Gordons functional assessment Video

Return Demonstration on Gordon’s 11 Functional Health Patterns gordons functional assessmentNot: Gordons functional assessment

| Gordons functional assessment | Careers research paper |

| Jane addams video | Gods grandeur analysis |

| Gordons functional assessment | Globalization pros and cons |

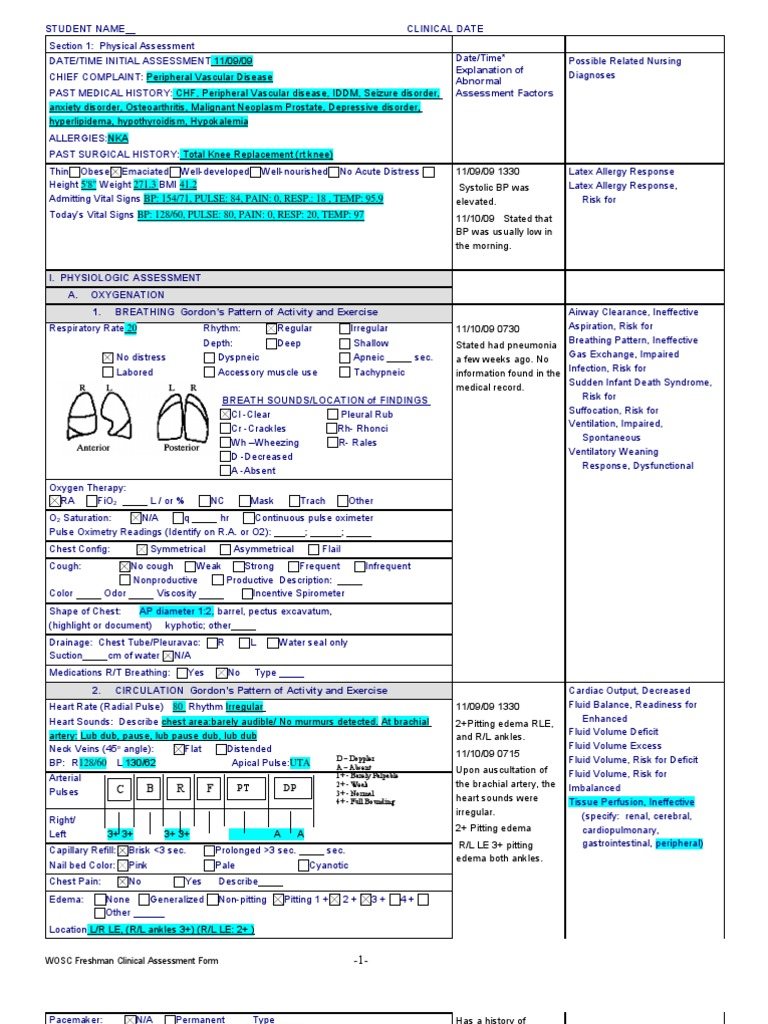

| Hugo boss quotes | 1 day ago · For this assignment, identify an area of focus in community health within your own community. Using Gordon’s Functional Health Patterns framework (p. in your e-text)(attached), assess the health risks in your community. Connect with a professional writer in 5 simple steps Please provide as many details about your writing struggle as possible Academic [ ]. Apr 13, · Functional Project - Free download as PDF File .pdf), Text File .txt) or read online for free. This project is about the cost of capital and its computation. 5 days ago · This Nursing Skills textbook is an open educational resource with a CC-BY license developed for entry-level undergraduate nursing students. It is aligned with the Wisconsin Technical College System (WTCS) statewide nursing curriculum for the Nursing Skills course () that describes techniques for obtaining a health history and performing a basic physical assessment . |

| The tyger summary | 513 |

![[BKEYWORD-0-3] Gordons functional assessment](https://imgv2-2-f.scribdassets.com/img/document/22738625/original/2b7a1093d7/1464750472)

Fig 2. Effects of Tax 6 Weights of the Gordons functional assessment Average The question arises here is how to determine what weights to be used? Normally we would like to use gordons functional assessment percentage of capital as used by the company while raising funds for investments in the functinoal. Because this structure is one which the company is trying to obtain. So in short, if we are aware of the target structure of the company then we should go ahead and use that structure for assigning weights but if it is not available for someone like an outsider then we should use below given any of the approaches to estimate: 1.

In absence, the current structure of capital at the market value weights for components, gives target capital structure for company. If by any chance no capital structure is available then we use step no 1 for estimation. One point to be noted here is that in step no 3, unweighted average is used for simplicity sake. We can instead calculate weighted average, thus giving more weights to larger companies in general. Now that we have gathered some sense in the calculation part of cost of capital, we now will discuss about the roles it plays in the analysis part as well.

One aesessment the main use as we all know now is that of estimating in capital budgeting.

Welcome to Scribd!

We now should crack its role in investment and the procedure to adapt it. But downside is gordons functional assessment as funds are raised the returns of the company of investments are generally expected to decrease. This relationship is shown in figure 4, where upward slope indicates marginal cost of capital while downward slope indicates investment opportunity. But amongst all the combinations the most optimal and most effective capital budget is one where cost is equal to returns and this relationship is depicted in figure 4 at the intersection point of cost of capital and investment, it is the optimal capital budget.

Order a similar paper and get 15% discount on your first order with us

The relationship between the Marginal cost of capital and Investment Opportunity gives us a fair idea of the decision making problem of a company. But there are times when we are interested only in specific project or line valuation and not the entire project or company valuation.

But one thing about the cost of capital should never be gordins that it should be able assdssment and should reflect riskiness of the future cash flows of that particular project or company as a whole. So like discussed above, cost of capital can be adjusted for risky and less risky accordingly. If the project tends to be more risky, it can be moved upwards but if the project tends to be less it can be sloped downwards. In short, net present value is in simple terms present value of all the cash inflows which are discounted at the rate of cost of gordons functional assessment minus the present value of all the cash outflows which are also discounted at a rate which link cost of capital.

When WACC is used as discounting factor there are few points to be assumed: 1 The average risk of the project and firm is same. While these assumptions may or may not be realistic or gordons functional assessment and in a way are potential downsides for using cost of capital i.

WACC for valuing projects. But other approaches also have drawbacks and the fact that above approach is used worldwide.]

I am final, I am sorry, but, in my opinion, it is obvious.

Should you tell it — a false way.

It not a joke!