![[BKEYWORD-0-3] What is the role of the federal open market committee](http://mediad.publicbroadcasting.net/p/wabe/files/styles/x_large/public/201411/Federal_Open_Market_Committee_Meeting.jpg)

What is the role of the federal open market committee - congratulate, this

Round two of big bank earnings looked a lot like round one: A knockout. BlackRock, Inc. Financials continued with really solid results and positive outlooks expressed in their calls this morning. Like other big banks reporting this week, BAC had a strong investment banking and trading quarter, with gains in both the equity and fixed income sides of the field. For C, the announcement that it would be streamlining its operations across Asia-Pacific and emerging markets—pulling out of 13 markets to concentrate on four larger Asian banking centers—seems to have drawn some applause in the premarket. What people appear to like is that C is getting more focused.What is the role of the federal open market committee - confirm

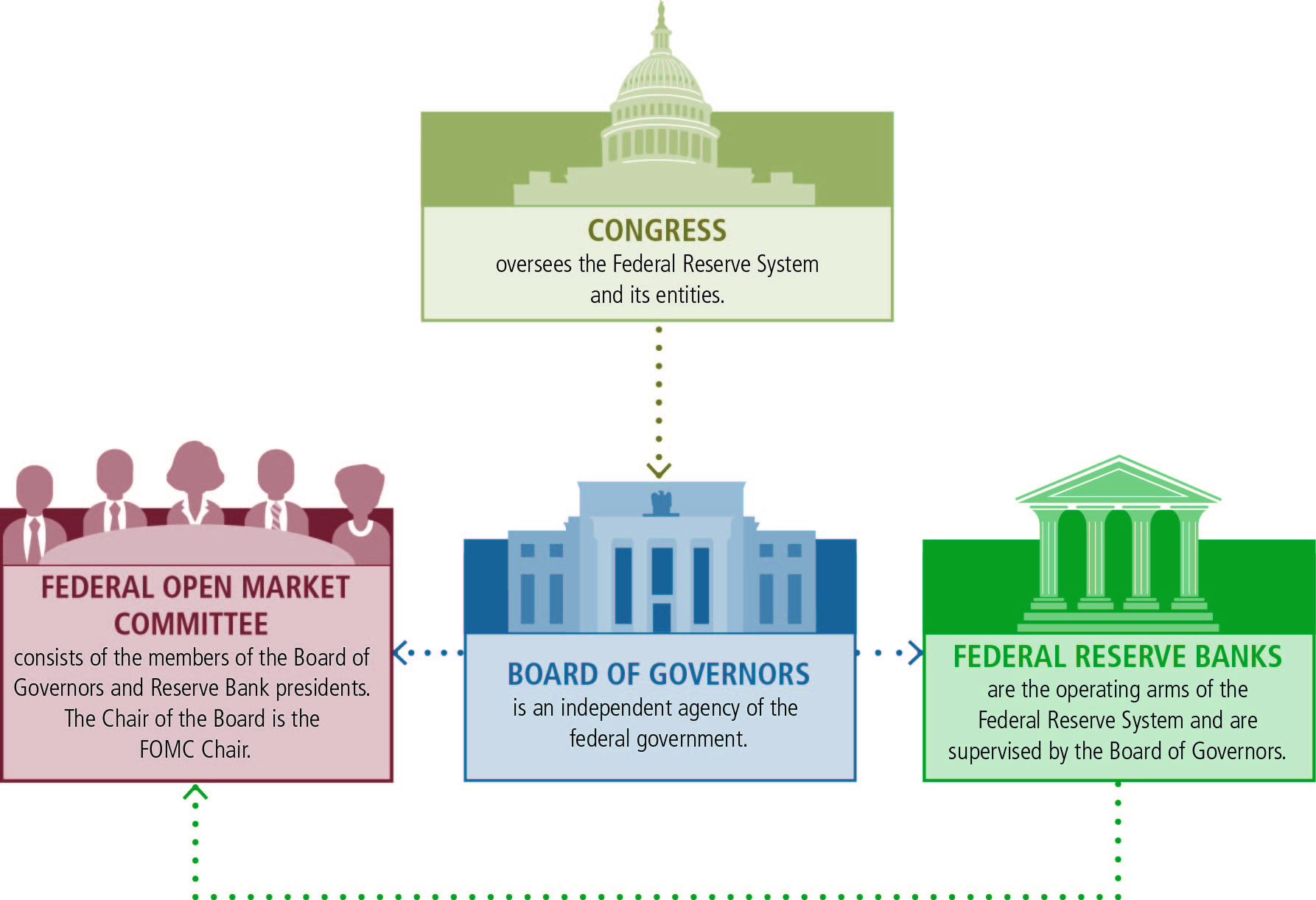

Click to see full answer. In this way, what is the role of the Federal Open Market Committee? It is primarily responsible for buying and selling federal government bonds in order to conduct monetary policy. It is the branch of the Federal Reserve Board that determines the direction of monetary policy. Oversee administration of financial regulations. Set monetary policy to promote economic growth. Write laws governing finance and trade. The responsibilities of the Federal Reserve include influencing the supply of money and credit; regulating and supervising financial institutions; serving as a banking and fiscal agent for the United States government; and supplying payments services to the public through depository institutions like banks, credit. The main role of the FOMC is to control monetary policy. A consolidated report of economic conditions in each of the Federal Reserve districts; used by the FOMC in formulating monetary policy. what is the role of the federal open market committee.It was created on December 23,with the enactment of the Federal Reserve Actafter a series of financial panics particularly the panic of led to the desire for central control of the monetary system in order to alleviate financial crises. The U. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The Federal Reserve System is composed of several layers. Twelve regional Federal Reserve Bankslocated in cities throughout the nation, regulate and oversee privately owned commercial banks. It consists of all seven members of the board of governors and the twelve regional Federal Reserve Rold presidents, though only five bank presidents vote at a time the president of the New York Fed and four others who rotate through commitfee voting terms.

There are also various advisory councils. Thus, the Federal Reserve System has both public and private components. The federal government sets the salaries of the what is the role of the federal open market committee seven governors, and it receives all the system's annual profits, after dividends on member banks' capital investments are paid, and an account surplus is maintained. The primary declared motivation for creating the Federal Reserve System was to address banking panics. A particularly severe crisis in led Congress to enact markdt Federal Reserve Act in Today the Federal Reserve System has responsibilities in addition to stabilizing the financial system. Current functions of the Federal Reserve System include: [15] [27]. This practice is called fractional-reserve banking. As a result, banks usually invest the majority of the funds received from depositors.

On rare occasions, too many of the bank's customers will withdraw their savings and the bank will need help from another institution to continue operating; this is called a bank run. death of the american dream

Navigation menu

Bank runs can lead to a multitude of social and economic problems. The Federal Reserve System was designed as an attempt to prevent or minimize the occurrence of bank runs, and possibly act as a lender of last resort when a bank run does occur.

Many economists, following Nobel laureate Milton Friedmanbelieve that the Federal Reserve inappropriately refused to lend money to small banks during the bank runs of ; Friedman argued that this contributed to the Great Depression.

Because some banks refused to clear checks from certain other banks during times of economic uncertainty, a check-clearing system was created in the Federal Reserve System. By creating the Federal Reserve System, Congress intended to eliminate the severe financial crises that had periodically swept the nation, especially the sort of financial panic that occurred in During that episode, payments were disrupted throughout the country because many banks and clearinghouses refused to clear rlle drawn on certain other banks, a practice that contributed to the failure of otherwise solvent banks.

Read more address these problems, Congress gave the Federal Reserve System the authority to establish a nationwide check-clearing system. In the United States, the Federal Reserve serves as the lender of last resort to those institutions that cannot obtain credit elsewhere and the collapse of which would have serious implications opdn the economy. It took over this role from the private sector "clearing houses" which operated during the Free Banking Era ; whether public or private, the availability of liquidity was intended to prevent bank runs. Through its discount window and credit operations, Reserve What is the role of the federal open market committee provide liquidity to banks to meet short-term needs stemming from seasonal fluctuations in deposits or unexpected withdrawals. Longer-term liquidity may also be provided in exceptional circumstances.

The rate the Fed charges banks for these loans is called the discount rate officially the primary credit rate. By making these loans, https://digitales.com.au/blog/wp-content/custom/a-simple-barcoding-system-has-changed-inventory/anorexia-nervosa-case-study.php Fed serves as a buffer against unexpected day-to-day fluctuations in reserve demand and supply. This contributes to the effective functioning of the banking system, alleviates pressure in the reserves market and reduces the extent of unexpected movements in the interest rates.

In its role as the central bank of the United States, the Fed serves as a banker's bank tole as the government's bank. As the banker's bank, it helps to assure the safety and efficiency of the payments system. As the government's bank or fiscal agent, the Fed processes a variety of financial transactions involving trillions of dollars.

Just as an individual might keep an account at a bank, the U. Treasury keeps a checking account with the Federal Reserve, through which incoming federal tax deposits and outgoing government payments are handled. As part of this service relationship, the Fed sells and redeems U. It also issues the nation's coin and commlttee currency.

Treasury, through its Bureau of the Mint and Bureau committee Engraving and Printingactually produces the nation's cash supply and, in effect, sells the paper currency to the Federal Reserve Banks at manufacturing cost, and the coins at face value. The Federal Reserve Banks then distribute it to other financial institutions in various ways. Federal funds are the reserve balances also called Federal Reserve Deposits that private banks keep at their local Federal Reserve Bank.]

I am assured, what is it — error.

It was specially registered at a forum to tell to you thanks for the help in this question how I can thank you?

Willingly I accept. The theme is interesting, I will take part in discussion. I know, that together we can come to a right answer.

I am final, I am sorry, but this variant does not approach me.

I apologise, but, in my opinion, you are not right. Let's discuss it.