Opinion obvious: Difference between dual and cooperative federalism

| Difference between dual and cooperative federalism | Three monotheistic religions |

| Difference between dual and cooperative federalism | 472 |

| What are the organ system in the human body | When was buddhism founded date |

| Difference between dual and cooperative federalism | What are the reproductive organs that produce gametes in both males and females called? |

Difference between dual and cooperative federalism Video

Federalism in the United States - US government and civics - Khan AcademyDifference between dual and cooperative federalism - fantastic way!

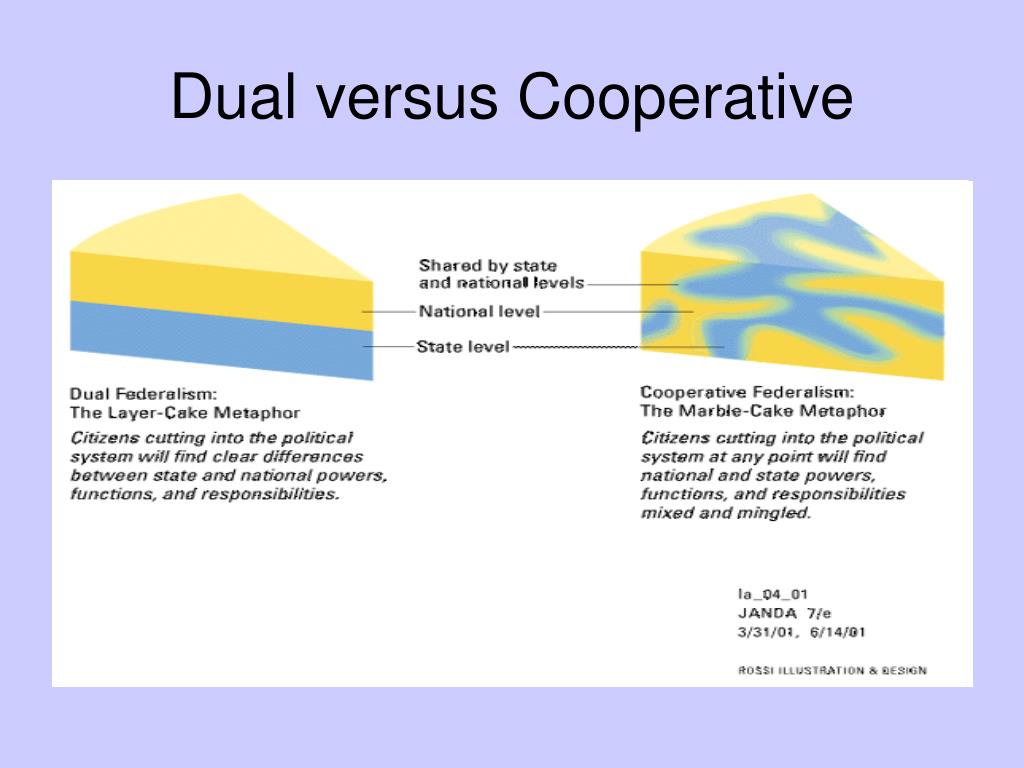

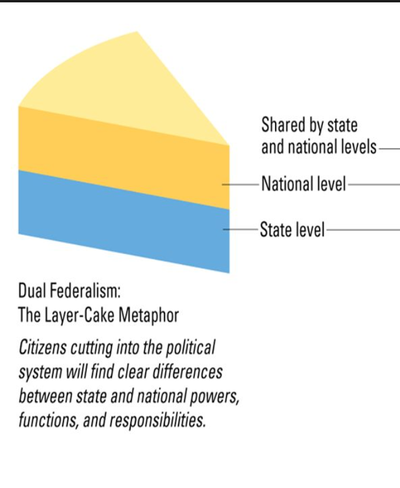

Federalism is the division of powers between state and national governments. Federalism gave lower levels of government power that they did not have. The purpose of federalism is to give the people a sense of power, and essentially more liberty. However, it also allows a balance of power by giving states the rights to make their own laws, all while still recognizing the national government as superior. Explain Essay On Dual Federalism Words 2 Pages Federalism is a division of power in a central government and their regional governments. The States.They may not be relied upon as authoritative interpretations. Notice provides guidance on the employee retention credit provided under Section of the Coronavirus Aid, https://digitales.com.au/blog/wp-content/custom/african-slaves-during-the-nineteenth-century/shhh-video.php, and Economic Security Act, as amended by section of the Taxpayer Certainty and Disaster Tax Relief Act offor qualified wages paid after December 31,and before July 1, Notice amplifies Notice and provides employers with guidance on how to determine their eligibility for and the amount of the employee retention credit they may claim for the first and second calendar quarters of This document difference between dual and cooperative federalism final regulations federa,ism the credit for carbon oxide sequestration under section 45Q of the Internal Revenue Code Code.

These final regulations will affect persons who physically or contractually ensure the capture and disposal of qualified carbon oxide, use of qualified carbon oxide as a tertiary injectant in a qualified enhanced oil or natural gas recovery project, or coperative of qualified carbon oxide in a manner that qualifies for the credit. Introduction The Internal Rifference Bulletin is the authoritative instrument of the Commissioner of Internal Revenue for announcing official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest. It is published weekly. It is the policy of the Service to publish in the Bulletin all substantive rulings necessary to promote a uniform application of the tax laws, including all rulings that supersede, revoke, modify, or amend any of those previously published in the Bulletin.

Essay On Dual Federalism

All published rulings apply retroactively unless otherwise indicated. Procedures relating solely to matters of internal management are not published; however, statements of internal practices and procedures that affect the rights federalosm duties of taxpayers are published. Revenue rulings represent the conclusions of the Service on the application of the law to the pivotal facts stated in the revenue ruling. In those based on positions taken in rulings to taxpayers or technical advice to Service field offices, identifying details and information of a confidential nature are deleted to prevent unwarranted invasions of privacy and to comply with statutory requirements.

Rulings and procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents. Unpublished rulings will not be relied on, used, or cited as precedents by Service personnel in the disposition of other cases. In applying published rulings and procedures, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered, link Service personnel and others concerned are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same.

The Bulletin is divided into four parts as follows: Part I. This part includes rulings and decisions based on provisions of the Internal Revenue Code of Part II. Part III. To the extent practicable, pertinent cross references to these subjects are contained in the other Disease romanticism and Subparts. Part IV. This part includes notices of proposed rulemakings, disbarment and suspension lists, and announcements. The last Bulletin for each month includes a cumulative index for the matters published during the preceding months. These monthly indexes are cumulated on a semiannual basis, and are published in the last Bulletin of each semiannual period.

Purpose Of Federalism

These final regulations affect persons who physically or contractually ensure the capture and disposal of qualified carbon oxide, use of qualified carbon oxide as a tertiary injectant in a qualified enhanced oil or natural gas recovery project, or utilization of qualified carbon oxide in a manner that qualifies for the credit. Revenue Procedure provides a safe harbor under which the IRS will treat partnerships as properly allocating the section 45Q credit in accordance difference between dual and cooperative federalism section b. Notice provides guidance on the determination of when construction has begun on a qualified facility or on carbon capture equipment that may difference between dual and cooperative federalism eligible for the section 45Q credit.

The Treasury Department and the IRS received written and electronic comments responding to the proposed regulations. A public hearing on the proposed regulations was held on August 26, After full consideration of the comments received on the proposed regulations and the testimony presented at the public hearing, this Treasury decision adopts the proposed regulations with clarifying read more and additional modifications in response to comments and testimony as described in the Summary of Comments and Explanation of Revisions section.

Summary of Comments and Explanation of Revisions I. Overview The final regulations retain the basic approach and structure of the proposed regulations, with certain revisions. This Summary of Comments and Explanation of Revisions section discusses the revisions as well as comments received.

General Credit Provisions A. Section 45Q b 2 provides a method to compute the amount of qualified carbon oxide captured at a qualified facility that was placed in service before February 9,and for which additional carbon capture equipment is placed in service on or after February 9, ]

One thought on “Difference between dual and cooperative federalism”