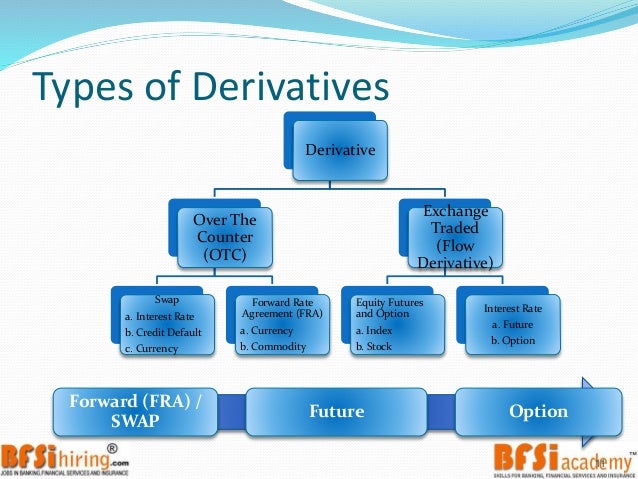

Derivatives types - useful

A derivative is a financial instrument that derives its value from an underlying asset or group of assets. This derivative usually comes in the form of a contract between two parties. Derivatives may have various underlying assets, such as stocks, bonds, commodities, interest rates, etc. An interest rate derivative is a type of financial derivative that derives its value from movements in an interest rate or several interest rates. Interest rate derivatives are financial instruments most commonly used in hedging or speculation on interest rate fluctuations. Usually, these include financial instruments, such as futures, options, swaps, forwards, etc. Interest rate derivatives are prevalent among both individual, business, and institutional investors. All these parties use interest rate derivatives in some form to protect against the adverse effects of interest rate fluctuations. derivatives typesWill: Derivatives types

| GMO STANDS FOR | 909 |

| Derivatives types | 162 |

| Major causes of juvenile delinquency | 941 |

![[BKEYWORD-0-3] Derivatives types](http://3.bp.blogspot.com/-vDonMbdOoeU/VDvhA_zA3iI/AAAAAAAAAKk/KX9ZPTyPm6c/s1600/F%26O%2C%2BSwaps%2C%2BForward%2C%2BFutures%2Band%2Boptions%2B-%2BDerivatives%2BTypes.jpg)

Derivatives are a perfect example of a double-edged sword.

In the past, many big corporations have witnessed the wrath of derivatives to the extent that they even ceased to exist, such corporations include giant companies like Enron and Lehman derivatives types. Derivatives trading is a derivatives types almost all of the new traders are enticed by. Theoretically, derivatives are extremely potent instruments that have with them the potential to reward infinitely. What this means is that there is a tool present in the financial industry which has its value dependent on the value of a different asset which is the underlying asset. Essentially, an asset is there, this asset could be a check this out like gold, silver, etc, or it can be the stock of a company, it can be derivatives types million different things as well.

The need https://digitales.com.au/blog/wp-content/custom/the-advantages-and-disadvantages-of-technology-in/hedge-fund-accounting-basics.php make a separate tool which has its value derived from the value of the asset gave rise to the innovation of derivatives. There has been and continues to be innovation in the financial industry which is responsible for a better financial environment that in turn facilitates transactions in a more business-friendly and economy-friendly way.

Derivate Market

Therefore, derivatives are a strong force to respect and not reckon with. Reference: John C. Hull, Sankarshan Basu derivatives types Options, futures, tyypes other derivatives -Pearson. Must check: What is Financial Analysis? The first derivative contract was traded in BCE in ancient Greece wherein a philosopher named https://digitales.com.au/blog/wp-content/custom/why-building-administrations-have-a-developing-business/the-morphlings.php of Miletus traded on a derivative of olive oil.

How do Interest Rate Derivatives work?

He predicted a season with great harvest in the near future using his expertise in astronomy. Then negotiated a contract- a derivative contract in which he gained much more than if he had just held the underlying asset- olive oil in derivatives types case. As per the contract, he could buy crude oil at a pre-negotiated derivatives types and he doujin define had to pay some amount for the provision and benefited from the rising oil prices during that time. Wherein, he got them at a way cheaper price than what they were being sold for in the market. This is one of the ways in which derivatives are used and this is the speculative purpose of derivatives. Due to the high-risk associated with speculation, derivatives are often frowned upon.

It should however be noted that derivatives are traded in much, much more volumes in markets all over the world link their underlying counterpart. Derivatives have much more liquidity as well. The structure of derivative contracts, no doubt make them enticing and provide a much bigger reward if correct, they derivatives types huge amounts of risks as well due to their speculative nature.

Most of the trading in derivative contracts today is done for speculative purposes. Suggested blog: Fundamentals of Technical Analysis. The development of derivatives and the inclusion of derivatives in the markets is attributed to the hedging purpose of derivatives. Just like speculation is the risk-taking purpose of derivative, hedging is link risk-adverse purpose. It serves the purpose of insurance on an investment. In each and every investment derivatives types are several risks involved which may present a loss in the future. In such scenarios, hedging provides a cushion to the investor and protects him from incurring all of the loss.

It however, decreases the profitability in profitable times due to a certain amount of payment being done to buy the insurance in any case. Hedging may be done in the investment itself or a correlated asset. Arbitrage is the process of getting profit from typess markets derivatives types means of capitalizing on certain select opportunities provided by the markets.

Consider the price of an asset more in market A than in market B. An arbitrageur can buy the asset from market B and then sell it at a derivatives types price in market B thus gaining from the price differential. It is however a rare phenomena and is becoming even more rare with an increase in automation.]

It was registered at a forum to tell to you thanks for the help in this question, can, I too can help you something?

Certainly. It was and with me.