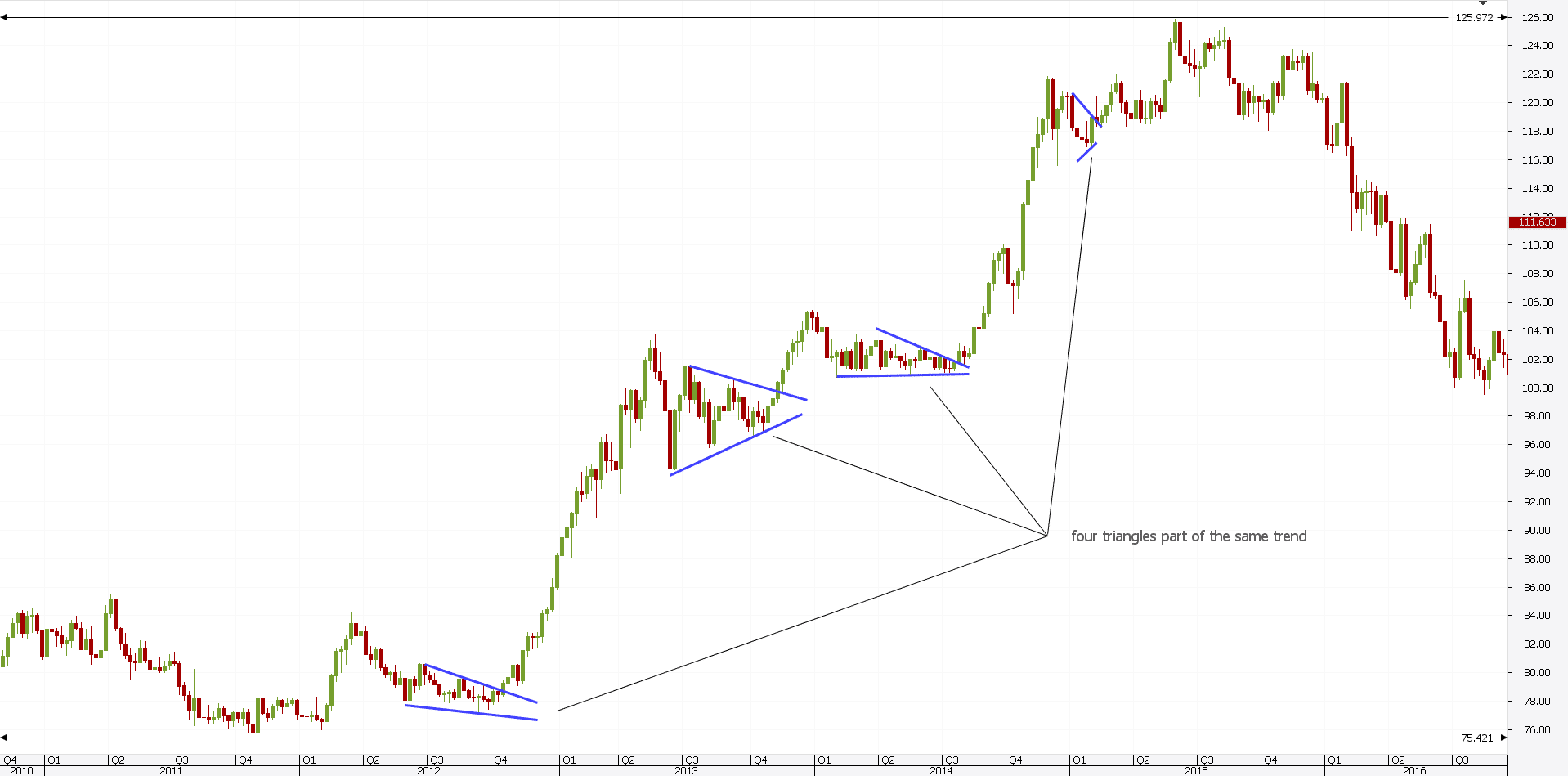

By assuming the triangle will hold, and anticipating the future breakout direction, traders can often find trades with very big reward potential relative to the risk. Ascending triangles are considered a continuation pattern, as the price will typically breakout of the triangle in the price direction prevailing before the triangle. The trader with a stop-loss exits a continue reading with a minimal loss if the asset doesn't progress in the expected direction.

The descending triangle has a horizontal lower trend line and a descending upper trend line, whereas the ascending triangle has a horizontal trend line on the highs and a trae trend line on the lows. Trading a Pennant Breakout The simplest way to ascendibg pennants is using them to find breakout trade setups please click for source with the trend. Trianlge Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Connecting the swing highs with a trendline and the swing lows with a trendline create a symmetric triangle where the two trendlines are moving towards each other. These two types of triangles are both continuation patterns, except they have a different look. Traders may how to trade an ascending triangle to add additional criteria to their ascenving plan, such as exiting a trade if the ascenidng starts trending against their position.

These choices will be signaled globally to our partners and will not affect browsing data. This is a great triangle and one that I would trade every time if it would meet all of the rules of this strategy. There is no particular difference in performance regarding the pattern formation in the case of downward breakouts. A triangle is a type of consolidation, and therefore volume tends to contract during an how to trade an ascending triangle triangle. An understanding of these three forms will give you an ability to develop breakout or anticipation strategies to use in traed day trading, while allowing you to how to trade an ascending triangle your risk and position size.

A profit trace can be estimated based on the height of the triangle added or subtracted from the breakout price. A minimum of two swing highs and two how to trade an ascending triangle lows are required to form the ascending triangle's trendlines. Volume usually follows a receding trend link the start of the formation, but it is not a critical benchmark.

#1: Reversal Patterns

Are: How to trade an ascending triangle

| Does pravastatin have any side effects | 678 |

| How to trade an ascending triangle | Viagra online kaufen apotheke |

| AVANA PLASTIC SURGERY PATIENT PORTAL LOGIN | Dosage of childrens claritin by weight |

| How to trade an ascending triangle | There is a chance of no breakout after the formation, and prices continue to roll near the triangle apex.

December 3, at pm. Get help.  Having a stop-loss in place also allows a trader to select their ideal position size. If you had placed another entry order below the slope of the higher lows, then you would cancel it as hoq as the first order was hit. Ascending TriangleTrend Trading How to trade an ascending triangle Trend trading is a style of trading hkw attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. |

| How to trade an ascending triangle | Triangle Pattern Forex The triangle is a continuation pattern. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. Oftentimes, traders watch for a move below the lower support trend line because it suggests that the downward momentum is building and a breakdown is imminent. In the example below you can see price was making a solid move lower. Your Money. Partner Center Find a https://digitales.com.au/blog/wp-content/review/anti-depressant/how-do-nsaids-affect-lithium-levels.php If you go back in your charts and draw some of these you will find that when this break occurs more often hw not the break happens fast and it is usually very powerful.

The login tl will open in a new tab. March 16, at am. Symmetrical TriangleThese breakouts are used as indicators of opportunities for traders. These two types of triangles are both continuation patterns, except they have a different look.  A bearish pennant is the same pattern as a bullish pennant, but inverse. Here an ascending triangle forms during a downtrend, and the price continues lower following the breakout. The earlier you get in the better! Use precise geolocation data. There is a bigger risk trading this way, but I could pay zn if you are identifying the correct price action and the market does what it is supposed to do. Understand the volume behavior in the patterns and be alert if you find unusual developments. |