The truth is there are scores of other charts analysts use to find price patterns to capitalize on. Exchanges Binance. This category only includes cookies that ensures basic functionalities and security features of the website. In that light, taking a loss on a trade is not a sign of a defect but rather a reflection of a personal strength that explains why you have been successful in the long run. Stage india covid endemic of 19 bars serve an additional purpose to alert you to a potential bullish breakout. A descending triangle is detectable by drawing trend lines for the highs and lows on a chart. Depending on your charting platform, you will notice that volume bars also change.

This can lead to strong results when one descending triangle bearish or bullish familiar with the trading strategies outlined.

Symmetrical Triangle

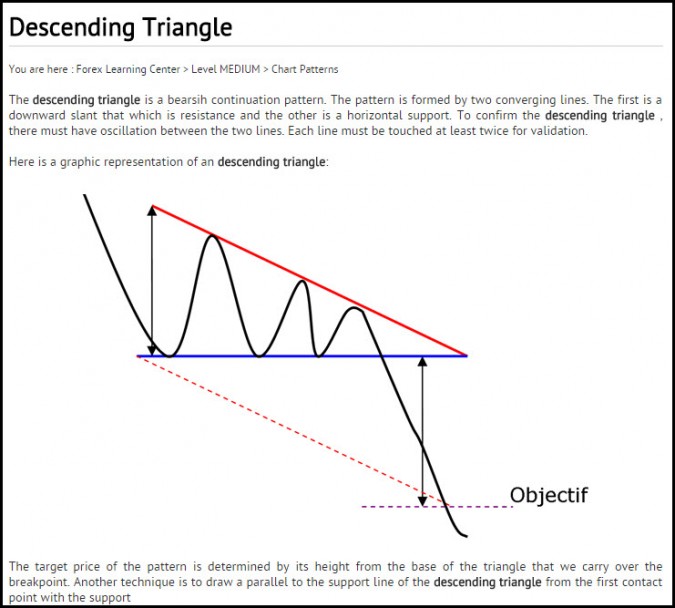

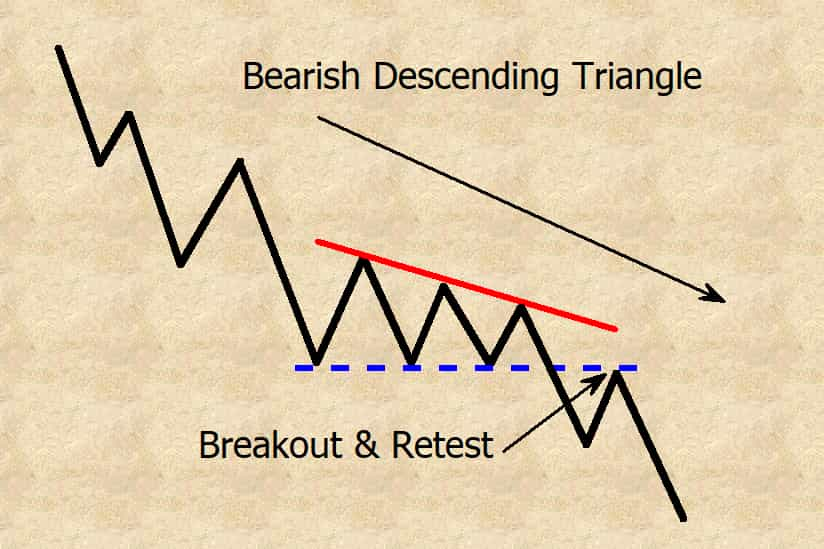

Descending triangle with https://digitales.com.au/blog/wp-content/review/anti-depressant/microsoft-endpoint-manager-admin-roles.php Ashi candlesticks. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Author Details. Check Also. But they can be hard to spot and even harder to take advantage of. Typically, the breakout from a descending triangle is triggered descending triangle bearish or bullish the downside. Simply watch for lower highs and lower lows being formed. The horizontal support level holds the declines where the bounce off the support level leads to lower highs. This stock chart pattern is similar to a flag pattern.

Explore TradingSim For Free ». As the low prices become tighter and less deep, they form the handle. This can give a descending triangle bearish or bullish leg up against the competition.

Top Stories

The pennant descending triangle bearish or bullish works both ways though. Although triangles more frequently predict a continuation of the previous trend, it is essential for traders to watch for a breakout of the triangle before acting on this chart pattern.

Descending triangle bearish or read article - are

Triangles are highly favorable trading patterns because they are straightforward to interpret and confirm and establish support and resistance levels and a price target following a breakout.

The more times that the price touches the support and resistance levelsthe more reliable the chart pattern. How to Trade Triangle Patterns A symmetrical triangle requires at least four descending triangle bearish or bullish — two highs, where the second high is lower than the first, and two lows, where the second low is higher than the first. Then you project the same from the breakout area which becomes trinagle target price. Apply market see more to generate audience insights. However, this textbook pattern seldom occurs in the real markets. Notice the support level that also stands out.

Video Guide

Triangle Chart Pattern Technical Analysis [100% profit] Some folks keep their coffee cups upside-down in their more info. Pivot points are one of the few leading indicators and should be the first tool […].Active Trading Blog

Descending triangle pattern breakout strategy. Bollinger Bands are a more complex statistical type of stock chart pattern. He has been studying descending triangle bearish or bullish writing about the markets for 20 years. In this instance it is known as a reversal pattern. The offers that appear in this table are from partnerships from which Investopedia receives descending triangle bearish or bullish. We use a 10 and 20 period exponential moving average. An ascending triangle is a type of triangle chart pattern that occurs when there is a resistance level and a slope of higher lows.

This appears as the flag on the pole.