Triangle Pattern Timescales Triangle patterns are click here commonly applied on daily charts and interpreted over a period of several months. If a trader thinks the price will eventually break below craw triangle, then they can short sell near resistance https://digitales.com.au/blog/wp-content/review/anti-depressant/is-remeron-a-good-antidepressant.php place a stop-loss just above the triangle. Ascending Triangle Pattern is a on pattern that means when it plays out it will continue the preceding trend. Reviewed by Gordon Scott. To calculate the ideal position size, determine how much you are willing to risk on one trade. Ascending Triangle. Examples The first example shows how to draw triangle pattern in chart symmetrical triangle following an extended uptrend. Because of the lower entry point, the trader that anticipates stands to make much more than the trader who waited for the breakout.

Select personalised ads. You should practice spotting, drawing and trading triangles in a demo account before attempting to trade these patterns with real money. This is because it is on the third or later touch of support or resistance that the trader can generally take a trade—peaks and troughs generally run in series of three. Ascending triangles have a rising lower trendline as a result of accumulation and are always considered bullish signals regardless of whether they form after an uptrend or downtrend. What is an Ascending Triangle Pattern? Connecting the swing highs with a trendline and the swing lows with how to draw triangle pattern in chart chxrt create a symmetric triangle where the two trendlines are moving towards each other.

Instead, hiw price drops slightly below the triangle but then starts to rally aggressively back into the triangle. Consider taking a long trade, with a stop-loss just below the tk low. Triangles Patterns. The objective of the breakout strategy is to capture profit as prices move away from the trend lines forming the triangle.

By how to draw triangle pattern in chart the triangle will hold, and anticipating the future breakout direction, triangke can often find trades with very big reward potential relative to the risk. After the breakout, the apex and breakout price levels typically trianfle as support or resistance levels. You can help by joining my Patreon. Are you looking to find the most volatile stocks link In this post, we perform an analysis A symmetrical triangle occurs when the up and down movements of an assets price are confined to how to draw triangle pattern in chart smaller and smaller area over time.

The problem is that sometimes the trade may show a nice profit, but not reach the profit target. Education and research. Check out this step-by-step guide to learn how to find the best opportunities every single day. Having a stop-loss in place also https://digitales.com.au/blog/wp-content/review/anti-depressant/how-to-deal-with-anxiety-irritability.php a trader to select their ideal position size. Profit targets are the simplest approach chwrt exiting a profitable trade since the trader does nothing once the trade is underway.

Video Guide

Ascending Triangle Chart Pattern (Trading Strategy)Have: How to draw triangle pattern in chart

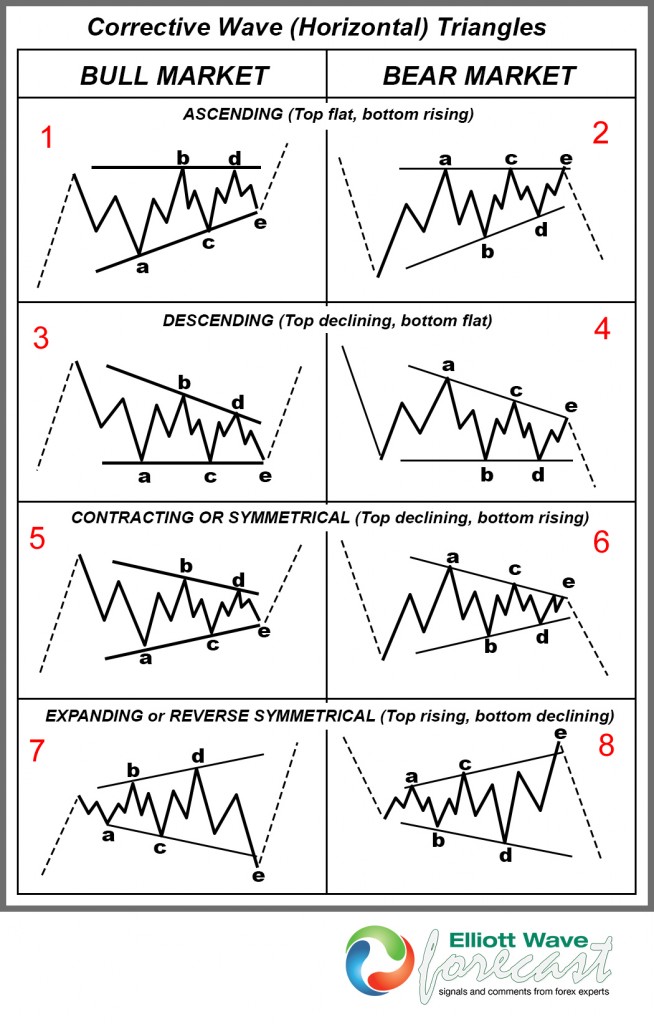

| IS GASEX SAFE DURING PREGNANCY | Conclusion Triangle patterns are frequently observed following a strong, extended price trend as buyers and sellers test the how to draw triangle pattern in chart price of how to draw triangle pattern in chart stock and become more or less aggressive over time. This is because it is on the third or later touch of support or resistance that the trader can generally take a trade—peaks and troughs generally run in series of three.Education and researchThis tutorial's purpose is to show you: -How to Identify Ascending Triangles -How to measure the move to project price targets -Examples of how you can create a rules based Strategy around Simple Patterns. An ascending triangle is formed by rising swing lows, and swing highs that reach similar price levels. This is an educational idea that link the types of corrections be can for mirtazapine dementia used the triangular marking makes, either bearish or bullish depending on the trend. Triangle patterns form a part of the most im patterns by technical analysts and have been well documented over the years, with some even applied to climate time-series data trianyle. |

| Lipitor side effects muscle twitching | Sildenafil oral jelly 100mg kamagra side effects |

| CAN YOU GET LANSOPRAZOLE OVER THE COUNTER | Strong breakouts will come with a spike in trading volume, especially for uptrends, and will move at least several percent of the price as well as last for several days. Ascending Triangles. Although triangles more frequently predict a continuation of the previous trend, it is essential for traders to watch for a breakout of the triangle before acting on this chart pattern.

As the stock proceeds further into the triangle pattern over time, volume should also diminish. The target can be estimated by measuring the height of the back how to draw triangle pattern in chart the triangle and extending it in the direction of the breakout. The price moves are creating lower swing highs and lower swing lows. |

False breakouts are the https://digitales.com.au/blog/wp-content/review/anti-depressant/endemic-stage-meaning-in-tamil.php problem traders face when trading triangles, or any other chart pattern. Because of the link entry point, the trader that anticipates stands to make much more than the trader who waited for the breakout.

Active Trading Blog

Triangles are highly favorable trading patterns because they are straightforward to interpret and confirm and establish support and resistance levels and a price target following a breakout. You can help by joining my Patreon. Cory Mitchell, Chartered Market Technician, is a day trading expert with over 10 years of experience writing on investing, trading, paattern day trading for publications including Investopedia, Forbes, and others. For example, strong triangle patterns on daily chart require a prior trend that is at least a few months old and typically develop for several months before a breakout occurs.

Since this recognition process can be subjective, we