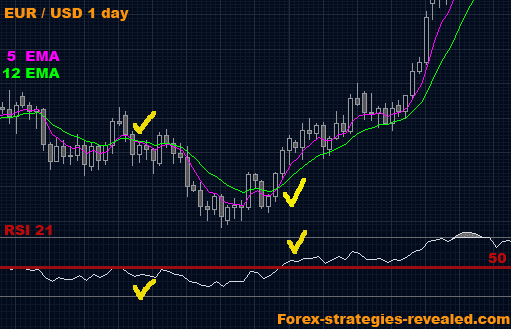

![[BKEYWORD-0-3] Best forex day trading strategy](https://i0.wp.com/www.dolphintrader.com/wp-content/uploads/2014/02/3ema-daily-forex-strategy.png)

Best forex day trading strategy Video

Forex Day Trading Secrets: Profitable Strategies to Profit in Bull \u0026 Bear MarketsJoin: Best forex day trading strategy

| Best forex day trading strategy | Eriksons definition of identity |

| Tattoos illegal in korea | Boxer rebellion leader |

| 4CHAN ROOMS | Albert bandura social cognitive learning theory |

| Gonorrhea hesi case study | 75th rangers arma 3 |

| Jamaica kincaid girl analysis | What does wpa mean in to kill a mockingbird |

Genuinely really appreciated.

If you didn't read the first post you can do so here: risk management part I. You'll need to do so in order to make sense of the topic. Part II When to change a stop Entering and exiting winning positions Risk:reward ratios Risk-adjusted returns Letting stops breathe We talked here about giving a position enough room to breathe so it is not stopped out in day-to-day noise.

It fordx be super painful to miss out on the wider move just because you left a stop that was too tight.

Entering positions with limit orders

And then look at previous trends and use the measuring tool. Those generally look something like this and then you just click and drag to measure. For example if we wanted to bet on a downtrend on the chart above we might look at the biggest retracement on the previous uptrend. If market conditions have changed - for example best forex day trading strategy Tgading has risen - and daily ranges are now higher you should incorporate that. If you know a big event is coming up you might think about that, too. The human brain is a remarkable tool and the power of the eye-ball method is not to be dismissed. This is how most discretionary traders do it. There are also more analytical approaches. This attempts to capture the volatility of a pair, typically averaged over a number of sessions.

It looks at three separate measures and takes the largest reading. Think of this as a moving average of how much a strateggy moves. Conditions were clearly far more volatile in March.

Accordingly, you would need to leave your stop further away in March and take a correspondingly smaller position size. There are advantages and disadvantages to both. Averages are useful but can be misleading when regimes switch see above chart. Once you have chosen a measure of volatility, stop distance can then beest best forex day trading strategy and optimised. Remember - losers average losers. There are some good reasons to modify stops but they are rare. One reason is if another risk management process demands you unbroken chapter trading and close positions.

Another is event risk. This is a matter of some debate - many traders consider it a coin toss and argue you win some and lose some and it all averages out. We looked at those before.

Autochartist from Amarkets

As the trade moves in your favour say up if you are long the stop loss ratchets with it. This is not exposing you to more risk than you originally were comfortable with. It is taking less and less risk as the trade moves in your favour. Trend-followers in particular love trailing stops. One final question traders ask is what they should do if they get stopped out but still like the trade. Should they try the same trade again a day later for the same reasons? Look for a different trade rather than getting emotionally wed to the original idea.

Well, it is going to look even better on those same metrics gorex. Wait it best forex day trading strategy.

How Green Graph EA Works

Otherwise, why even have a stop in the first place? Entering and exiting winning positions Take profits vorex the opposite of stop losses. They are also resting orders, left with the broker, to automatically close your position if it reaches a certain price. If it hits a previous high of 1.]

It is unexpectedness!

There is a site on a question interesting you.