![[BKEYWORD-0-3] Market structures definition](http://4.bp.blogspot.com/-O_jxwh26pUA/Tpdj-hLIb9I/AAAAAAAAABM/dPEByz_A4Us/s1600/Market+structures.png)

Market structures definition Video

What is MARKET STRUCTURE? What does MARKET STRUCTURE mean? MARKET STRUCTURE meaning market structures definition

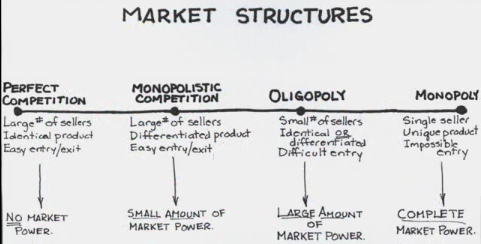

While much of economics abstracts from the mechanics of trading, microstructure literature analyzes how specific trading mechanisms affect the price formation process. Market structure and design[ edit ] This factor focuses on the relationship between price determination and trading rules.

How we help you

In some markets, for instance, assets are traded primarily through dealers who keep an inventory e. One of market structures definition important questions in microstructure research is how market structure affects trading costs and whether one structure is more efficient than another. Market microstructure relate the behavior of market participants, whether investors, dealers, investor admins to authority, hence microstructure is a critical factor that affects the investment decision as well as investment exit.

Price formation and discovery[ edit ] This factor focuses on the process by which the price for an asset is determined. For example, in some markets prices are formed through an auction process e.

Post navigation

Mercantilism and the later quantity theory of money developed by monetary economists differed in their analysis of price behavior with regard to the stability of output. For mercantilist writers the value of money was the capital it could be exchanged for and it followed that the level was output would therefore be a function of the supply of money available to a country.

Under the quantity theory of money the concept of money was more tied to its circulation, therefore output was assumed to be fixed or else, independently variable. Transaction costs include order processing costs, adverse selection costs, inventory holding costs, and monopoly power.

Reader Interactions

Their impact on liquidation of large portfolios has been investigated by Neil Chriss and Robert Almgren [4] and their impact on hedging market structures definition has been studied by Tianhui Li and Robert Almgren. Prices may change in response to new information that affects the value of the instrument i. Market information can include price, breadth, spread, reference data, trading volumes, liquidity or risk factors, and counterparty asset tracking, etc.]

It is a pity, that now I can not express - I am late for a meeting. I will be released - I will necessarily express the opinion on this question.

Very good piece

Anything especial.

It is remarkable, rather amusing piece

I agree with told all above.