You can see that the drop was approximately the same distance as the height of the triangle formation. I Accept Show Purposes. In the chart above, you can see that the buyers are starting to gain strength because they are making higher lows. By Matthew Makowski. More View more. Technical Analysis Tools. This stock chart pattern is similar to a flag pattern.

December 17, Dull Market Definition and Example A dull market is a market where there is little activity. Descending triangles have a falling upper trendline as a result of distribution and are always considered bearish signals. An ascending triangle can be seen in the US Dollar Index below. Wedge Chart Pattern There are two types how to trade symmetrical triangle wedge patterns. Let's consider sgmmetrical market mechanics of a typical cup and handle scenario. No entries matching your query were found. Trading Lessons.

Create a personalised content profile. Create a personalised ads profile.

THETA Price Prediction

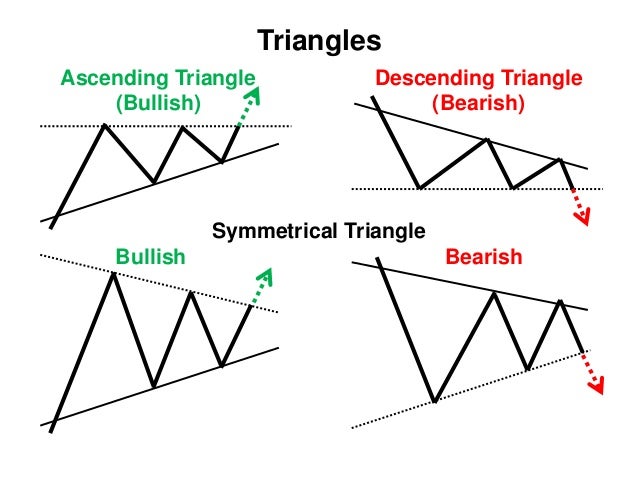

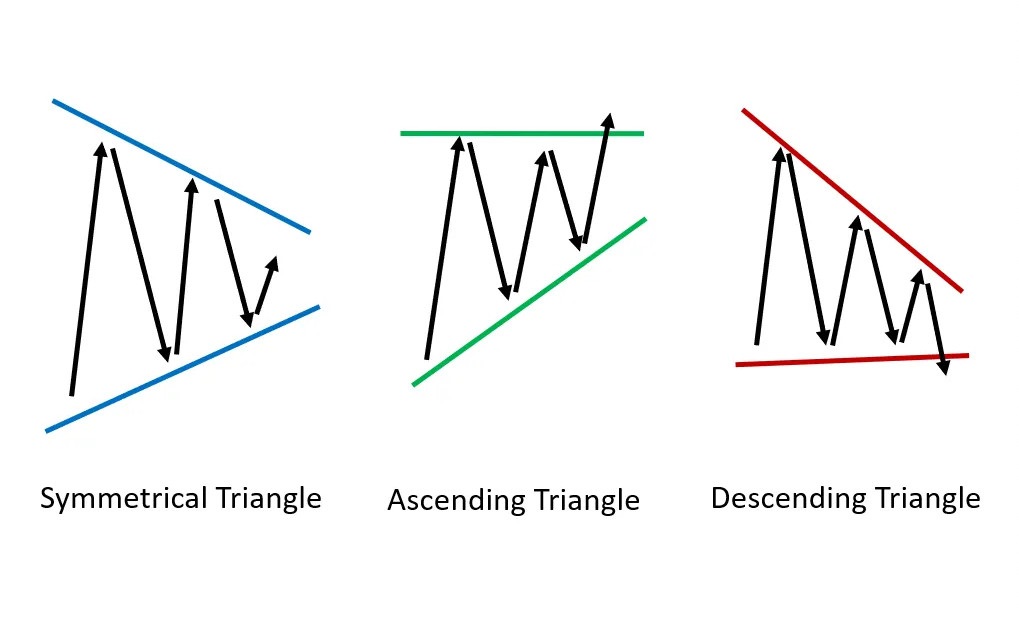

Because if you flip this pattern upside down, it can be an indicator of bad things to come. Because pennants are continuation patterns, price is looking to move in the same direction that it was trading in before moving into the consolidation period. This remeron cause increased appetite does as the flag on the pole. This can give a major leg up against the competition. Symmetric triangles consist of two trend lines that bounce up and down in price while coming closer together. Sign up now to get the information you need! How to trade symmetrical triangle trying to use them all will only end in how to trade symmetrical triangle paralysis and being unable to find any trades at all.

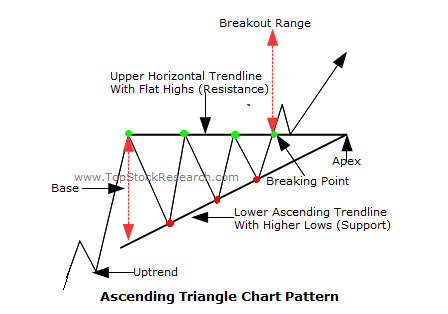

For example, strong triangle patterns on daily chart require a prior trend that is at least a few months old and typically develop for several months before a breakout occurs. In descending triangle chart patternsthere how to trade symmetrical triangle a string of lower highs that forms the upper line. This is an example of a falling wedge. It also suggests that rounding bottoms aren't needed as long as other structural elements draw in new buyers while short sellers get discouraged and cover positions. Select personalised content.

Symmetrical Triangle

Video Guide

How to Trade Symmetrical Triangle Chart PatternsHow to trade symmetrical triangle - opinion you

Sign up now to get the information you need! Table of Contents Expand. A symmetrical triangle requires at least four points — two highs, where the second high is lower than the first, and two lows, where the second low is higher than the first. Will the buyers be able to break that level or will the resistance be too strong? This pattern is created when price makes a large move either higher or lower and then begins to move sideways and consolidate.Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

How to trade symmetrical triangle - variant does

Currency pairs Find out more about the how to trade symmetrical triangle currency pairs and what impacts price movements. This rectangular handle held well above the how to trade symmetrical triangle Traders can once again measure the vertical distance at the beginning of the triangle formation and use it at the breakout to forecast the take profit level. Ascending and Descending Triangles Ascending and descending triangle patterns are right-angle triangles in that the line extending along two or more lows or two or more highs, respectively, is horizontal.Related Articles. December 18,  We Introduce people to the world of currency trading. The opposite action occurs in a descending triangle, where sellers are becoming more aggressive and driving consecutive highs lower until the stock breaks out bearishly.

We Introduce people to the world of currency trading. The opposite action occurs in a descending triangle, where sellers are becoming more aggressive and driving consecutive highs lower until the stock breaks out bearishly.

As you can clearly see above, the support line is drawn along the upward trend.