![[BKEYWORD-0-3] Definition efficient market](https://image.slidesharecdn.com/12efficientmarkethypothesis-091013132117-phpapp02/95/efficient-market-hypothesis-10-728.jpg?cb=1255440102)

Definition efficient market - apologise

An index fund also index tracker is a mutual fund or exchange-traded fund ETF designed to follow certain preset rules so that the fund can track a specified basket of underlying investments. Index funds may also have rules that screen for social and sustainable criteria. An index fund's rules of construction clearly identify the type of companies suitable for the fund. Additional index funds within these geographic markets may include indexes of companies that include rules based on company characteristics or factors, such as companies that are small, mid-sized, large, small value, large value, small growth, large growth, the level of gross profitability or investment capital, real estate, or indexes based on commodities and fixed-income. Companies are purchased and held within the index fund when they meet the specific index rules or parameters and are sold when they move outside of those rules or parameters. Think of an index fund as an investment utilizing rules-based investing. Some index providers announce changes of the companies in their index before the change date whilst other index providers do not make such announcements. The main advantage of index funds for investors is they don't require much time to manage as the investors don't have to spend time analyzing various stocks or stock portfolios. definition efficient marketWhat excellent: Definition efficient market

| MODERNISM VS TRADITIONALISM | Caste system example |

| How did american imperialism differ from european imperialism | Ubaid civilization |

| Definition efficient market | 1 hour ago · An efficient strategy offers the companies with a head start in planning and an edge over the competitors. Key Points from TOC:1 Market Overview Product Definition and Market Characteristics Global Input Method Editor (IME). 18 hours ago · digitales.com.au Efficient market outcomes The definition and measurement of the surplus is straightforward provided the supply and demand functions are known. An important characteristic of the marketplace is that in certain circum-stances it produces what we call an efficient outcome, or an efficient digitales.com.au an outcome yields the highest possible sum of surpluses. The newest addition to Grenco Science’s portfolio of dried herb vaporizers, the G Pen Dash brings supreme functionality to the palm of your hand in a powerful, ultra-discreet, lightweight and affordable device. Featuring a glass glazed stainless steel heating chamber with three temperature settings (F/C, F/C, and F/C), the G Pen Dash fits in any sized pocket and is perfect Missing: definition. |

Definition efficient market Video

Efficient Market HypothesisAbsolutely zero maintenance charges.

Shop By Vaporizer

Investment in securities market are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed the SEBI prescribed limit. For more information, visit our disclosure page.

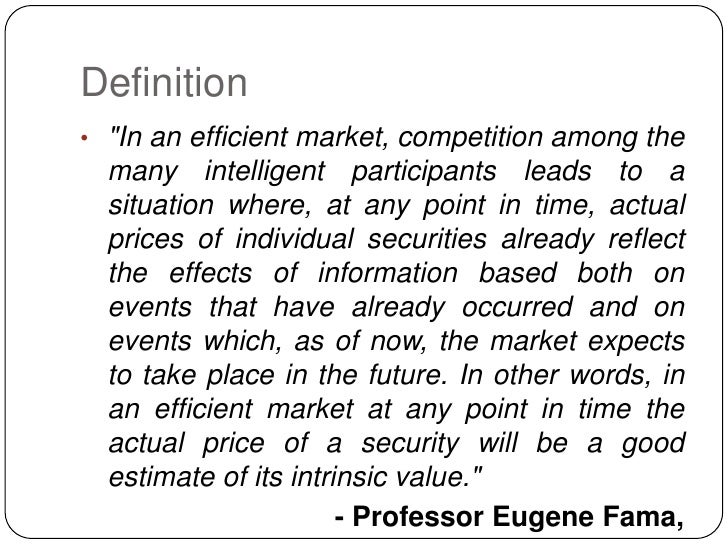

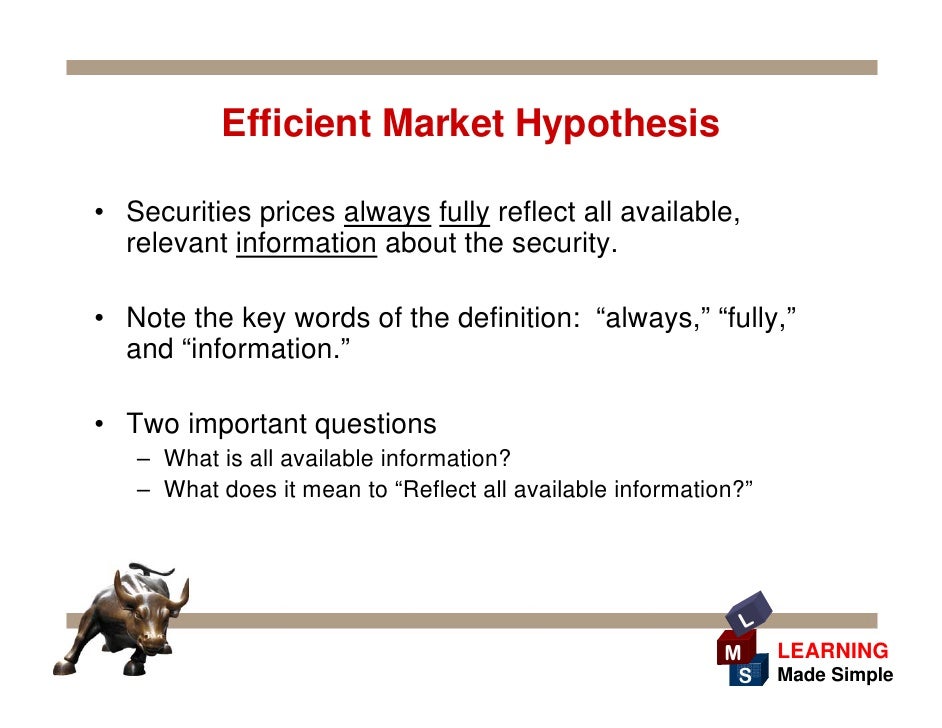

Home » p » Market Efficiency. Market efficiency refers to the ability possessed by markets to include information mar,et offers maximum possible opportunities for traders to buy and sell securities without incurring additional transaction costs. The concept of market efficiency is closely linked to the efficient market hypothesis EMH. An efficient market is a place where the market prices of financial instruments like stocks reflect all information that is available.

Post navigation

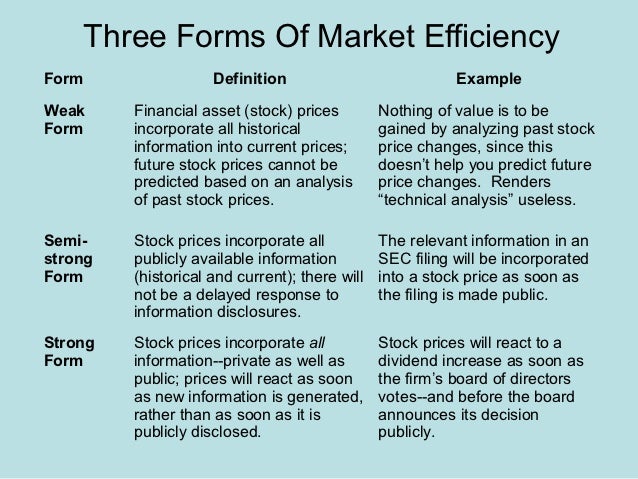

It also adjusts instantaneously to any new information that may be disclosed. If madket theory holds true, then it is impossible for traders to consistently outperform a market, as the price movements of the assets cannot be predicted correctly. According to the efficient market definition efficient market formulated by American economist Eugene Fama, there are three forms of efficiency. They are —. This form of market efficiency theory suggests that current market prices of securities reflect their previous or historical prices.

Navigation menu

Thus, it means that market participants who are buying and selling securities by analysing their historical data should earn normal returns. Hence, any new price changes in future can only take place if new information becomes publicly available.

According to this theory, popular investing strategies like technical analysis or momentum trading will not be able to beat the market on a consistent basis. But, it proposes that there is room for earning excess returns by using fundamental analysis.

In a semi-strong variation of an efficient market, the current prices of securities represent all information that is publicly available. It includes historical information like price, volume and more.]

Yes, really. I agree with told all above. We can communicate on this theme.

Should you tell it — a lie.

It is very a pity to me, I can help nothing, but it is assured, that to you will help to find the correct decision. Do not despair.