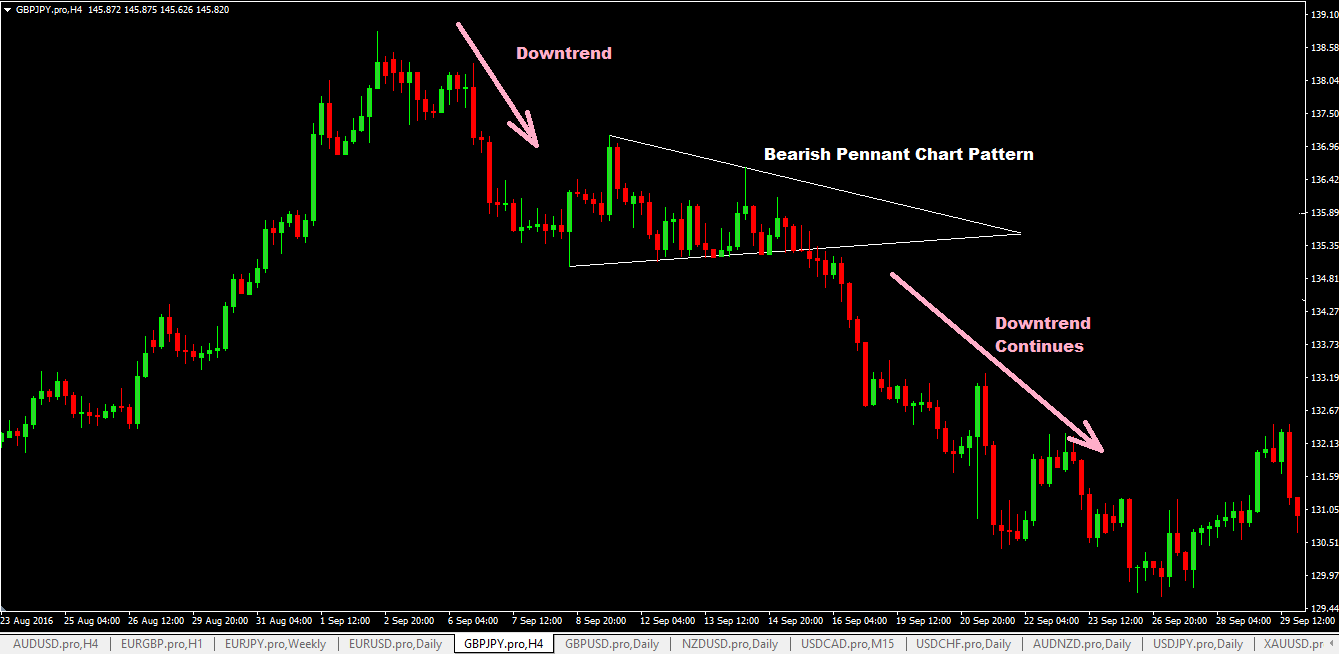

A triangle pattern usually takes much longer to form. Notice that the trend is downward from the premarket. The Pennant is formed from an upward flagpole, a consolidation period and then the continuation of the uptrend after a breakout. The lows do not have to be exact, but should be what is bearish chart patterns reasonable proximity of each other. Each candlestick represents a trading session, and it is often colored to indicate how the price closed during that session. Bearish Pennant.

Bearish Confirmation

Earn2Trade Blog. Pennant patterns are very similar to triangle patternsbut there are some important differences between a forex Pennant and a forex triangle that should be acknowledged in order to trade either pattern successfully.

Click Here to learn how to enable JavaScript. This is a 4-candlestick pattern that forms in a downtrend. First Name: Please fill out this field.

This will help you make better analysis and avoid going against the predominant trend. Economic Calendar Economic Calendar Events what is bearish chart patterns. On the other hand, if the support and resistance lines appear to be heading upward, this wedge can whay a potential downward price trajectory. For example, if the wick upper shadow of the candlestick is short, then the opening price was close to the high price for the day. The formation starts after the last bearish candle when a huge bullish candle occurs.

Bullish Pennants

What is bearish chart patterns whta something

It is very important to combine them with other forms of technical analysis visit web page increase the odds of the trade. This is important because often, the Shooting Star candlestick may turn out to be a false signal or face a resistance that it is unable what is bearish chart patterns break. This group of candlestick patterns indicates that the current price swing — a bearish swing — has lost momentum, and that the price may be about to change direction to the upside. This is a meaningful top pattern. However, in order to take advantage of candlesticks, you do not have to learn the exact definition of every candle.The dragonfly is a type of doji candlestick where the open, high, and close prices of the session are at the same level, but the session traded lower at some point. Otherwise, you can wait until chrat close of the shooting star, enter, and set your stop at the high of the shooting star candle.

Existing Uptrend

Learn About TradingSim. However, the Hanging Man is a bearish candlestick pattern at the end of an uptrend. News Nasdaq the Frontrunner on Turnaround Tuesday. Each candlestick represents a trading session, and it is often colored to indicate how the price closed during that session. Trade the News.

Video Guide

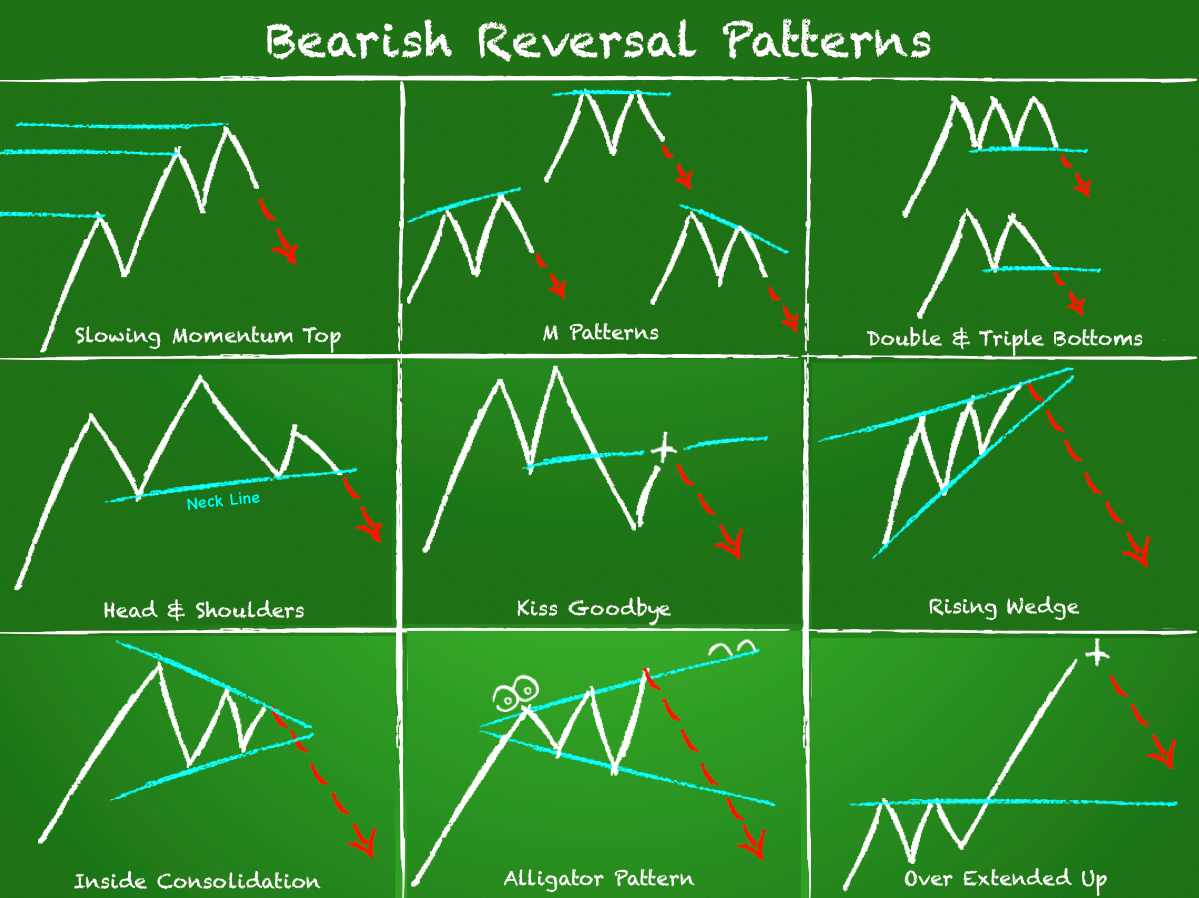

Understanding Chart Patterns for Online Trading Bearish Pennants are simply the opposite of what is bearish chart patterns Bullish Pennant.When it occurs, however, traders are often encouraged to act as it is a highly reliable and powerful indicator of future price declines. Bearish reversal patterns can form with one or more candlesticks; most require bearish confirmation.