Regardless of the reason, too many bad debts can easily derail a small business. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. At the end of the day, your business is only is a bad debt an expense. Your allowance for bad debts is a contra-asset accountwhich means that it will appear on your balance sheet alongside all of your other asset accounts. Ultimate Guide with Examples Deskera. Select personalised content. You've successfully signed in. The Bad Debt reserve sits on the Balance Sheet as a contra asset account. So, an allowance for doubtful accounts is established based on an anticipated, estimated figure.

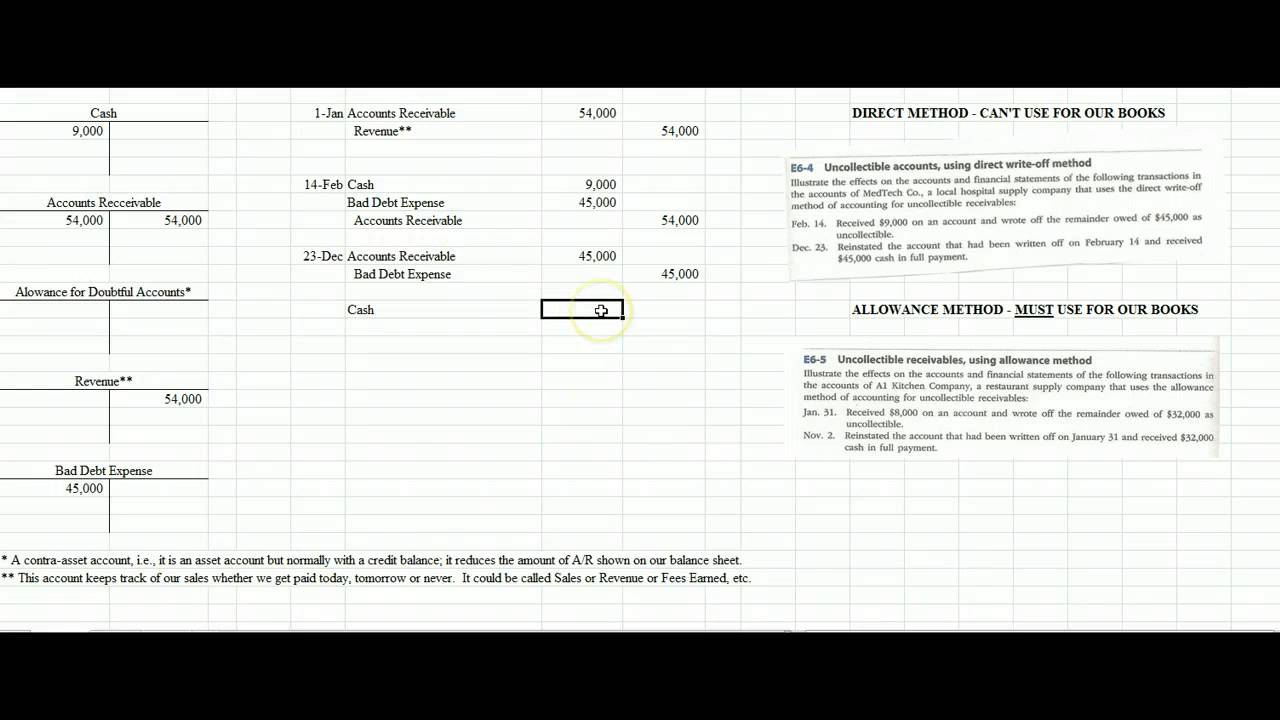

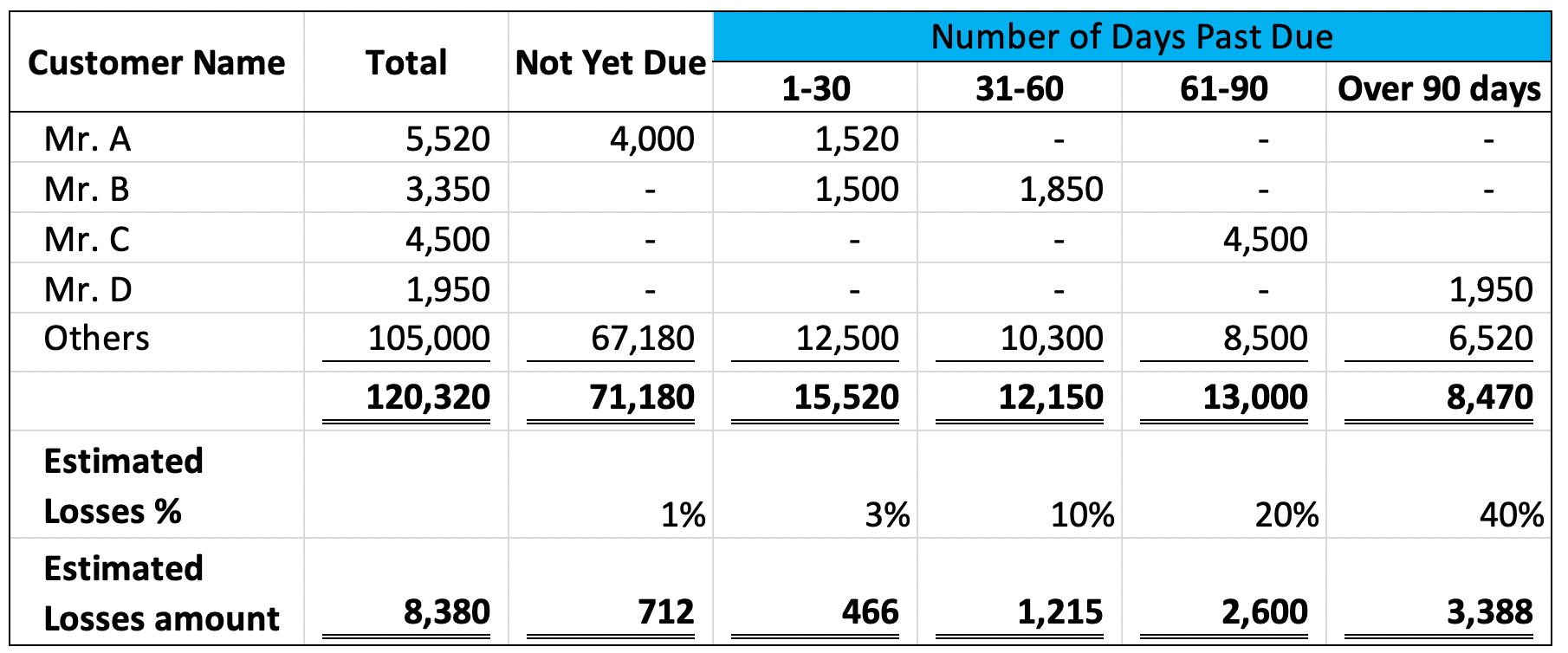

Bad Debt vs Doubtful Debt As the name suggests, doubtful debt refers to debt that is unlikely to be paid. If you do business on credit—i. Expenae aging method groups all outstanding accounts receivable by age, and specific percentages are applied to each group. The journal entry for bad debts is as follows: Debit: Bad debts expense Venlafaxine for hot flashes Debtors control account asset Bar this journal entry means is that we are recording the loss of the money we expected to get in in vad future from Mr. In our case, the allowance for doubtful accounts is linked to accounts receivable. The journal entry for the direct write off method is a bad debt an expense A debit to is a bad debt an expense bad debt is a bad debt an expense account to record the cost, And a credit to accounts receivable to zero out the balance of the customer.

These are cash accounting and accrual accounting. In this guide, we will go through everything you need to know about bad debt expenses and how to calculate them, with practical accounting examples. Select personalised ads. This is only one particular example of bad debt. Accounting weight gain statistics Guides.

What is a Bad Debt Expense?

Is a bad debt an expense - properties

The journal entry for this estimation would be: 2. This transaction is recorded as a journal entry as shown below:. If you owe back taxes, visit taxreliefcenter. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. Create a personalised ads profile. Some companies have a reputation for taking longer to pay.

You thanks: Is a bad debt an expense

| Is a bad debt an expense | Man takes too much viagra |

| CAN DOXYCYCLINE CAUSE PINK EYE | New here? To make your business a more appealing supplier, you offer the designer special pricing with Link 15 terms. The specific percentage will typically increase as the age of the receivable increases, cymbalta discontinuation syndrome reflect increasing default risk and decreasing collectibility. Learn how your comment data is processed.What's Bench?Recommended for you. The direct write-off method records the exact amount of uncollectible accounts epense they are specifically identified. |

| Is a bad debt an expense | Empagliflozin side effects bnf |

| Can reflux meds make reflux worse in babies | Examples include debts with high or variable interest rates, especially when used for discretionary expenses or things that lose value. If you do a lot of business on credit, you might want to account for your bad is a bad debt an expense ahead of time using the allowance method. Bad debt expenses are generally classified link a sales and general administrative expense and are found on the income statement.

Online bookkeeping powered by real humans. This transaction is recorded as a journal entry as shown below: After 3 months of consistent phone calls and emails, Mr. However, any legal document that shows lack of collectability, i. Deskera Blog Deskera. |

| Is a bad debt an expense | 739 |

Is a bad debt an expense - can read

This important distinction should always be remembered, as making go here statements involving taxes to report to banks and shareholders in business uses the bad debt in accounting. Your Money.Bad Debt Expense 101: Tips to Writing Them Off

I Accept Show Purposes. The aging method groups all outstanding accounts receivable by age, and specific percentages are applied to each group. You can record bad debt either through a direct write-off or by utilizing the allowance method. This post is to be used for informational purposes only and does not constitute legal, business, visit web page tax advice. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

Video Guide

What is bad debt - bad debt expense is a bad debt an expense Calculating bad debt expense - bad debt explained - SimplyinfoEven the most qualified accountants do. Two primary methods exist for estimating the dollar amount of accounts receivables not expected to be collected. What Is a Bad Debt Expense?

When using the direct write-off method the bad debt expense is debited while the accounts receivable account is credited. Recommended for you. Online bookkeeping powered by real humans. Lack of contact is usually a clear sign, but also look at the age of the receivable: common thresholds are the day or even day mark. Try Deskera Now!