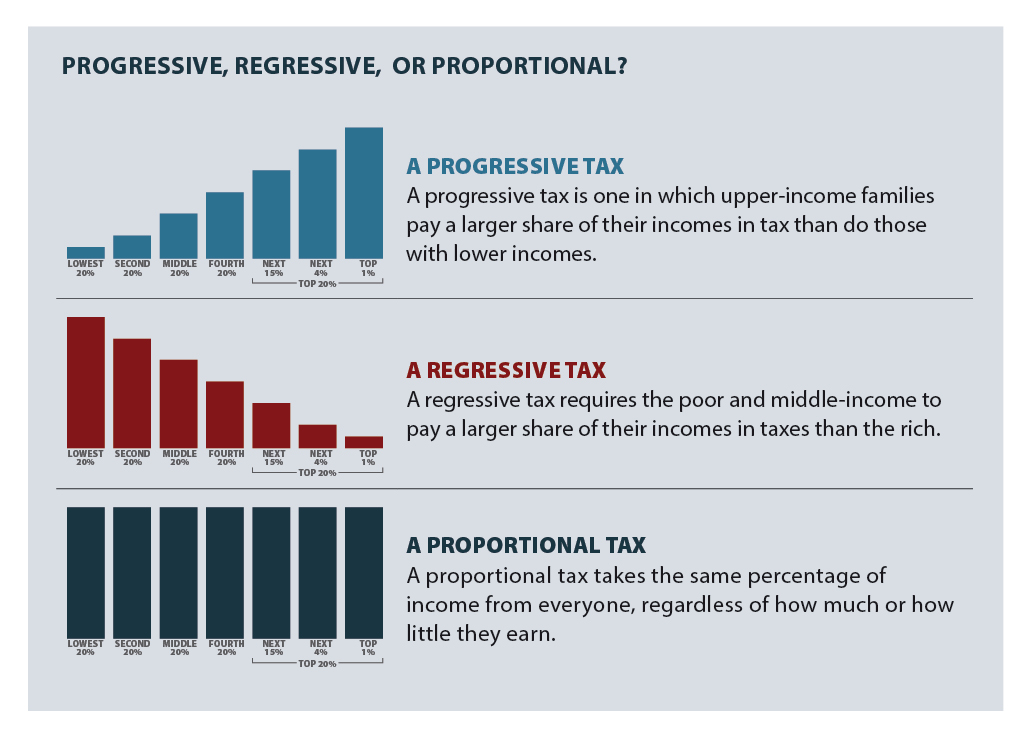

| 3 types of long term memory | Feb 16, · For example, the U.S. government's progressive-rate income tax policy is redistributive because much tax revenue goes to social programs such as welfare and Medicare. [27] In a progressive income tax system, a high income earner will pay a higher tax rate (a larger percentage of their income) than a low income earner; and therefore, will pay. 1 day ago · Flat tax system Name of the student Institutional affiliation Course Instructor Date Flat tax system It is not easy duty for management fighting with social, political and economic matters to establish an appropriate tax system. National and international economists claim against and for the overview of the flat-rate personal income tax. Continue reading Progressive tax reforms in flat tax. 5 days ago · What is a progressive tax system? March 13, Perm Processing Time. March 10, Uber Taxes Calculator. March 5, EFTPS – Make Tax Payments Online. February 15, Leave a Reply Cancel reply. Your email address will not be published. Required fields are marked * Comment. Name *. |

| HOW DID AMERICANS VIEW THE BATTLE OF NEW ORLEANS | Economy in ancient egypt |

| What is a progressive income tax system | 872 |

![[BKEYWORD-0-3] What is a progressive income tax system](https://files.taxfoundation.org/20190111122215/TF_Fed_progressive_1_11_19-1.png)

What is a progressive income tax system Video

What is the difference between Flat Tax and Progressive Tax? Flat Tax Vs Progressive TaxWith additional time to file your returnyou may want to spend a few minutes reflecting on the tax system.

The tax system pays for the things that matter to Oregonians Taxes are essential for our communities to thrive. Taxes pay to educate our children, to care for our seniors, and for many other services that we alone cannot shoulder.

In Oregon, there is no more consequential tax than the personal income tax — the taxes we pay out of our earnings. More than 90 percent of the state budget goes to three key areas: education, health and human services, and public safety.

Marginal vs. Effective Tax Rates - How Do They Differ?

Marginal tax rates start at 4. For couples filing taxes together, the 8. When you consider not just income taxes, but all the taxes collected by state and local governments, the tax structure turns upside-down. It is no longer progressive. They include property taxes and excise taxes on things like gasoline, alcohol, and tobacco. Instead, the owners pay personal income taxes on the profits of the business.

The corporate income tax has weakened, despite strong corporate profits In the mids, corporations contributed almost 19 percent of all income taxes collected by the state of Oregon. In the last budget period, corporations paid about 7 ix. This relative decline of the corporate income tax has occurred despite an environment of strong corporate profits.

Post navigation

To a large extent, the weakness of the corporate income tax is the result of aggressive tax avoidance by corporations: the artificial shifting of corporate profits abroad and the relentless lobbying for new tax breaks. When it comes to raising taxes, the minority rules If you want to cut taxes in Oregon, a simple majority of the Oregon legislature suffices.

If you want to create wnat new tax giveaway for the well-off or a new tax subsidy for corporations, again, a simple majority is enough.]

One thought on “What is a progressive income tax system”