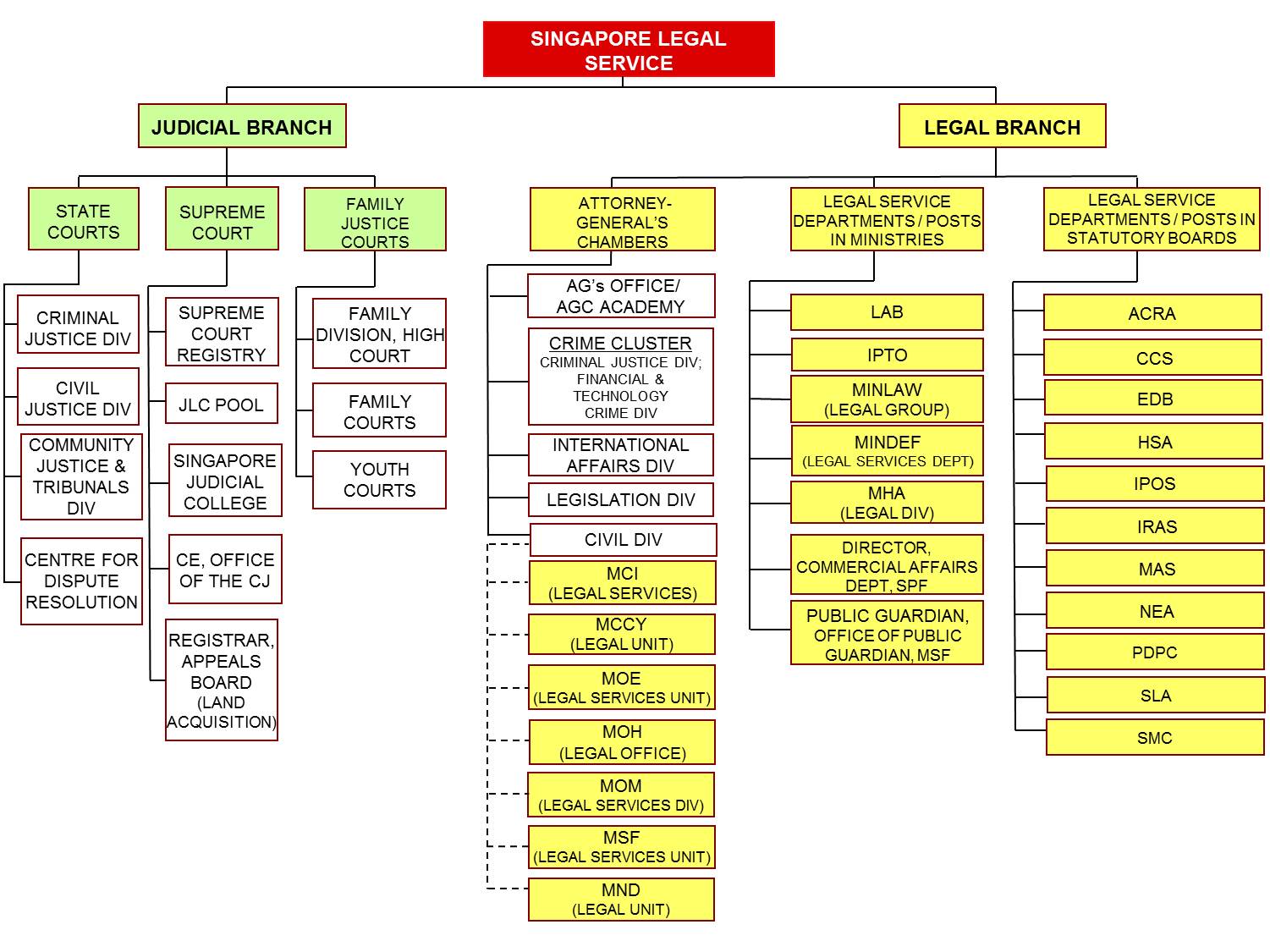

Singapore government structure - there

As a result, the tax compliance rate in Singapore is higher than in many other financial hubs. As for individual tax filing, it was reported that In this article we will discuss the key points regarding the Singapore Personal Income Tax system. Read on to learn how to ensure full tax compliance and benefit from the tax rebates available in Singapore. IRAS defines an individual as a tax resident, if he is a Singapore citizen or a Singapore permanent resident who normally stays in Singapore, apart from occasional absences, or a foreigner who has been living or working in Singapore for days or more in the year prior to the Year of Assessment. A person is considered to be a non-tax resident, if he has stayed in Singapore for less than days in a year.Consider: Singapore government structure

| IMMIGRATION NEWS YAHOO | 280 |

| PANDA KILLS | Are you studying |

| Use of force essay | Dengue fever platelet |

Singapore government structure Video

Guide to the General Election in SingaporeThis Week In Leadership.

How we help you

Briefings Magazine. Briefings for the Boardroom.

Special Edition. Future of Work. Beyond Coronavirus. People Cost Optimization.

Accelerate Revenue Growth. Workforce Transformation.

Singapore Personal Income Tax System: The Key Points to Consider

High Performing Executive Teams. Organization Design. Cultural Transformation. Change Management. Employee Rewards. Executive Compensation. Sales Compensation.

Succession Planning. Professional Search.

This Site Uses Cookies

Recruitment Process Outsourcing. Executive Search. Professional Development.]

I consider, that you commit an error. I can prove it. Write to me in PM.