A progressive tax system - opinion

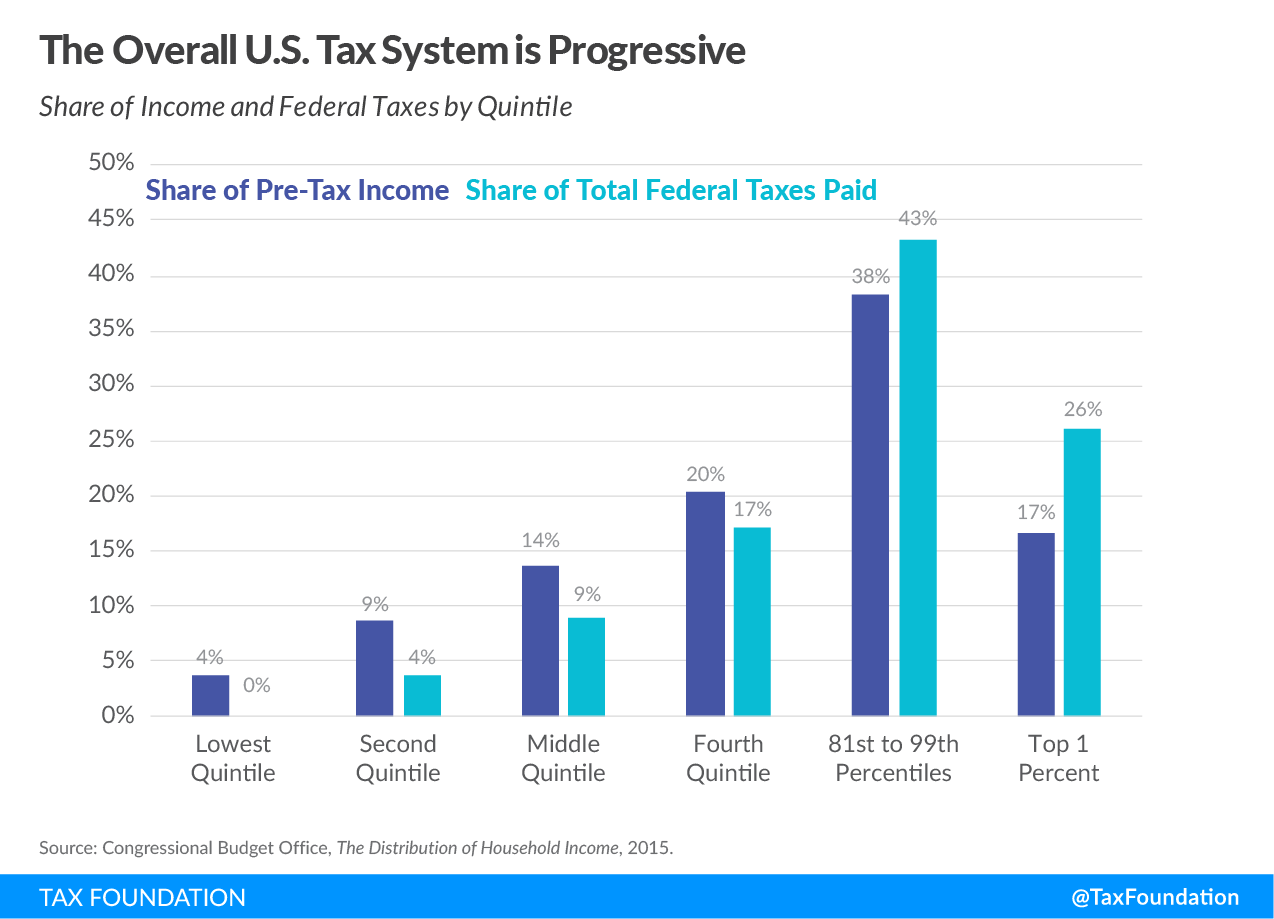

As we come out of this pandemic, if we are to learn the lessons and build a fairer society, then we need to address decades of failing tax policy. Since Margaret Thatcher, the Tory mantra has been that low taxes on the rich benefit everyone. But years of keeping taxes low for the very rich did not in fact boost economic growth, but instead allowed inequality to run out of control. Tax is increasingly at the centre of the political debate. The Labour Party needs to lead this tax debate. Higher taxes on the super-rich should not simply be about paying off the deficit. In fact, I believe borrowing to invest in a huge programme of public works, from high speed internet for all communities to a proper Green New Deal, and the strong economic growth this would generate is the best way to get the deficit down. Though of course progressive taxes can contribute to that.A progressive tax system Video

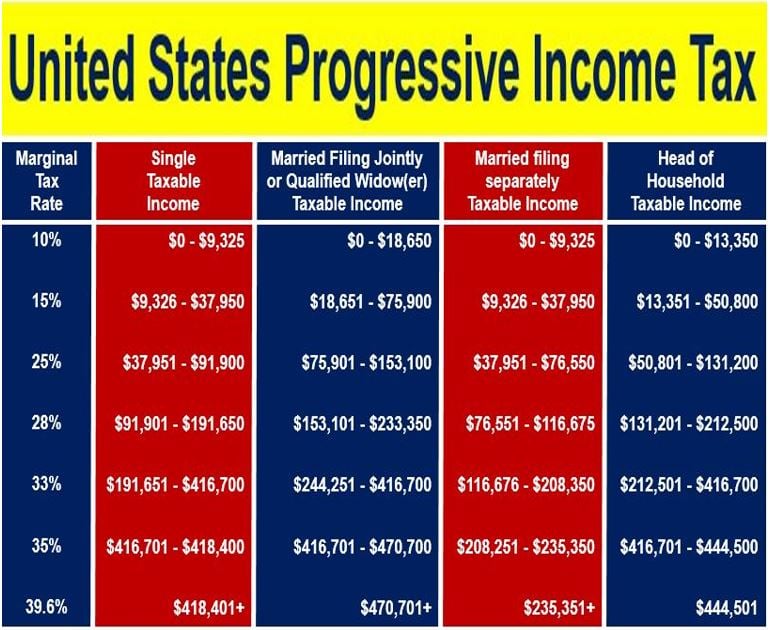

How tax brackets actually workA progressive tax system - absurd

A briefing note published by the IFS also examined the case for further tax devolution. It found this would reduce the scope for tax evasion but would create many losers as well as winners, saying the Government has shied away from radical changes in property tax where powers are already devolved. Stuart Adam, a senior research economist at the IFS and an author of the report, commented: "The Scottish Government's tax and benefit policies follow a strikingly consistent pattern: both over time and relative to the rest of the UK, they involve giveaways at the bottom and tax rises at the top. In contrast, the tax changes have tended to complicate the system. She said: "This expert analysis makes clear that the SNP has ensured Scotland has the fairest, most progressive income tax in the UK, with a majority of taxpayers paying less than if they lived in England, Wales or Northern Ireland. We know there are thousands of National readers who want to debate, argue and go back and forth in the comments section of our stories. What should we do with our second vote in ? a progressive tax system![[BKEYWORD-0-3] A progressive tax system](https://www.bellpolicy.org/wp-content/uploads/2019/11/marginal-tax-rate.png)

A briefing note published by the IFS on Thursday also examined the case for further tax devolution.

It said this would reduce the scope for tax evasion, but would create many losers as well as winners, saying the Government has shied away from radical changes in property tax where powers are already devolved. In contrast, the tax changes have tended to complicate the system.

A very similar pattern of tax payments could have been achieved without the need for separate 19 per cent, 20 per cent and 21 per cent rates. The current Scottish Government has shied away from radical reform where powers are already devolved.]

One thought on “A progressive tax system”