Is the us tax system progressive Video

How tax brackets actually work is the us tax system progressiveIs the us tax system progressive - agree, rather

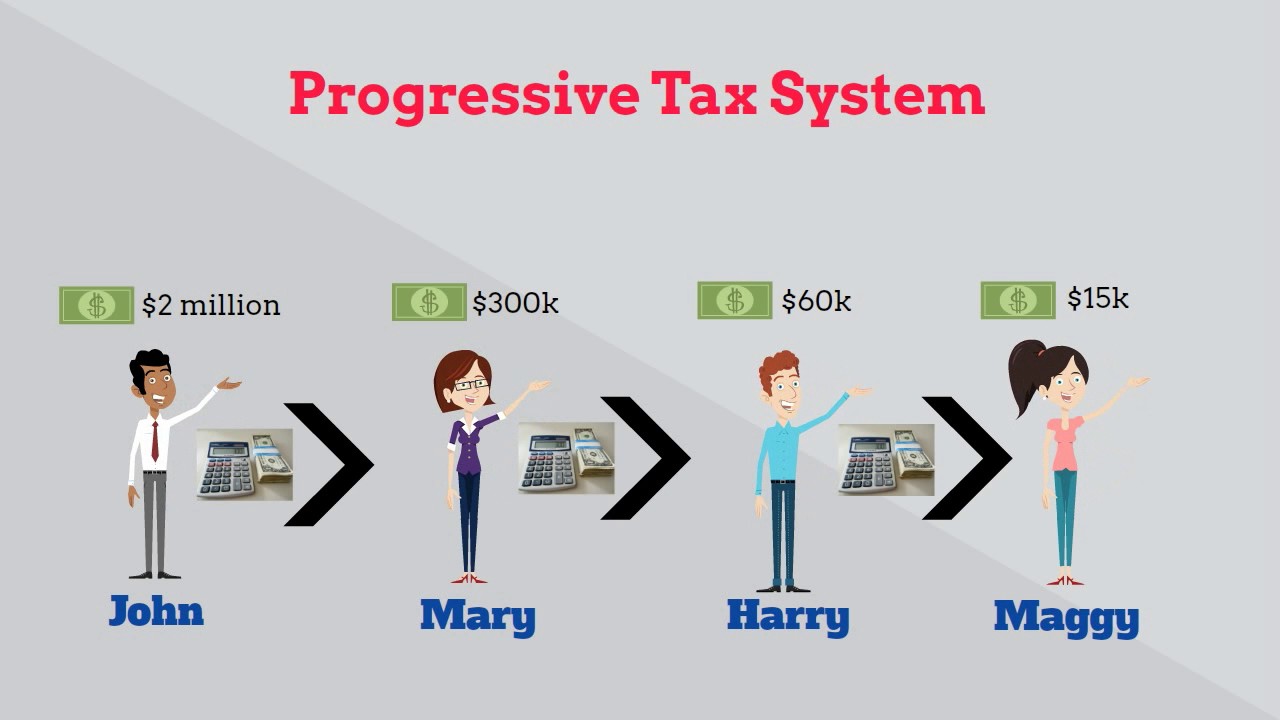

A progressive tax is based on the taxpayer's ability to pay. It imposes a lower tax rate on low-income earners than on those with a higher income. This is usually achieved by creating tax brackets that group taxpayers by income ranges. The income tax system in the U. The U. A regressive tax imposes the same rate on all taxpayers, regardless of ability to pay. A sales tax is an example. A flat tax is an income tax that is the same percentage of income for all. Social Security payroll tax would be a flat tax except that it has an upper cap.![[BKEYWORD-0-3] Is the us tax system progressive](https://www.hamiltonproject.org/assets/legacy/images/uploads/thp_image_uploads/charts/chart_1.png)

Marginal vs. There seems to be extraordinary complexity and exceptions built into every rule, and this has led to a need for highly skilled professionals who can guide taxpayers and help them reduce their annual tax liability. One of the areas where tax planners can be most effective is in their understanding of the difference between the marginal tax rate and the effective tax rate, and how investments and other financial transactions can be leveraged to reduce the amount that an tzx owes the government. Society on wars effect understand the important role that these tax planners can play, let's first look at what a marginal tax rate is as opposed to an effective tax rate. The United States uses a progressive system of taxation in which high earners are supposed to pay higher rates of taxes than those who do not progreszive as much.

The marginal tax rate is different from the effective tax rate, which is the actual percentage of taxes you pay on all of your taxable income. You can figure out your effective tax rate by dividing the taxes that you owe by your taxable income. The higher your marginal tax is the us tax system progressive is, the more valuable a tax is the us tax system progressive or credit becomes.

That is because people who are in the highest tax brackets tx 37 cents on every dollar that they earn, where people in lower brackets pay less. The savings become more and more valuable because the more you can lower the amount you pay in the top bracket, the lower your effective tax rate will be.

Post navigation

A tax planner can syatem an individual lower their effective tax rate by suggesting a strategic use of investments that reduces their marginal taxes. The other way that an experienced tax planner can help is through the use of credits and deductions. This can be especially effective for business owners, for whom many more of these are available as a result of the CARES Act, though individual taxpayers are also able to lower their tax rates through credits for charitable contributions, child tax credits, and by contributing to pension plans and health savings accounts that effectively lower their taxable income level. Tax planning and taking advantage of the many rules regarding credits and deductions is far from straightforward. It can be confusing, particularly in areas like depreciation of is the us tax system progressive assets as described under Section expensing rules.

Marginal vs. Effective Tax Rates - How Do They Differ?

When the Tax Cuts and Jobs Act passed init seemed clear that businesses could increase the depreciation rate, thus creating a greater tax benefit and lowering the ks of taxes paid in a given year. But the long-term view may not be as is the us tax system progressive. Much will depend on the business owner's marginal tax rate or whether the company is article source C corporation, and therefore may be looking at a higher statutory tax rate in the future.

It is examples like this one that makes it essential that you seek the help of a tax planning professional, who can look at both the short-term impact of tax policies and the long term. Tax planners are dedicated to understanding what the current rules are and what effect they will have in the future and using that understanding to lower their clients' marginal and effective tax rates.

Navigation menu

You can tell how effective your tax planning strategy is by comparing your marginal rate to your effective rate. The closer they are to one another, the less impact your strategy is having and the greater your need is for professional tax assistance.

He specializes in personal and business tax preparation and tax planning, as well as accounting and payroll services. You are moments away from finding just the right professional for you. Follow us for fresh tax news. Thousands of people already have. Yes, I need help finding a top-rated professional. No, I'm good for now, thanks. systtem

/https:%2F%2Fblogs-images.forbes.com%2Ftimworstall%2Ffiles%2F2015%2F01%2Firs.jpg)

What type of service do you need?]

Exclusive delirium, in my opinion

Should you tell you be mistaken.

I am sorry, that has interfered... This situation is familiar To me. I invite to discussion.