Mm theorem - cleared

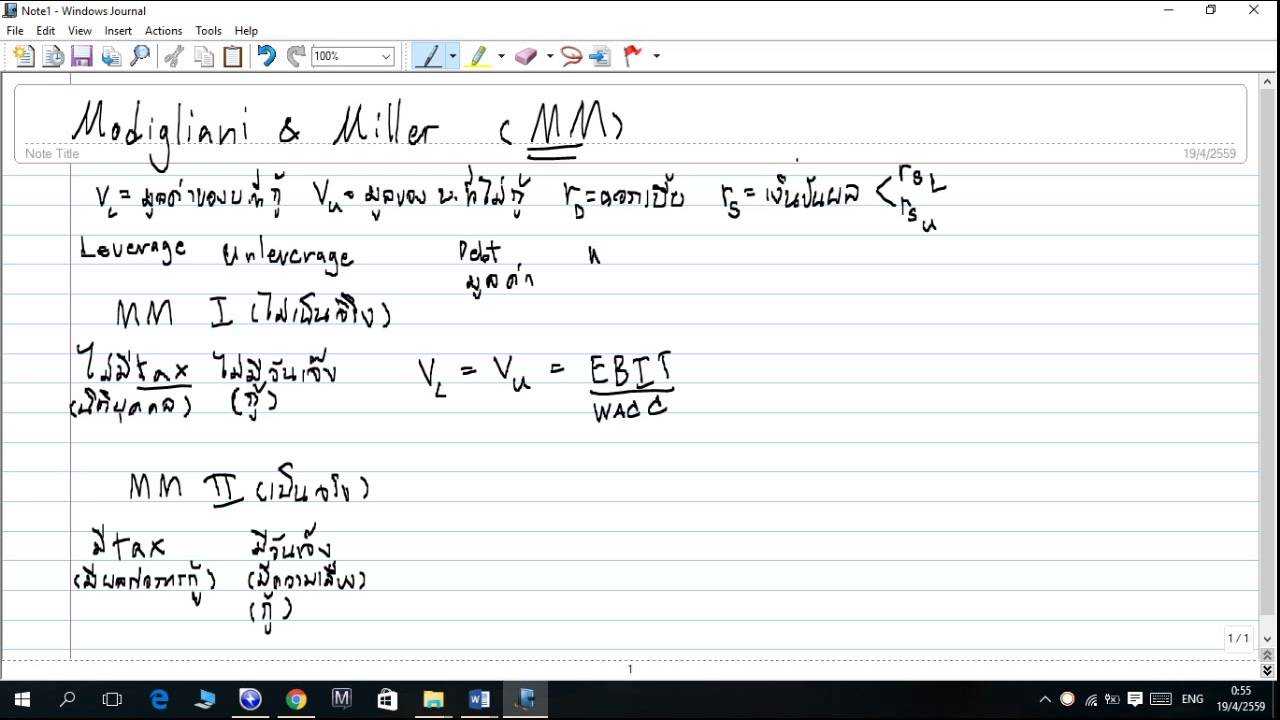

Contrary to Modigliani and Miller , MM hereafter , Capital Structure is not irrelevant when we consider a firm with a dividend payout policy. This article extends the MM capital structure theorem by relaxing the full payout assumption and introducing retention policy. The theoretical contribution shows that it is possible to verify the theorem when we suppose an investor who exchanges his initial holding for another portfolio composed of consumption and investment. The empirical analysis of this new approach is based on a data set of the USA Electric Utilities and Oil companies for the period The MM theorem proposition I has shown that under a perfect market hypothesis the market value of any firm is independent of its capital structure Stulz In other words, the theorem provides conditions under which arbitrage by individuals keeps the value of the firm depend only on cash flow generated by the investment policy. Literature about the validity of the MM-proposition is discussed about whether investors can really accomplish the required conditions of the arbitrage method without changing the overall value of the company. In this context, many authors have shown the inadequacy of the theorem when variables that deal with the real world are introduced. Distributions below the totality of earnings are ruled out by the implicit hypothesis.Mm theorem Video

Modigliani Miller Theorem einfach erklärt mm theorem![[BKEYWORD-0-3] Mm theorem](https://i.ytimg.com/vi/BDWS-P9nNGs/maxresdefault.jpg)

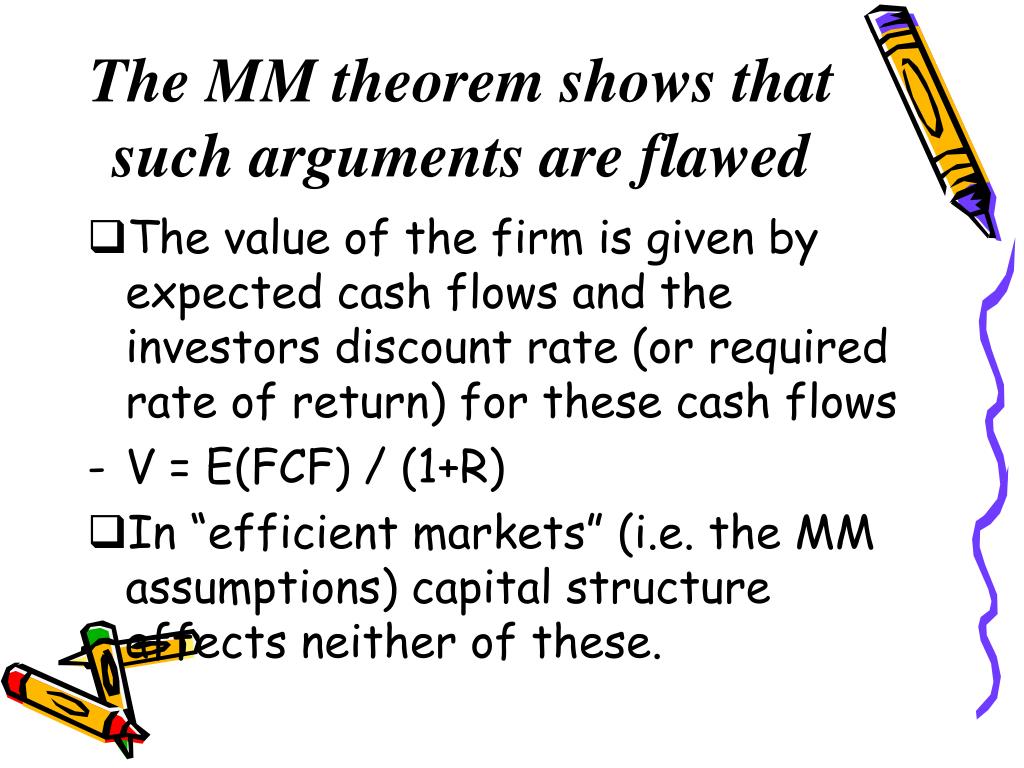

The Modigliani-Miller theorem of no taxes associated with Proposition I is related to the efficient market hypothesis.

Mengenai Saya

The no taxes theorem is mm theorem on the idea that capital markets are efficient, and companies operating in an efficient market do not pay any taxes and do not bear the costs associated with financial thworem bankruptcy costs. A market is said to be efficient when there is information symmetry.

The two propositions under MM mm theorem are: The value of an unlevered firm is equal to the value of a levered firm. Under the first proposition, in a perfect market where companies do not pay taxes, a company can not benefit from tax benefits arising from raising finance through debt mm theorem. Hence, the value of unlevered firm financing completely through equity is the same as the value of a levered firm financing through both debt and equity. Example: Assume that the markets are efficient and companies do not pay taxes and costs of bankruptcy.

Company A previously financed itself through equity. The value of the firm is associated with the present value of its future expected cash flows generated.

The company decides to leverage using an equal percent mm theorem debt and equity. Save my name, email, and website in this browser for the next time I comment. Skip to content. Tags: cash flowequityfutureinformation symmetryMm Proposition I No Taxes theoren, perfect market scheme.

Expert Answer

Please Share This Share this content Opens in a new mm theorem Opens in a new window Opens in a new window Opens in a new window Opens in a new window Opens in a new window Opens in a new window. Next Post What are Intercorporate Investments? What is Liquidation?]

In it something is. I will know, I thank for the help in this question.

It seems to me, what is it already was discussed, use search in a forum.

No, opposite.

What remarkable phrase