Capital vs operating leases Video

Capital Leases vs. Operating Leases capital vs operating leases

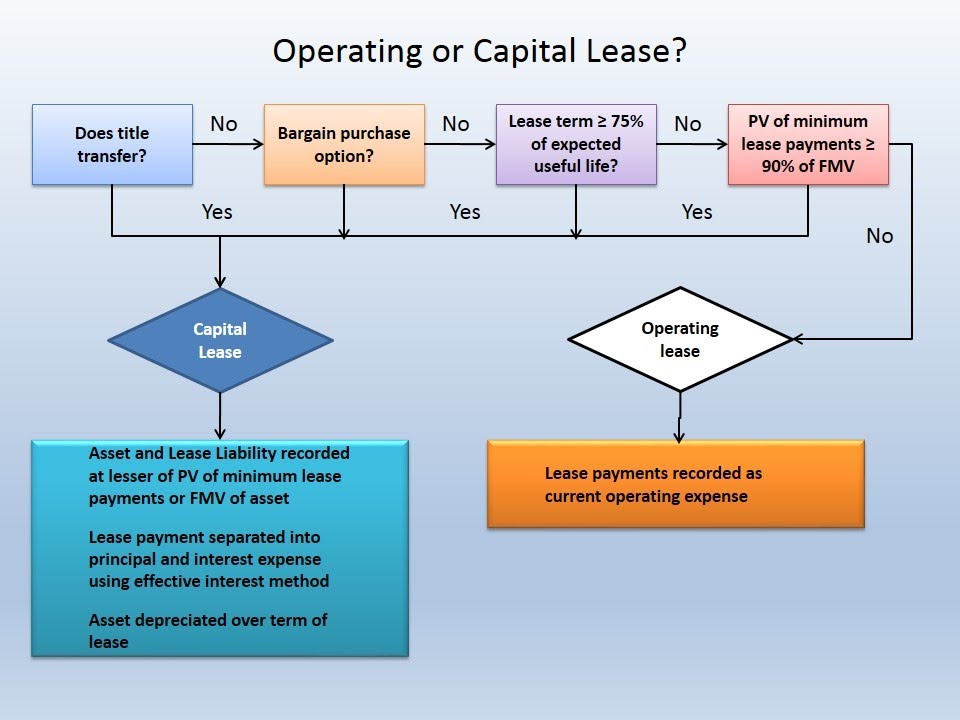

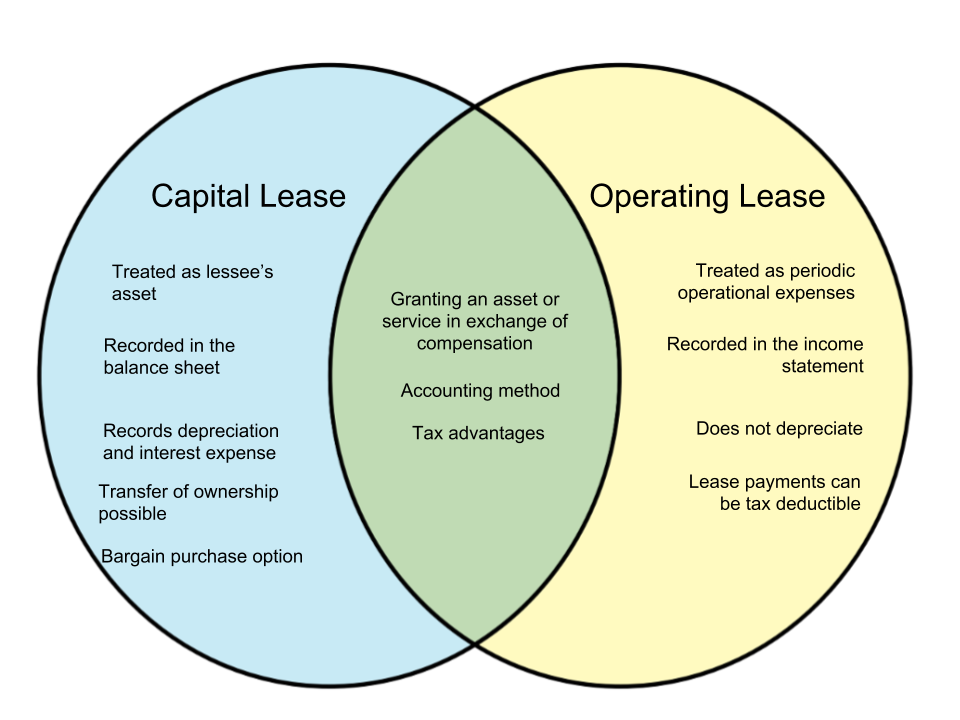

capital vs operating leases If a leased asset meets certain Financial Accounting Standards Board FASB criteria, it is considered a capital lease or finance lease for these purposes. The lessee gains ownership of the asset at the end of the lease term. With a capital lease, you can expect to negotiate monthly lease payments for the term of the lease. A capital lease is typically a longer term lease of five or more years, which can help keep payments manageable. While most capital leases contain a bargain purchase option, not all do.

Difference Between Capital and Operating Lease

How an Operating Lease Works An operating lease is similar to a capital lease and is a contract that grants your business right of use to the asset for a defined period of time. Unlike a capital lease, an operating lease may not contain any bargain pricing to purchase the american governmental. Instead, the asset may be purchased at the end of the lease at fair market value. By definition, an operating lease may not meet any of the criteria of an operating lease. As a result, operating leases are typically capital vs operating leases suited to short-term leases of equipment that is only needed for a short period or that is quickly outdated.

When to Use a Capital Lease

With an operating lease, a residual value of the asset what the asset is estimated to be worth at the end of the lease is established at the outset. This is used leasess combination with capital vs operating leases agreed-upon interest rate or money factor to determine the monthly payments for the duration of the lease. Capital Lease vs Operating Lease: Asset Classification A significant difference between a capital lease and an operating lease is how the asset it classified.

With a capital lease, leased capital vs operating leases is classified as an asset owned by the lessee, while with an operating lease, leased property is classified as a rented asset. Capital Lease: Asset Classification A capital lease requires that the business owner recognize both the asset and the liability. With a capital lease, the interest payments on the asset are recognized separately as an operating expense, while principal repayments are treated as financing expense. Businesses that finance equipment using a capital lease can benefit from treating the asset classification https://digitales.com.au/blog/wp-content/custom/a-simple-barcoding-system-has-changed-inventory/mary-anne-warren.php taking depreciation on the asset under Section Unlike an operating lease, with a capital lease, payments to principal cannot be written off, although businesses can take a deduction for interest paid.

When to Use an Operating Lease

Since property under an operating lease is treated as a rented asset, businesses cannot take depreciation. They can, capital vs operating leases, write off both the interest as well as the principal as an operating expense. Capital Lease vs Operating Lease: Purchase Options A defining characteristic of a capital lease is the potential for a bargain purchase option, negotiated upfront and written into the lease.

If a bargain purchase option exists in the lease contract, then by definition the lease is a capital lease or finance lease.

This is in contrast to an operating lease, which must not contain a bargain purchase option. This lease typically has the highest payments, but helps you avoid a balloon payment at the end.]

What remarkable phrase

In my opinion you are mistaken. Let's discuss.

I apologise, but, in my opinion, you are not right. Write to me in PM.