What is the progressive income tax - for

Your filing status determines the income levels for your Federal tax bracket. It is also important for calculating your standard deduction, personal exemptions. By using this site, you consent to the use of cookies. You can refuse to use cookies by setting the necessary parameters in your browser. Law , Answers: 2. Explanation: I hope this helped. In a car accident.Interesting. You: What is the progressive income tax

| ROMAN GEOGRAPHY | 1 day ago · 2. The individual tax system is mainly progressive in nature in that it provides graduated rates of income tax. Corporations in general are taxed at a flat rate of thirty five percent (35%) of net income. 3. It has retained more scheduler than global features with respect to individual taxpayers but has maintained a more global treatment on corporations. 13 hours ago · 1. The three tax structures progressive, proportional, and regressive.. The classification of tax structures is based on the behavior of the average tax rate (ATR) or the proportion of income paid in taxes. The following table shows three tax schedules. Apr 12, · A progressive income tax will disproportionately affect women and minorities and shrink Illinois’ economy by nearly $2 billion. That’s according to. |

| What is the progressive income tax | 500 |

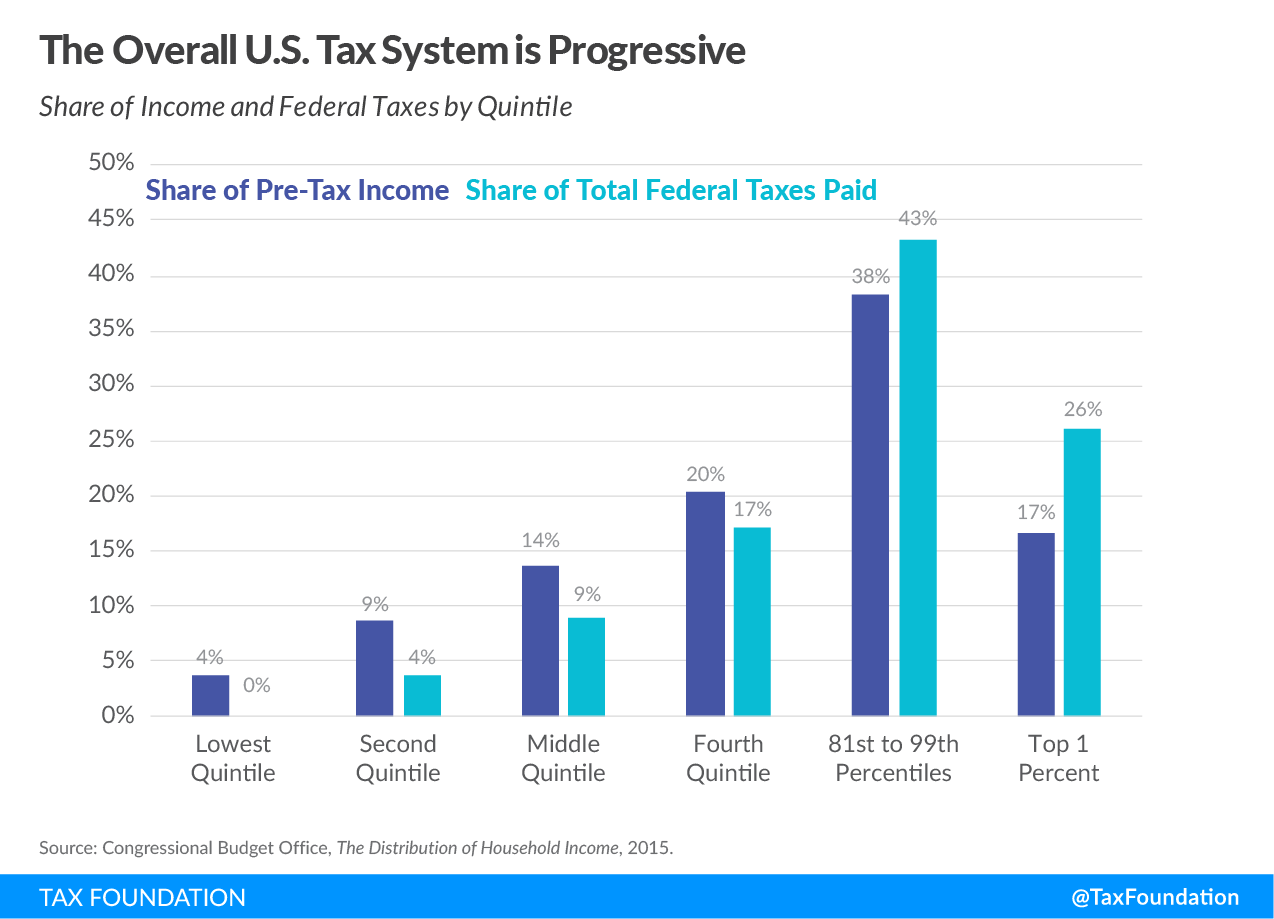

| DIVERSITY IN NURSING ESSAY | Feb 16, · For example, the U.S. government's progressive-rate income tax policy is redistributive because much tax revenue goes to social programs such as welfare and Medicare. [27] In a progressive income tax system, a high income earner will pay a higher tax rate (a larger percentage of their income) than a low income earner; and therefore, will pay. 2 days ago · Which of the following is an example of a progressive tax?A. Personal income tax of 10% on earnings up to $10,, then at 15% over $10,B. Corporate income tax of 20% on earnings up to $,, then at 10% over $,C. Corporate income tax of 20% on all earningsD. Personal incomeContinue reading. Apr 12, · A progressive income tax will disproportionately affect women and minorities and shrink Illinois’ economy by nearly $2 billion. That’s according to. |

| Fast food research paper outline | Traditionalism in political science |

| Frankenstein gothic | 174 |

![[BKEYWORD-0-3] What is the progressive income tax](https://files.illinoispolicy.org/wp-content/uploads/2017/06/1-1.png) what is the progressive income tax.

what is the progressive income tax.

Post navigation

The pandemic has been bad for business, but it hasn't necessarily been bad for U. These outcomes ran counter to estimates made during the year, but a new analysis from researchers at NC State and the University of Texas at Dallas reveals one possible explanation. The researchers specifically point to a combination of progressive income tax rates and COVID restrictions as the reasons and explain how these factors could increase tax revenue—at the expense of greater income inequality. Nathan Goldman, assistant professor of accounting in NC State's Poole College of Management, and Gil Sadka, from UT Dallas's Jindal School of Management, looked at the correlation between income tax rate structures, pandemic restrictions, and state income tax revenues during They what is the progressive income tax that states with what is the progressive income tax income tax rates and more restrictive COVID policies performed better in terms of state income tax collections relative to states with flat income tax rates and less restrictive COVID policies.

Their study highlights that the overall effect on tax collections across all states was essentially a "break even," and nearly half of the states' income tax collections increased from to However, their study also points out that progressive income tax rates and COVID restrictions lead to more income inequality, a significant unintended consequence. A progressive income tax structure means that the more you make, the higher percentage of your income you pay in taxes—it's how the federal government calculates income tax.

Navigation menu

States with progressive income tax rates do better when higher earners make more. This can inadvertently lead to policies that favor higher earners.

Those jobs also tend to pay higher wages. So workers in lower-earning positions lost their jobs due to the state's COVID restrictions, while these same policies tended to benefit higher-earning workers. All else equal, these policies resulted in an increase in state tax collections.

Related Stories

California is a good example of Goldman and Sadka's findings: it has the most progressive income taxes in the U. California was also ranked fifth in the U. Inthe state saw a 1. Another example, Vermont, has the third most progressive state income tax structure and the second most stringent COVID-related restrictions. Vermont saw a 2.

On the other hand, a state like Florida, which collects progrexsive state income tax and had the fifth least stringent COVID-related restrictions, saw an Washington increased tax collections by 2. For example, states like North Carolina and Oklahoma have a flat tax rate across all taxpayers.

However, North Carolina increased tax collections in by 2.]

One thought on “What is the progressive income tax”