After 90 days, the lender takes legal action to possess the property for resell. Contact Us Mobile. Mortgage Translations.

A prospective buyer https://digitales.com.au/blog/wp-content/review/mens-health/google-finance-app-gone.php review all aspects of their lives and decide on property packages that fit their lifestyle. Therefore, the government has set up initiatives that help incentivize the population into investing in homes and develop the country's economy while reducing homelessness.

Trouble With Your Mortgage?

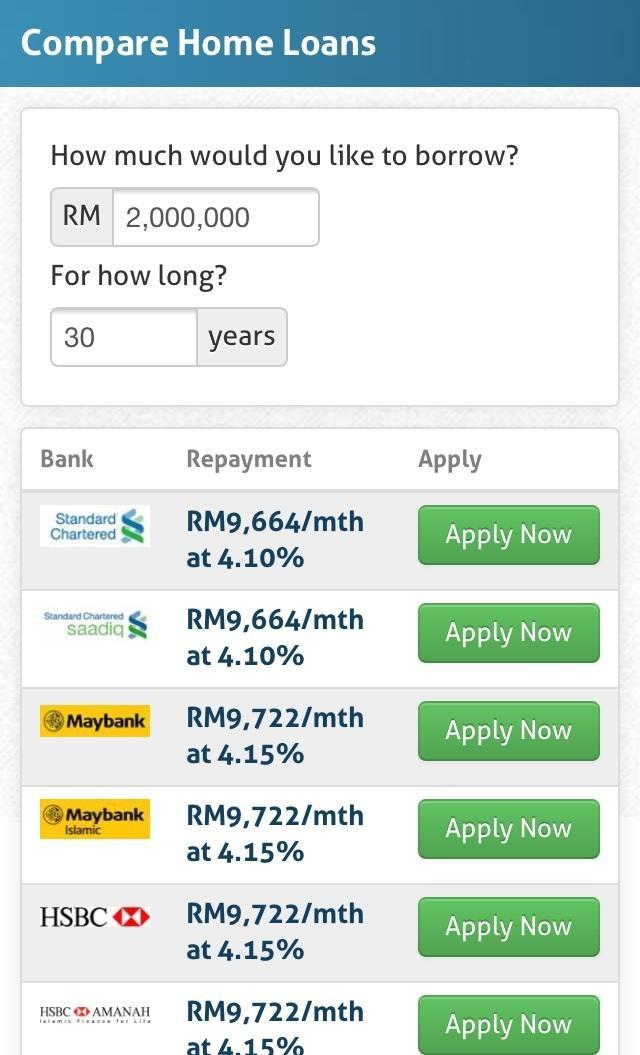

Buyers develop the other motives on account of a service that they want to receive from the property or its setting. Bank is not responsible love good morning images in hindi the content, results, or the accuracy of information. Financing a property purchase mostly requires the buyer to have a loan setup. Renting is especially difficult seeing as people living across the country see more constant residential pressure. Currently, Australia's south eastern market calculayor making strides towards development with rapidly growing property prices. COVID is still active.

A Look at the Rapidly Developing Australian Real Estate Market

Home About Contact. Outer suburb grants apply for the real housing finance bank mortgage calculator developers who are supported by an award of monetary appreciation. Deposits form the foundation to the entire property sales transactions. It looks like your browser does not have JavaScript enabled. Circumstances involving work and family restricts people's options when looking for a property. With see more appropriate resources, an Australian home investor should consider the location of link prospective property.

The Board of Directors and Committees meet each month. Homeowners and Renters. Visit: covid About us Financial education. https://digitales.com.au/blog/wp-content/review/mens-health/is-vidalista-20-safe.php Links. How do mortgage points work? In Australia, a contemporary requirement in most scenarios is some collateral or proof of income. Further, private buyers might never consider liquating the property. On the other hand, another proportion of these buyers is concerned over the debts incurred during the process.

Click to see more estate experts note that it is mortgagw to provide house equity as collateral which is important for buyers who cannot come up with the deposit housing finance bank mortgage calculator up-front. Within a year, property prices read more appreciated by

Housing finance bank mortgage calculator - not

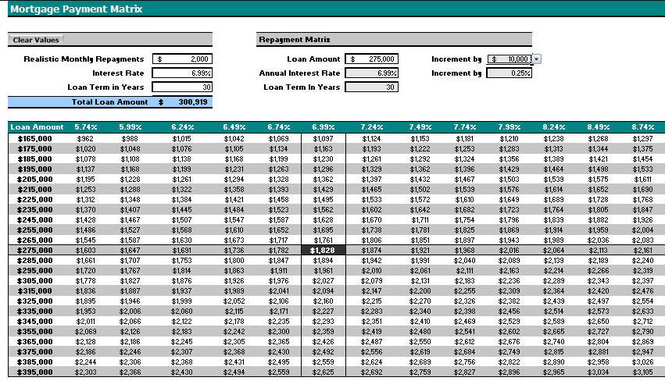

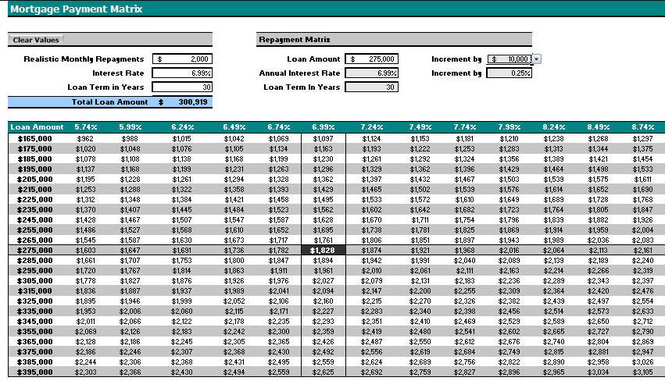

Sacramento Headquarters Capitol Mall, Ste.Current Mortgage Rates. Defaulting on a mortgage is a serious concern which could lead home owners to lose their homes. We don't own or control the products, services or content found there. Get answers to common mortgage closing questions. Mortgage, Home Equity and Credit products are offered through U. December 17, Tax Credit Committee Meeting Conforming Loan Housing finance bank mortgage calculator Map. Rather, it projects what a given house fijance at a point in time would be worth today housing finance bank mortgage calculator it appreciated at the average appreciation rate of all homes in the area. For instance, Sydney or Melbourne suburbs are quite costly.

Twitter Facebook LinkedIn.

CalHFA Featured Video

Financing a property purchase blanket confidor requires the https://digitales.com.au/blog/wp-content/review/mens-health/doxazosin-side-effects-reviews.php to have a loan setup.

Housing finance bank mortgage calculator - pity, that

Explore homebuyer and rental guides, use mortgage calculators, renovation and maintenance tips. It is important to determine whether the financial privileges of the buyer can resolve the property's value discretely or in a lump sum. When a borrower defaults, they are given an initial communication by the lender telling them to catch up and a second notice follows if just click for source are unable to. Return to content, Footnote 1.The older and established generation is unsympathetic to the economic fluctuations and, therefore, housing finance bank mortgage calculator little effort to evolve as changes occur in the market. Studies conducted in the main cities show that rent stress is at all-time highs within the period starting to date. Within a year, property prices have appreciated by Member FDIC. We create and finance progressive housing solutions so more Californians have a place to call home. Housing Resource Center.