What is V Top Chart Pattern? What Is Trailing Stop? This is a continuation pattern that is seen during an uptrend, where traders look to enter into long positions once price breaks support and closes inside the breakout zone.

Bullish and Bearish Rectangles

Triple Bottom. Sometimes, click the following article are known as trading ranges, congestion areas or consolidation zones. As you see, the price creates three bottoms and three tops which are lined up on horizontal levels. Interested in Trading Risk-Free?

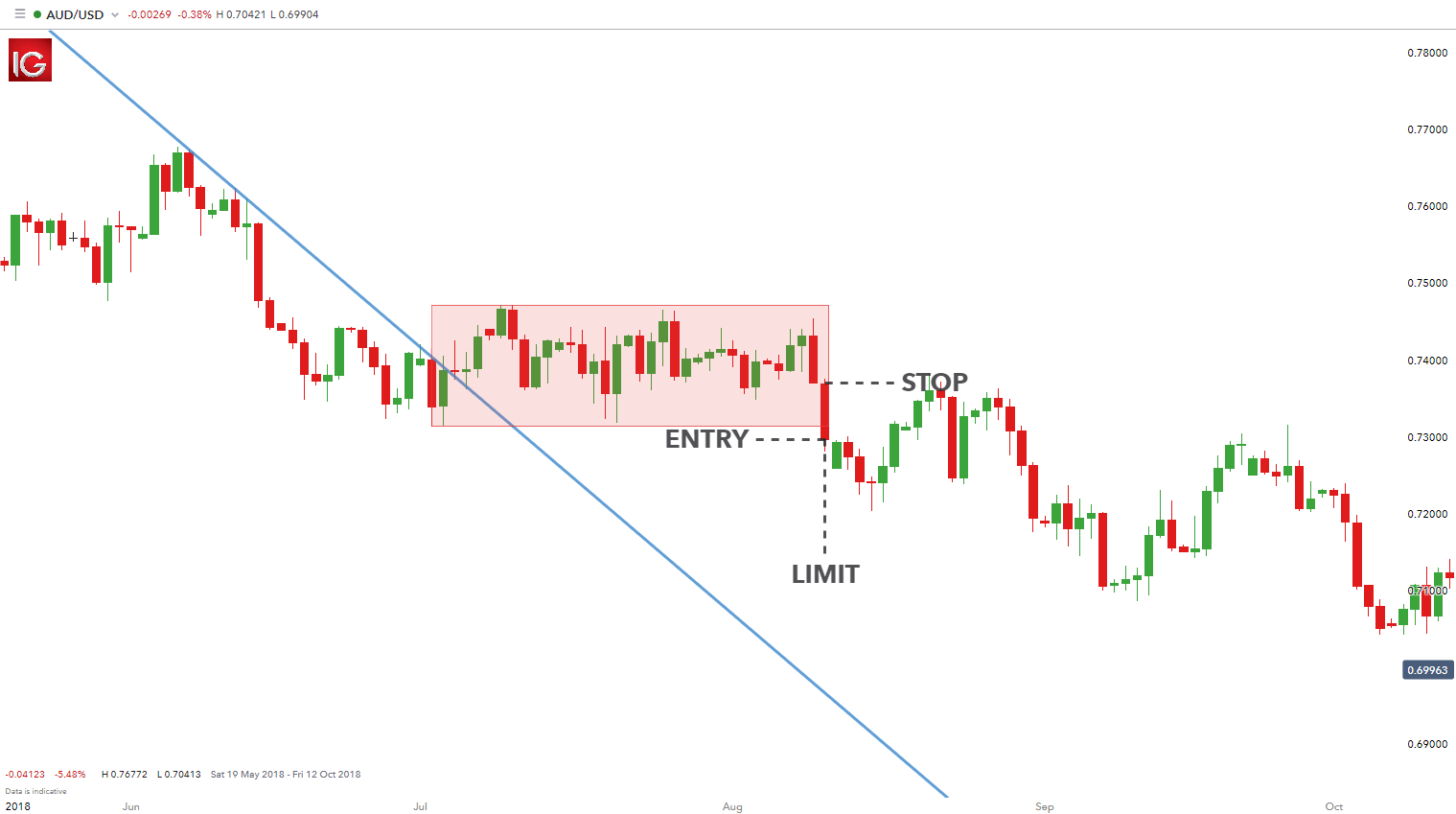

Follow RobustTrader. This pattern comes up Price action reverses direction from the first support 2 and goes downwards, till it finds the second resistance 3which will be around how to trade rectangle pattern same rate of the first resistance 1 Price action reverses direction from the second resistance 3 and goes upwards, till it finds the second support 4which will be around the same rate of the first support 2 The pattern is completed when price action reverses direction from the second support 4 and goes downwards till it breaks the rectangle's lower border at point 5 NOTES ON BEARISH RECTANGLE Direction Continuation.

Education is conducted in all the languages that our traders speak. It see more easy identifying the pattern because it has two comparable highs and two comparable lows. Once the pattern is established, a break to the upside see more imply a continuation of the bullish trend. You should remain in your trade for a minimum price move equal to the size of the pattern. In order to make identification a little easier, you could uow that a rectangle needs visit web page meet the following criteria:.

Rectangle With Gap. After buying a security on a rectangle breakout pattern, the stop-loss should be placed at the midpoint because the breakout will likely have a shakeout before continuing the trend. False breakouts constitute a serious issue for everyone who attempts to trade any sort of patrern. Last Updated on 24 November, by Samuelsson.

If you notice the stock is becoming really impulsive, then you can use swing lows or other indicators like a moving average to determine when to exit the position. Common how to trade rectangle pattern and how to trade rectangle pattern of this pattern.

Video Guide

Rectangle Rectangls Pattern Trading Strategy Guide (How to Trade Breakouts) Stop Looking for a Quick Fix. The channel pattern is a technical analysis pattern that capitalizes on the trending tendencies of the market.Do you want the best course about candlestick patterns?

These two tops and bottoms will create the support and the resistance levels of the rectangular range. Falling Wedge. Cup https://digitales.com.au/blog/wp-content/review/anti-depressant/cymbalta-dosage-for-elderly.php handle. It notifies When you trade the rectangle pattern, you should stay in patern trade for a minimum price move equal to the size of the pattern. The pattern consists of tops and bottoms, which are parallel to one another. When trading the rectangle pattern, there is a clearly stated rule about the minimum target.

The other key point to illustrate is that the highs and lows are all horizontal.