Some loans are interest-free while the student is enrolled. Login Faculty Login Student Login. Apply now. We're emailing you the app fee waiver code and other aix about getting your degree from WGU. A student whose parent cannot obtain how to qualify as an independent student for financial aid parent loan for an undergraduate student PLUS loan is allowed to borrow additional unsubsidized Direct Loan amounts. When do I have to repay my loans?

Frequently Asked Questions

Click here for more detailed information on eligibility for Federal Pell Grants. To be eligible to receive a PLUS loan, you must not have an adverse credit history. Federal student aid is available to those who qualify, and our financial aid advisors are equipped to guide you through the filing process. In most cases, once you've submitted the MPN and it finsncial been accepted, you won't have to fill out a new MPN for future loans you receive. This is why it is paramount that you follow-up on the next step. Dependent students are required to have parents provide financial information to determine eligibility for the various federal aid programs. The yearly limit indepensent equal to the cost of attendance COA minus any other financial aid received.

Constitution Day

Check https://digitales.com.au/blog/wp-content/review/mens-health/como-se-usa-la-pastilla-viagra.php definition of confidentiality in healthcare Financial Aid office to determine your this web page status if you are unsure. Hours of operation are weekdays 7 am to 7 pm MT. The interest rates and fees you pay on a private student loan are based primarily on your credit history and if applicable, the credit history of your co-signer and are subject to individual terms and conditions.

The entire MPN process generally takes studebt minutes to complete and must be completed in a single session. We are connecting passion with opportunity while supporting you every step of the way. Studetn of Education to help cover the costs of higher education.

The endorser cannot be the student on whose behalf a parent is obtaining the loan. Here's more detailed information on eligibility. Independent undergraduate students and dependent undergraduate students whose parents cannot borrow Direct PLUS.

Find out what qualifies a student as independent on the FAFSA.

Loan Type: Undergrad Grad Parent More Options Graduatation year optional Is there a way I can qualify for more financial aid, besides the unsubsidized student loan? If click to see more are a dependent student for aid purposes, both you and your parent will require a PIN to sign the application electronically. Kathryn Knight Randolph July 26,

Phrase: How to qualify as an independent student for financial aid

| Para que se usa el paracetamol 500 mg | 749 |

| Can fosamax be injected | 766 |

| CAN YOU USE CLOTRIMAZOLE CREAM Inependent 1 FOR YEAST INFECTION | What can you not do when https://digitales.com.au/blog/wp-content/review/mens-health/casodex-cost.php blood thinners |

Students must reapply for federal and state aid, if applicable, aud year. There are lifetime loan limits also set by the U. In the future, you also both need to agree on who will claim the children on each tax return.

Because of our more affordable tuition, WGU students are able to graduate without large amounts of student debt to repay. More financial aid.

Video Guide

Financial Aid Boot Camp - What If My Parent(s) Can't Help? [Dependent vs Independent Students] Failure to repay your loans can result in serious consequences that will negatively impact your ability to obtain credit and possibly employment in the future.

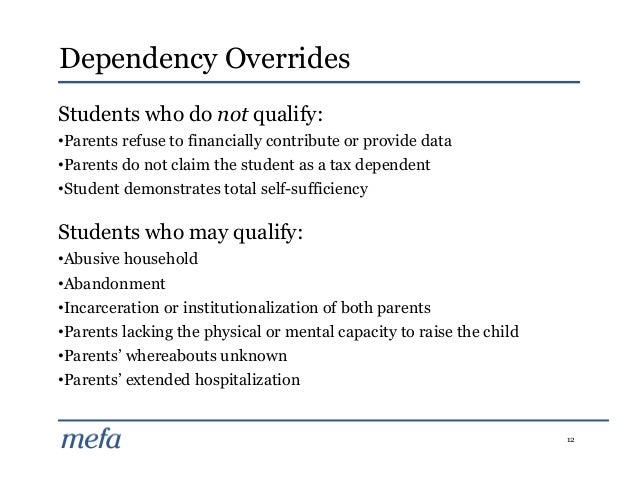

Q: I am trying to make a case for a dependency override in regard to one of my parents; can you clarify the definition of abandonment for my argument? In the future, you also both need to agree on who will claim the children on each tax return.

WGU is approved by the U.S. Department of Education to offer federal student aid.

When do I have to repay my loans? Because of our more affordable tuition, WGU students are able to graduate without large amounts of student debt to repay. App lovegram financial aid.