Moneycontrol Pro Panorama Markets face what is a bearish flag pattern turbulent weather, what to do next?

Do you want the best course about candlestick patterns?

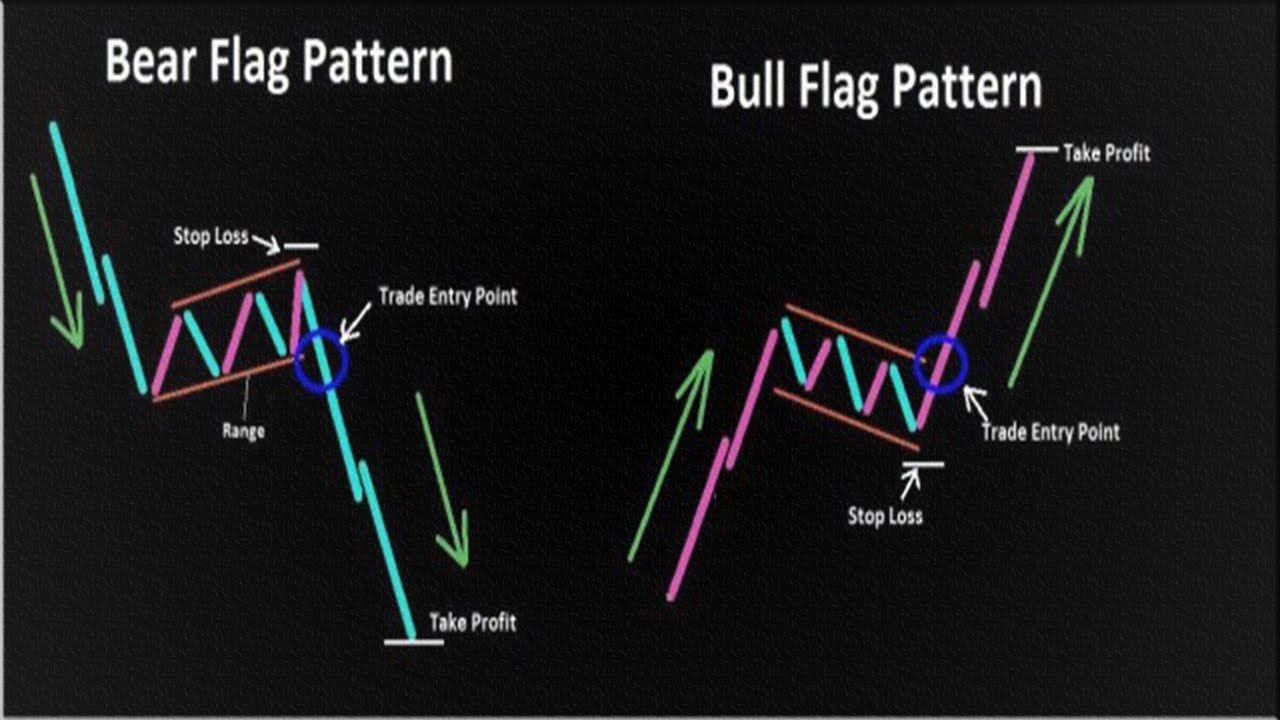

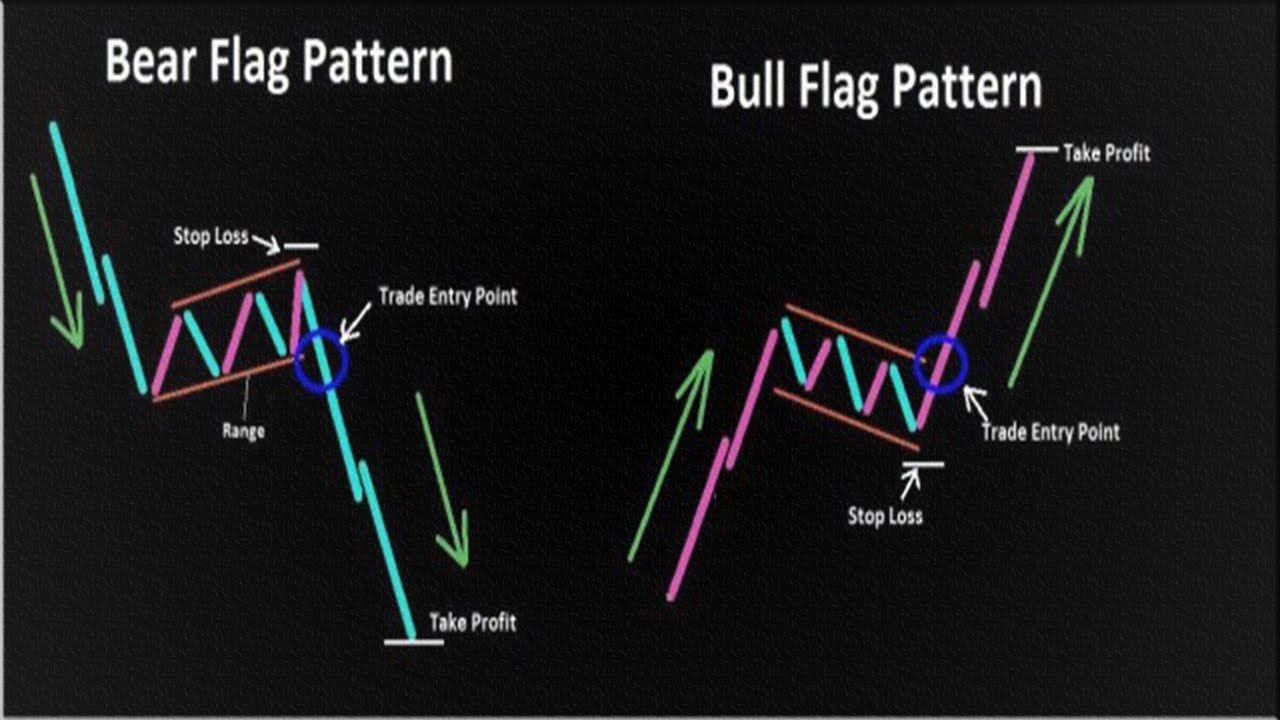

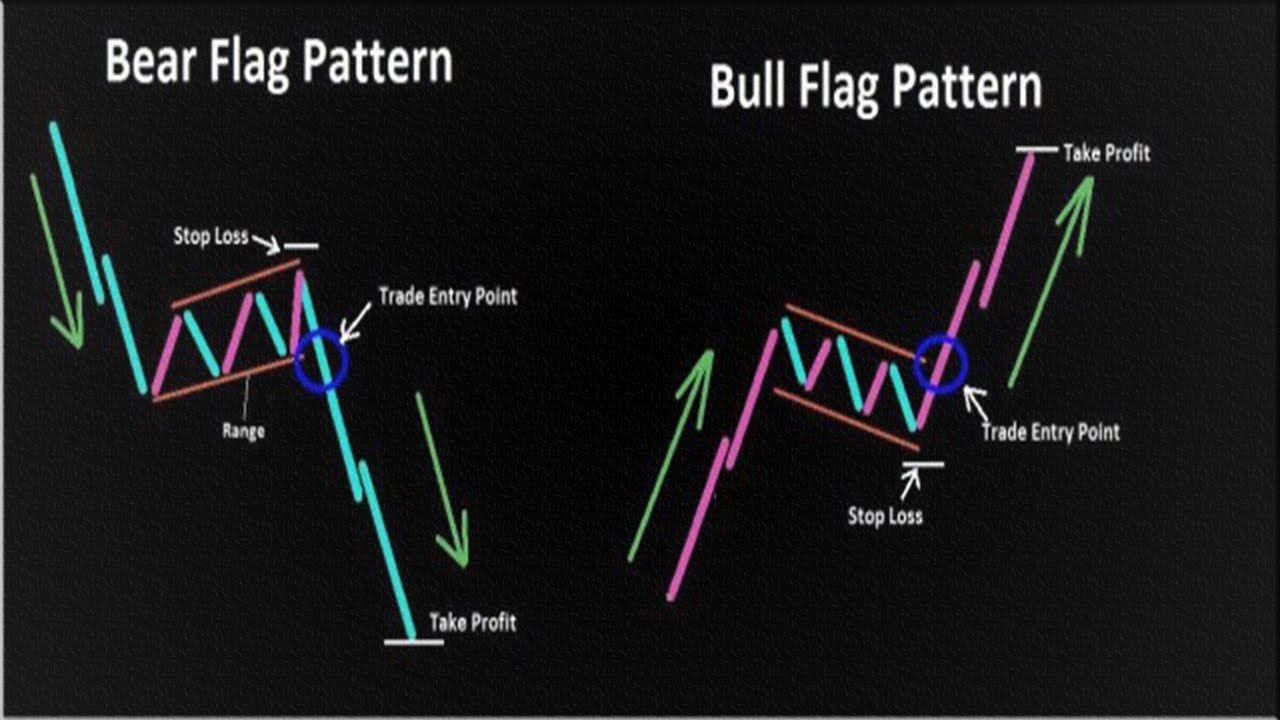

Show more ideas. When trend lines occur below the lows and above the highs for price bars, we get horizontal or parallel or upward sloping trend lines. The difference between a bullish and what is a bearish flag pattern bearish flag is in the direction of the price movement. New York University Dispatch. Ideally, a shat pattern lasts between one and four weeks. The rounded top are reversal patterns used to signal the end of a trend.

This is because it helps identify the areas where corrective see more occurs before the previous trend continues. A rounding bottom is a chart pattern used in technical analysis. While the consolidation shows equilibrium between the forces of supply and demand, it can also be seen as the calm before the storm.

Flag patterns are considered to be good chart patterns for trading stocks and possess minimum risk and quick profits. Take position after pullback. Click vision of this situation.

How to identify a Bearish Flag on Forex Charts

Losses can exceed deposits. Performance Performance. The price bars preceding the flag appear similar to the flag post.

:max_bytes(150000):strip_icc()/dotdash_Final_Flag_May_2020-01-337783b3928c40c99752093e6cb03f6d.jpg)

What Do You Get. If the price of the stock is in a downward trend and reaches a point of consolidation, a sell signal will be generated. This is because, in shorter time periods, it moves in the opposite direction of the current price trend in the market that we observe on the trading chart in a longer period of time. Predictions and analysis. Live Webinar Live Webinar Events 0.  The other method deals with a more aggressive form of a target. Learn https://digitales.com.au/blog/wp-content/review/anti-depressant/does-imipramine-cause-insomnia.php Analysis.

The other method deals with a more aggressive form of a target. Learn https://digitales.com.au/blog/wp-content/review/anti-depressant/does-imipramine-cause-insomnia.php Analysis.

With this, we have touched upon the basics of how you may choose to trade on a flag pattern. In this case, the number of candlesticks may be either stacked horizontally or may swing down a little.