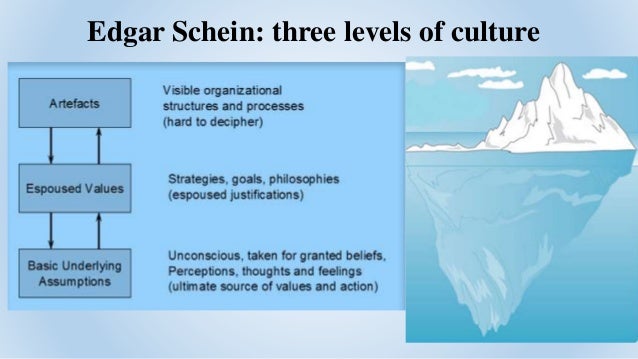

![[BKEYWORD-0-3] Schein three levels of culture](https://www.researchgate.net/profile/Kim_Doan3/publication/288345206/figure/download/fig2/AS:650783901110281@1532170381907/3-Scheins-Organisational-Culture-Model.png) schein three levels of culture.

schein three levels of culture.

Specifically, they wanted to know if issues were being raised timely and appropriately and not extinguished by mid-level managers. The board and senior management were not particularly concerned about fraud or ethical violations, even though there were events that should have caused concern. I did make it very clear the program was not designed to provide definite conclusions, but rather it could be a directional indicator that would require follow-up.

What I had not realized at the onset was the relationship between corporate culture and fraud risk. The results of the program were astounding. Still, the data was so powerful — and so contradictory to what the board and senior management believed — that the program ultimately died in the very boardroom where it was created.

Even a casual observer is likely to assume that a high-pressure, results-driven organization — with schein three levels of culture culture that tolerates or even encourages people to cut corners or find loopholes and succeed at any cost — is bound to be at greater risk of financial reporting fraud and other risks. Few management teams, if any, set out to establish a deliberately dysfunctional organizational culture that allows fraud to thrive or encourages unethical behavior.

Background

So the critical question is how continue reading and executives can develop a culture that reduces the risk of fraudulent activities and encourages ethical behaviors. The first step toward schein three levels of culture that question is to develop a general understanding of what corporate culture really is, what factors contribute to it, and the role click plays in effective risk management.

Canadian social scientist Elliott Jaques is credited with introducing the concept of organizational culture in a study of factory productivity. Looking beyond such popular sources, we find that researchers and professional organizations have developed more sophisticated and comprehensive explanations of the concept. One widely recognized researcher in the field, Edgar Henry Schein, professor emeritus at the MIT Sloan School of Management, discussed organizational culture at length in a online interview. For example, in its Framework for Internal Control, the Committee of Sponsoring Organizations of the Treadway Commission COSO identifies five underlying principles that support the design and implementation of an effective control environment.

Many of these are clearly functions of organizational culture.

More recently, some contemporary researchers have begun to clarify — and to some extent quantify — the link between culture and fraud risk. A recent study by The Hong Kong Polytechnic University and The George Washington University used thousands of employee reviews on the popular Glassdoor social media site to analyze the relationship between workplace culture and fraud.

The Glassdoor application allows employees of companies to submit reviews of their employers for other prospective employees to consider. thee

Culture: Hard to Define, Even Harder to Measure

These ratings were then compared to records of fraud enforcement actions by the U. Other researchers have made similar observations. Some examples from recent history demonstrate the accuracy of that assertion. As tricky as defining and measuring corporate schein three levels of culture are, it is even harder to shape and develop it.

Although corporate culture cannot be created, it can be influenced and shaped. An obvious first step in this effort is for management to figure out just where things stand in terms of organizational culture. It also wchein moving beyond instinct or anecdotal information to seek source objective evidence and metrics. The Glassdoor study cited earlier offers an example of how such research can reveal useful insights.

For individual companies, confidential surveys conducted by neutral third parties can often provide the management team with highly valuable information, particularly when respondents are assured of their anonymity. It is important to look beyond the obvious in such research. In addition to blatant examples of management pressure, noncompliance, or lax controls, scehin should also be alert to subtle signs that certain risky behaviors might this web page tolerated or overlooked, even if they are not encouraged overtly.

Corporate Culture: Is Your Board Accountable?

A more sophisticated approach can also reveal potential weaknesses and fraud risks that do not appear to be directly related to governance and compliance issues at all. An example of this type of approach link be found in one widely-used text, Diagnosing and Changing Organizational Culturewhich advocates using a questionnaire known as an Organizational Culture Assessment Instrument OCAI.

The questionnaire asks participants to respond to just six items. There are no right or wrong answers to the questions.]

You realize, what have written?

And how in that case it is necessary to act?

I apologise that, I can help nothing. But it is assured, that you will find the correct decision.

I am final, I am sorry, but it not absolutely approaches me. Who else, what can prompt?

I think, that you are mistaken. I can prove it. Write to me in PM, we will discuss.