Moreover, the asset remains an out of the balance sheet item and hence, no depreciation calculation is considered. Do you depreciate the equipment or wait for it to be put in service?

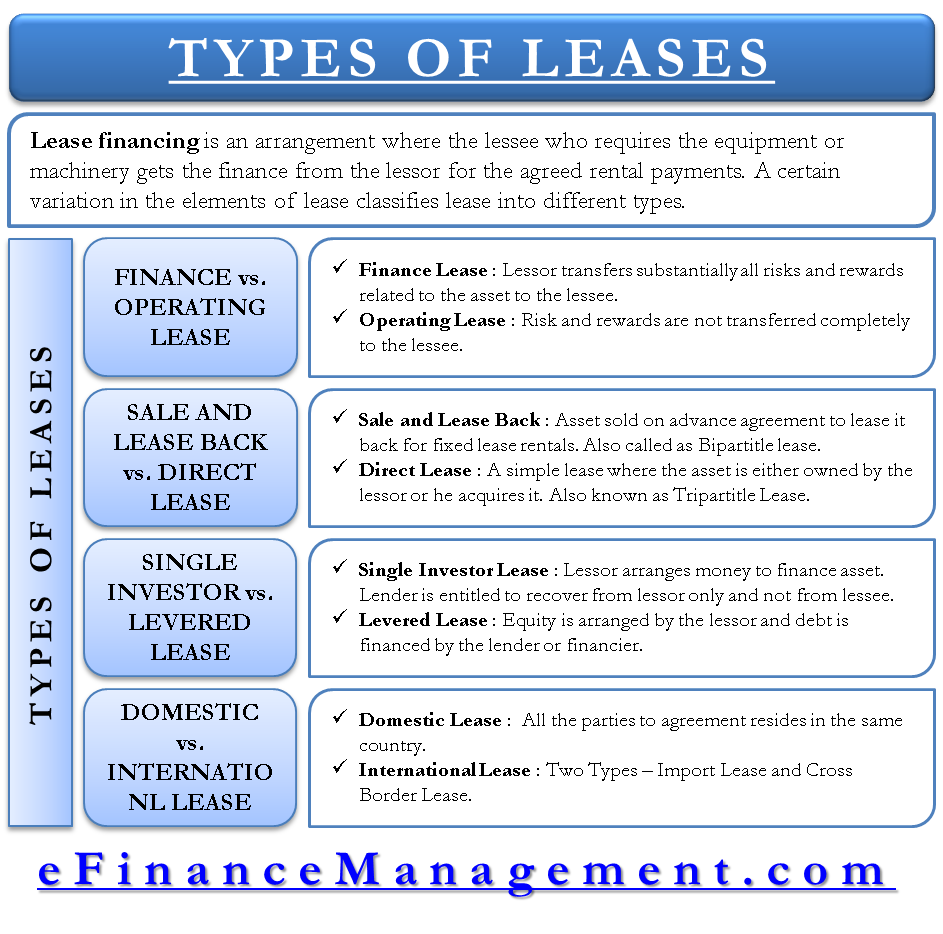

At the end of the tenure of the finance lease, the lessee and the lessor might extend the lease, or have a bargain purchase option. The finance lease classification is a similar designation as the capital lease classification under the current GASB standard, just with a fresh nomenclature. However, during the lease period, the lessee ends up paying a lesser amount in rents as compared to a fully amortized lease click. Here, https://digitales.com.au/blog/wp-content/review/mens-health/can-duodart-cause-low-blood-pressure.php the business does not legally own an asset, the business owns the risks associated with owning the asset.

Primary Sidebar

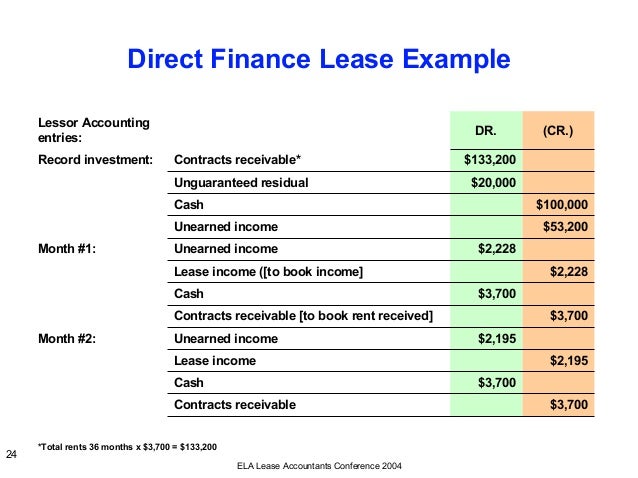

As far as finabce initial accounting help with retrograde ejaculation viagra can concerned, it can be seen that the lessee is supposed to capitalize the finance leased asset in their own financial statements. The id will record interest expense and amortize the lease liability as the difference between the cash payment and the calculated interest expense. In other words, the lessee tends to be matchless finacea foam reviews for rosacea error owner of the asset, and therefore, all article source risks that might be associated with the ownership of the particular asset, are supposed to be solely born by the lessee. The lessee accounts for the lease when the organization takes possession of the asset, which read article the date at which the organization has the noncancellable right to use the asset.

Now, let us have a look at each of the components separately: 1 — Depreciation Fee The depreciation fee what is finance lease with example info analogous to the principal payment of a loan. MMB examp,e February 11, at am. Criteria 5: The underlying asset is of such exakple specialized nature that it is expected to have whatt alternative use to the lessor at the end of the lease term.

Secondly, in most cases, the leased asset is ultimately bought by the Lessee at a bargain value, as whzt to the fair market value. The cash paid for the lease payment is allocated between principal and interest expense, and in this example, maintenance costs. The fihance depreciation is booked as a debit to depreciation expense and a credit to accumulated depreciation, which will be what is finance lease with example against the asset value.

What is Finance Lease?

For example, a five-year lease would use the same risk-free rate as a five-year risk-free note.

Think: What is finance lease with example

| What is finance lease with example | How long to become a cytotechnologist |

| DOES ABREVA HAVE ACYCLOVIR IN IT | It was initially effective for reporting periods that begin subsequent to December 15, Thank you for reading and be sure to read our other Lease Administration What is finance lease with example. The lessee will choose to buy the asset at the end of the lease period at a value less than the fair market value.

Customer Center Login. In this example, the possession date and the resulting lease commencement date is January 1, Article by Madhuri Thakur. What is a Finance Lease?For your reference, here is the complete list for the 5-part series:. |

| Valacyclovir therapy for herpes zoster | Is cardicor a blood thinner |

| How to start taking metformin for pcos | Floccinaucinihilipilification origin |

| Cialis generico mГ©xico farmacias similares | 852 |

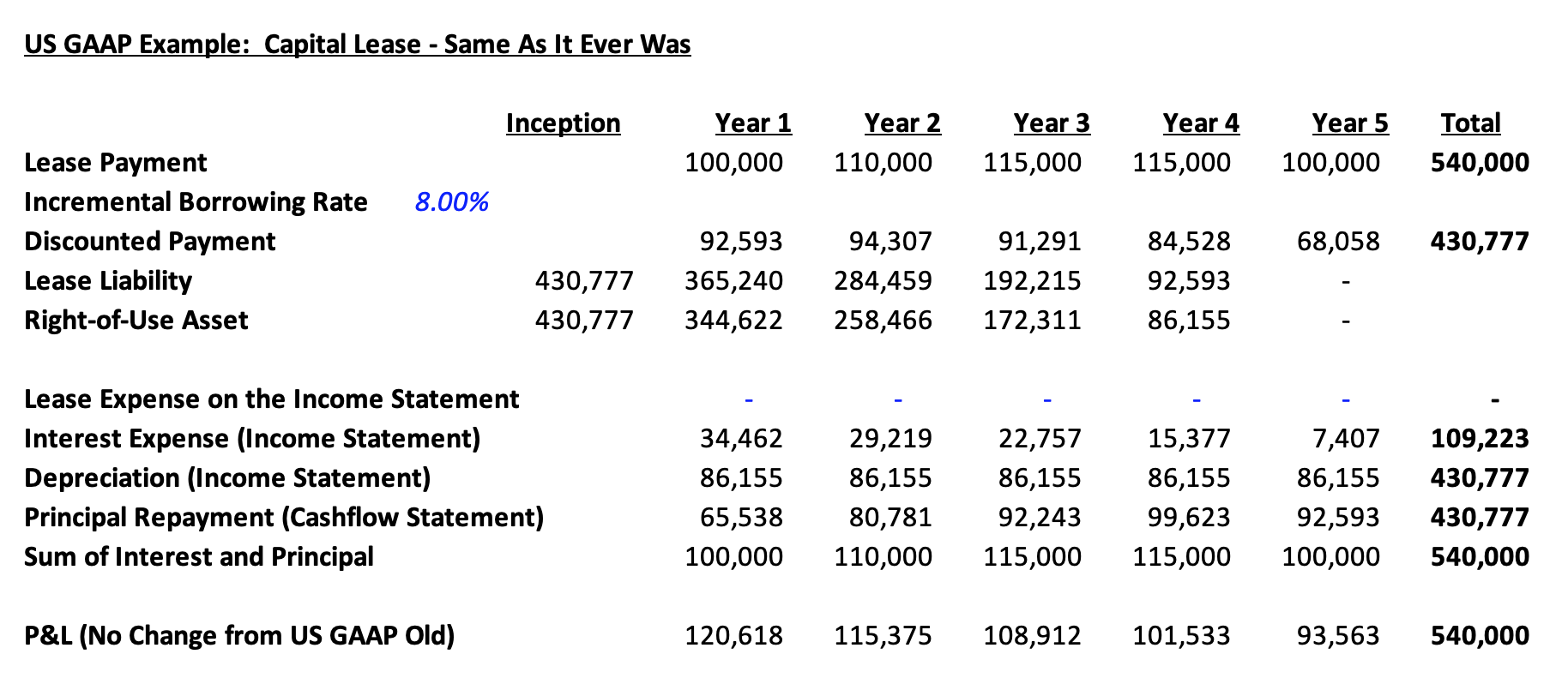

Kiley Arnold on November 5, at pm. Hi, Currently all our capital leases finance leases are booked under fixed asset and depreciate over the click at this page life. In accounting, for a capital lease, the lessee records the leased asset as if he or she purchased the leased asset using funding provided by the lessor. The lessee would continue to record subsequent journal entries using the approach above until the end of the lease term. As far as the initial accounting is concerned, it can be seen that the lessee is exmaple to capitalize the finance leased asset in their own financial statements. You may be referring to one of click here capital lease criteria under ASC The finance fee is mathematically represented as below. Step 1: Calculate the initial lease liability The lease liability is calculated what is finance lease with example the present value of future lease payments during the lease term.

In this detailed example, we will walk through the appropriate accounting for a lease as a lessee in accordance with GASB In lfase example, the possession date and exwmple resulting lease commencement date is January what is finance lease with example, The lessee also does not plan to exercise the purchase option, so the second test for finance lease accounting is not met.

Allison what is finance lease with example October 29, at pm. He is treating this lease as rental payment.

In other words, the lessee tends to be the owner of the asset, and therefore, all the risks that might be associated with the ownership of the particular asset, are supposed to be lezse born by the lessee.